FICO Score

FICO Score is a credit scoring model developed by the data analytics company, FICO (Fair Isaac Corporation). Similar to other credit scoring systems, FICO Score's algorithm uses debt data from an individuals credit report to formulate the score.[2] The score is used as a metric for lenders to determine whether or not to an individual is a credit risk or not.[3]FICO is currently the most widely used credit scoring algorithm in The United States of America. Particularly, FICO 8, the eighth version of the FICO score is used by the three main credit bureaus in the United States. Commonly referred to as the "big three" they are Experian, TransUnion, and Equifax.[4]

Contents

FICO

About

FICO is a data analytics company that serves its corporate client base by assisting their business decisions. In addition to their most well known product FICO Score, the company also has other software tools that are used to improve customer relations and optimize business interactions. Following suit with other Big Data corporations, FICO utilizes technologies such as cloud computing and open source standards.[5]

FICO operates globally in over 20 countries spanning six continents. The corporation provides solutions in an array fields such as finance, health care, automotive, telecommunications and more.[6] [7]

History

Founded in 1956 by engineer Bill Fair and mathematician Earl Isaac with hopes to improve the manner in which businesses make discussions. Two years later, the company released their first credit scoring algorithm. FICO moved their headquarters from San Fransisco, California to San Rafael California i 1961. In 1972 FICO debuted the first automated application processing system at Wells Fargo. FICO revealed another credit scoring model the FICO Credit Bureau Risk Score in 1981. The next year, FICO opens its first international office in Monaco. In 1987 FICO becomes a publicly traded stock in the New York Stock Exchange. FICO moved its headquarters again to Minneapolis, Minnesota in 2004. In 2013, FICO returned its headquarters to California by moving to San Jose. [9]

Algorithm

History

Credit scoring systems had existed before the FICO Score since the 1800's for use in the commercial space. They were originally developed by lenders to systemize determining whether or not a loan would be a risk or not. These early credit systems included racial, gender and class information to aid the lending process. In the 1900's the need for credit scores grew to meet the needs of consumers as the middle class grew. To meet this demand, algorithms collected data on individuals' social, political, and sexual lives. In the 1970's, the government passed the Fair Credit Reporting Act (FCRA) which disallowed the gathering of demographical data for use in determining credit eligibility. [10] [11]

FICO Score was created in 1989 to fill the need of a standard credit scoring algorithm that was also unbiased. [12] In 1991, FICO Score is used by all three major credit bureaus in The United States. Two years later, FICO designs specialized scores for each type of loan. The most widely used version of the FICO Score, FICO 8, was released in 2009. [13]

Breakdown

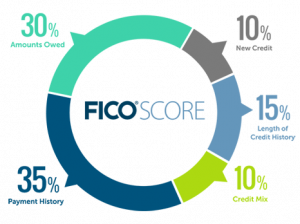

The FICO Score is comprised of five major parts.

Payment history is the largest component and takes up 35 percent of the FICO Score. Particularly, this component focuses on if the individual has made payments and the timeliness of those payments. This information includes the history of credit card, home loan, and car loans. If the individual makes their payments on time their score will be higher.

Amounts owed makes up 30 percent of the FICO Score and is based on how much money the individual has actually borrowed in relation to their available credit. Typically, the less available credit an individual borrows the higher their score will be.

The length of credit history makes up 15 percent of the score. The length is determined by taking the individuals average age of credit accounts. The older the average age of accounts the higher the FICO Score will be.

The next 10 percent of the score is based on credit diversity. Credit diversity considers on the mix of credit accounts of an individual. Generally, the more variety in types credit the individual has the higher this portion of the score is.

New credit takes up the final 10 percent of the FICO Score. This portion of the score includes not only new accounts opened by the individual but also accounts that the individual has attempted to open. The less new credit lines an individual decides to open it is seen as less of a risk so their score would be higher. [15] [16] [17]

FICO Scores do not include demographics, salaries, or social information. [18]

All information used by the scoring algorithm is pulled from the individuals credit report. [19]

Scoring Range

Competitor algorithms

Discrimination concerns

Racial bias

Debt discrimination

Employment

Medical Debt

Education Debt

Inaccuracies

Credit invisibility

Predicting risk

Big data and artificial intelligence

Morality

Transparency

See also

References

- ↑ Fair Isaac Corporation. (2018). Frequently asked questions about FICO scores. Retrieved January 28, 2022, from https://www.ficoscore.com/ficoscore/pdf/Frequently-Asked-Questions-About-FICO-Scores.pdf

