Weak Agency and Vulnerability in Surveillance Capitalism

Contents

Surveillance Capitalism

What is Surveillance Capitalism?

The Age of Surveillance Capitalism identifies how the internet and tech companies have defined a fundamentally different model of economic progress. Shoshana Zuboff identifies two fundamental tenets of this new market: it is in the business of "behavioral modification," and it relies on machine learning and information gluttony to generate the most predictive models possible.[1]

The most successful companies today are the ones that excel in predicting and influencing general consumer behavior. These "Surveillance Capitalists" are experts in collecting, interpreting, and utilizing behavioral data to promote sales and behavior. This unseen market - which places behavior as the main product - has come to dictate vast amounts of the economy. These companies are in the business of altering our perception. Their product is "the gradual, slight, imperceptible change in your own behavior and perception." [2]

What makes Surveillance Capitalism Successful?

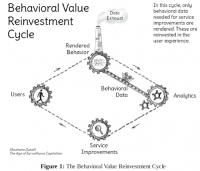

Surveillance Capitalists' success in behavioral alteration stems from two sources: the volume of data they collect and the ability of algorithms to interpret this data into valuable behavioral influencing data. [3] The world's largest tech companies gain data through each user interaction with their product. This data is fed back into their machine learning algorithms to generate even more accurate behavioral data, which is used to drive further engagement, thus providing more data for the algorithms. This positive feedback loop of data collection generates a more engaging user experience which in turn encourages more user interaction that provides these firms even more behavioral data. [4] Zuboff explains that the world's largest companies now have realized that the more data they have, the more predictive they can make their models. To that end, if tech companies have data they don't know what to do with, it still might be useful someday. All they need is a machine learning algorithm that figures out how to use this extra data. This desire for data in all forms has generated a "behavioral futures market" where companies value all data types regardless of their current use. [5] The result of this behavioral futures market is the mass practice of information gluttony. Collect as much information as possible because it may be useful someday with the right model. The success of this market stems from the ongoing ability to collect data and input it into sophisticated, growing algorithms.

Weak Agency

Debra Satz in her work "Why Some Things Should not be for Sale: The Moral Limits of Markets" lays out criteria for ways in which markets can fail. She enumerates four factors which may indicate a market is suffering from noxious business practices. One such factor is called Weak Agency. [6]

What is Weak Agency?

In her book, Debrah Satz explains that some “markets arise in circumstances in which some parties have poor information about the goods they are exchanging.”[7] The issue with these markets is that they usually result in negative outcomes for those lacking crucial information. In such markets, where consumers are at a disadvantage because of a fundamental gap in information we say they suffer from weak agency. Weak agency, also known as information asymmetry, is often seen as a problem we ought to fix. For example, all fifty states have passed so-called “lemon laws” which regulate the sale of used automobiles.[8] These laws exist because most Americans have little working knowledge of automobiles, and could easily be swindled by a cunning mechanic trying to pawn off a car which would break down in a matter of weeks after purchase. Here we see that as a society we have decided we are morally opposed to gross abuses of information asymmetry to swindle consumers. As a result there are countless regulations on the books to prevent this type of market failure in a wide variety of industries. Much like the market for "lemons," Surveillance Capitalism also has aspects which suffer from weak agency.

Weak Agency Issues within Surveillance Capitalism

Surveillance Capitalism operates off the back of some of the most advanced technology known to humankind. Its processes and goals are by their very nature hard to understand and difficult to discover. There are several ways in which Surveillance Capitalism as a market suffers from weak agency issues due to a massive gap in knowledge between consumers and Surveillance Capitalists.

Intentional Information Asymmetry

The first way there is weak agency in Surveillance Capitalism is that information is intentionally hidden from consumers. From the start of Surveillance Capitalist practice it has been designed to be unknowable to consumers. Its practices were both concealed and nearly impossible to understand almost immediately from its inception at Google’s founding in 1998. A perfect example of the desire to conceal how Surveillance Capitalism works is that it wasn’t until 2009 that “the public first became aware that Google maintains our search histories indefinitely.” Of course, this is common knowledge today. Yet, the point persists that Surveillance Capitalists are not forthright in telling us the ways in which they collect information or how they intend to use it. This is not just personal analysis, former Google executive Douglas Edwards has openly spoken about the company's “culture of secrecy around aggressive data capture and retention.” Edwards has explained that Google’s founders “opposed any path that would reveal [their] technological secrets or stir the privacy pot and endanger [their] ability to gather data” the worst thing that could happen would be “arousing users’ curiosity with clues… about the reach of the firm’s data operations.” [9] Google intentionally tried and tries to shroud its data collection and manipulation from us as consumers because it makes us worse resources for extraction. This practice is not just limited to Google either. It is standard practice in the Surveillance Capitalist industry. Surveillance Capitalism intentionally hides its ongoings from consumer view and understanding. This is an area where Surveillance Capitalism suffers from weak agency.

The Behavioral Futures Market

Another way Surveillance Capitalism suffers from weak agency is due to a time lag between consumer decisions and their ramifications. Satz explains that negative market outcomes from weak agency are "most likely in cases where there is a significant time lag between the initiation and the completion of a transaction." [10] For example, if someone sold their kidney today it would be hard for them to predict if that was a terrible decision until much later down the road. This temporal discounting angle can be applied to Surveillance Capitalism. As Zuboff identified, the Surveillance Capitalist market is heavily reliant on using new data to feed machine learning algorithms which attempt to utilize the new data to drive further engagement. This process leaves a system in place where all information collected could eventually be deemed useful by a sufficiently sophisticated algorithm. Thus, even if someone were able to understand all of Surveillance Capitalism currently, there is no way for anyone to predict how information collected today could be used down the road. It is impossible for consumers to be aware of how their data and time will be used down the road. This situation also represents weak agency as consumers are fundamentally unable to evaluate the consequences of their transaction.

Vulnerability

Debra Satz in her work "Why Some Things Should not be for Sale: The Moral Limits of Markets" lays out criteria for ways in which markets can fail. She enumerates four factors which may indicate a market is suffering from noxious business practices. One such factor is called Vulnerability [11] This section will focus on how this factor interacts with what we know about Surveillance Capitalism.

What is Vulnerability?

Another area where Surveillance Capitalism may ethically struggle is with vulnerability. Vulnerability within markets exists in two forms. The first type of vulnerability is vulnerability which is generated by the existence of a market. [12] For example, imagine a market in organs. If there was a market for kidneys, would someone filing for bankruptcy be forced to sell their organs as a part of the bankruptcy? If the market for kidneys did not exist, this dilemma would not as well; thus, a market in kidneys generates vulnerability by its very existence. The second type of vulnerability is vulnerability which is generated by participation in a market. Another good example of this would be the tobacco industry. By smoking users become more vulnerable in two ways. First, they become increasingly addicted to the product and want more. Second, their long term health prospects decrease with every smoked cigarette and they are vulnerable to a slew of illnesses and diseases. These individuals become more vulnerable the longer they interact with the market.

Vulnerability in Surveillance Capitalism

The Source of Vulnerability

Vulnerability due to Surveillance Capitalism stems from the fact that there is no way to engage with society today without consetting to Surveillance Capitalist practices. A study done at the University of California Davis estimates that “99.9 percent of the world’s information is now rendered in digital formats that Surveillance Capitalists helped to create.” [13] Most of the human day to day runs through these digital formats. For example, two-thirds of all banking transactions in the U.S. are done online through mechanisms which Surveillance Capitalists can collect data on individuals. In fact, nearly 30% of Americans use online-only banking services. [14] Pew Research finds that nearly half of Americans found their jobs online. [15] Not to mention the absolute social and societal necessity of participating in online activity. The reality is individuals have no option but to participate fully Surveillance Capitalism or they will be completely ostracized from all aspects of society. It is this requirement to participate that generates vulnerability. It is a vulnerability of being forced into a market individuals may or may not wish to engage with.

How Does Vulnerability Worsen?