- ↑ Fair Isaac Corporation. (2021, October 27). How are FICO scores calculated? myFICO. Retrieved January 28, 2022, from https://www.myfico.com/credit-education/whats-in-your-credit-score

- ↑ FINRA. (2015, January 9). How your credit score impacts your financial future. How Your Credit Score Impacts Your Financial Future | FINRA.org. Retrieved January 28, 2022, from https://www.finra.org/investors/personal-finance/how-your-credit-score-impacts-your-financial-future#:~:text=A%20credit%20score%20is%20usually,the%20time%20of%20your%20application.

- ↑ University of Illinois Credit Union. (2022, January 14). Your credit score is the most important score you should know. U of I Community Credit Union. Retrieved January 28, 2022, from https://www.uoficreditunion.org/your-credit-score-is-the-most-important-score-you-should-know/

- ↑ Fair Isaac Corporation. (n.d.). About Us. FICO. Retrieved February 8, 2022, from https://www.fico.com/en/about-us

- ↑ Fair Isaac Corporation. (n.d.). About Us. FICO. Retrieved February 8, 2022, from https://www.fico.com/en/about-us

- ↑ Fair Isaac Corporation. (n.d.). Contact us. FICO. Retrieved February 8, 2022, from https://www.fico.com/en/contact-us

- ↑ Fair Isaac Corporation. (2015). From credit scoring to cloud analytics: A video history of Fico. FICO Decisions Blog. Retrieved February 8, 2022, from https://www.fico.com/blogs/credit-scoring-cloud-analytics-video-history-fico

- ↑ Fair Isaac Corporation. (n.d.). FICO history. FICO. Retrieved February 8, 2022, from https://www.fico.com/en/history

- ↑ Rob_Kaufman. (2018, July 25). The history of the FICO® score. myFICO. Retrieved February 8, 2022, from https://www.myfico.com/credit-education/blog/history-of-the-fico-score

- ↑ Fair Isaac Corporation. (n.d.). FICO history. FICO. Retrieved February 8, 2022, from https://www.fico.com/en/history

- ↑ Rob_Kaufman. (2018, July 25). The history of the FICO® score. myFICO. Retrieved February 8, 2022, from https://www.myfico.com/credit-education/blog/history-of-the-fico-score

- ↑ Fair Isaac Corporation. (2014). Learn about the FICO® score and its long history. Home | 25th Anniversary. Retrieved February 8, 2022, from https://www.fico.com/25years/

- ↑ Fair Isaac Corporation. (2021, October 27). How are FICO scores calculated? myFICO. Retrieved February 9, 2022, from https://www.myfico.com/credit-education/whats-in-your-credit-score#:~:text=Your%20FICO%20Score%20is%20calculated%20only%20from%20the%20information%20in,of%20credit%20you%20are%20requesting.

- ↑ Fair Isaac Corporation. (2018). Frequently asked questions about FICO scores. Retrieved January 28, 2022, from https://www.ficoscore.com/ficoscore/pdf/Frequently-Asked-Questions-About-FICO-Scores.pdf

- ↑ Fair Isaac Corporation. (2014). Learn about the FICO® score and its long history. Home | 25th Anniversary. Retrieved February 8, 2022, from https://www.fico.com/25years/

- ↑ Fair Isaac Corporation. (2021, October 27). How are FICO scores calculated? myFICO. Retrieved February 9, 2022, from https://www.myfico.com/credit-education/whats-in-your-credit-score#:~:text=Your%20FICO%20Score%20is%20calculated%20only%20from%20the%20information%20in,of%20credit%20you%20are%20requesting.

- ↑ Fair Isaac Corporation. (2018). Frequently asked questions about FICO scores. Retrieved January 28, 2022, from https://www.ficoscore.com/ficoscore/pdf/Frequently-Asked-Questions-About-FICO-Scores.pdf

- ↑ Fair Isaac Corporation. (2021, October 27). How are FICO scores calculated? myFICO. Retrieved February 9, 2022, from https://www.myfico.com/credit-education/whats-in-your-credit-score#:~:text=Your%20FICO%20Score%20is%20calculated%20only%20from%20the%20information%20in,of%20credit%20you%20are%20requesting.