Vulnerability can worsen in Surveillance Capitalism in two main ways. First, is that many Surveillance Capitalist practices can be addicting. Social media and email being prime examples of this behavior. Individuals are forced to participate in this market so if they are forced to participate in an addictive activity the effects compound. Social media addiction is a very real thing and is now understood by the global psychological community to function in similar ways to other forms of addiction.[16] Some estimates predict 16-33 million Americans suffer from social media addictions. As much as 30% of the U.S. population says they use social media too much.[17] Yet, individuals are vulnerable to this market to begin with and thus cannot remove themselves. The result is increased vulnerability because not only can they not remove themselves from this market, but they are addicted and thoroughly enjoy its grips.

The other way that Surveillance Capitalism can increase vulnerability is through the previously described behavioral futures market. The concept is simple. Individuals cannot remove themselves from data collection and thus serve as massive data mines. As this information is better collected, interpreted, and utilized in the future due to machine learning all the previous problems stand to get worse. Content becomes more addictive and more mechanisms arise to keep individuals locked in. Consumers become vulnerable to data collection and intrusions in their life past what was every thought possible all because of how much data is given up today. Vulnerability worsens with time as data is released in the market of Surveillance Capitalism.

References

- ↑ Zuboff, Shoshana, The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power (New York: Public Affairs, 2019), 50.

- ↑ Jeff Orlowski, “The Social Dilemma” (Exposure Labs, 2020).

- ↑ Zuboff, Shoshana, The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power (New York: Public Affairs, 2019), 52.

- ↑ Zuboff, Shoshana, The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power (New York: Public Affairs, 2019), 54.

- ↑ Zuboff, Shoshana, The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power (New York: Public Affairs, 2019), 54.

- ↑ Debra Satz, Why Some Things Should Not Be for Sale : The Moral Limits of Markets (New York: Oxford University Press, 2010), 91.

- ↑ Debra Satz, Why Some Things Should Not Be for Sale : The Moral Limits of Markets (New York: Oxford University Press, 2010), 9.

- ↑ “Car Lemon Laws: What to Know by State - Kelley Blue Book” (Kelly Blue Book), accessed January 17, 2023

- ↑ Zuboff, Shoshana, The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power (New York: Public Affairs, 2019), 16.

- ↑ Debra Satz, Why Some Things Should Not Be for Sale : The Moral Limits of Markets (New York: Oxford University Press, 2010), 94.

- ↑ Debra Satz, Why Some Things Should Not Be for Sale : The Moral Limits of Markets (New York: Oxford University Press, 2010), 91.

- ↑ Debra Satz, Why Some Things Should Not Be for Sale : The Moral Limits of Markets (New York: Oxford University Press, 2010), 94.

- ↑ Martin Hilbert, “Big Data for Development: From Information- to Knowledge Societies,” SSRN, January 15, 2013, pp. 1-39, https://doi.org/http://dx.doi.org/10.2139/ssrn.2205145.

- ↑ René Bennett, “Digital Banking in 2022: Trends and Statistics,” Bankrate, September 28, 2022, https://www.bankrate.com/banking/digital-banking-trends-and-statistics/#:~:text=traditional%20banking%20statistics.-,Key%20statistics%20on%20digital%20banking,population%20uses%20digital%20banking%20services.

- ↑ Aaron Smith, “The Internet and Job Seeking,” Pew Research Center: Internet, Science & Tech (Pew Research Center, May 30, 2020), https://www.pewresearch.org/internet/2015/11/19/1-the-internet-and-job-seeking/.

- ↑ “Social Media Addiction,” Addiction Center, January 25, 2023, https://www.addictioncenter.com/drugs/social-media-addiction/#:~:text=Social%20media%20addiction%20is%20a,impairs%20other%20important%20life%20areas.

- ↑ Josh Howarth, “25 Startling Social Media Addiction Statistics (2023),” Exploding Topics (Exploding Topics, December 19, 2022), https://explodingtopics.com/blog/social-media-addiction. “Social Media Addiction,” Addiction Center, January 25, 2023, https://www.addictioncenter.com/drugs/social-media-addiction/#:~:text=Social%20media%20addiction%20is%20a,impairs%20other%20important%20life%20areas.