Venmo

|

Contents

History

Venmo was founded by Andrew Kortina and Iqram Magdon-Ismail. The two met at the University of Pennsylvania in 2001 when they were randomly assigned as freshman year roommates. Throughout their senior year and for a few years following their graduation, the two founders began working on various projects, eventually launching Venmo in August 2009. Their original idea was to launch a music startup through which people could send a text to a band and then receive an [MP3] via email. The idea for sending payments over technology supposedly came during a night when Magdon-Ismail forgot his wallet and owed Kortina money. The original design idea was for users to send and receive payments via text message but eventually morphed into the in-app payment method that Venmo uses today. [2]

Venmo was first bought by Braintree in 2012 for $26.2 million.[3] In 2013, one of Venmo's former competitors, PayPal, purchased Braintree and all of its subsidiaries in an all-cash deal of $800 million.[4] By the second quarter of 2015, PayPal's company earnings indicated that a total of $1.6 billion was being transacted through Venmo.[5] By the end of 2017, more than 2 million retailers accepted payments through Venmo.[6]

Service

User Guidelines

In order to successfully create a Venmo account, users must agree to Venmo's User Agreement. Within the documentation of this agreement, Venmo users agree that their "personal accounts may not be used to conduct business, commercial or merchant transactions with other personal accounts" [7]. Venmo later explicitly states that the exchange of "concert tickets, electronic equipment, sneakers, a watch, or other merchandise" is prohibited between users who do not know each other personally. If a user wishes to sell these these items they must set up an approved business account. Venmo encourages transactions between friends and personal contacts, with the mission of the company to "make it easier for you to pay your friends and family." [8]

Account Set Up

Users first set up their accounts on the application using either an email address or a Facebook account. There are three main methods for making payments on the application.

These three options include transferring money from an existing Venmo balance, using a credit or debit card, or sending money directly from a US bank account. A user's Venmo account balance accumulates when other users send them money through the app. Money in the existing balance can use to pay others or can be transferred back to the user's linked bank account. The credit and debit card option is available for users' connecting their Venmo accounts with a credit account. Venmo supports most major debit cards but incurs a 3% fee for credit cards and some debit cards issued by smaller banks.[9]Receiving money is always free. A user can also set up their Venmo account by connecting it to their US bank account, from which it is possible to directly transfer funds back and forth between the bank account and the application. Once the account is set up, users can immediately begin to send and request money.

Transactions

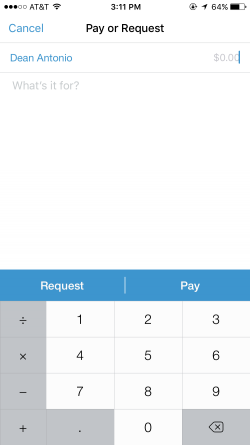

After verifying their bank accounts in the setup stage, users can send and receive money on Venmo. A user can click the new payment button in the top right corner to create a new transaction. Users can search the name of the user that they want to pay or request money from. After selecting someone to pay or request from, the user must enter a dollar amount accompanied by a comment that describes the payment.[10] The user can select the "Pay" option if they owe money or the "Request" option if they are owed money. Venmo alerts you before you send a payment, and sends a second alert if the user attempts to pay someone they never had before. The user on the receiving end is informed with an in-app notification in addition to an email or text message. Venmo also allows users to add their local contacts to venmo for easier transactions. A user's contacts will appear in their Venmo address book which allows users to search for someone by their username, phone number or email.[11]

Once a user has a balance in their Venmo account, they have the option to transfer it to their bank, or they can keep the balance in their account and use it for future payments. The user can transfer all or just some of their Venmo balance to their bank, and the transfer occurs within one business day.

Venmo Card

Venmo also has their own form of a debit card, the Venmo Card. Money on the Venmo Card is taken from your Venmo balance, but you can also transfer money from other funding source for purchases. You can also withdraw money from ATMs at no cost. The Venmo card is accepted everywhere that mastercard is and comes in a range of colors. Similar to the app itself, the Venmo card allows purchases to be split among multiple people -- Venmo will even keep track of your purchases to make splitting prices more convenient. The card itself is swipeable, has a chip, and can tap to pay using Near Field Connection -- like apple pay. There is also a freeze button in the app if you happen to lose you card, and you can unfreeze it if you find it again. .[12]

News Feed

Venmo has a news feed feature for its users. There are three types of news feeds:

* Global * Friends * Personal

The global news feed shows every request or payment that is made on Venmo in the order of their occurrence. The friend's news feed shows the user transactions that occur between the user's friends making a post or others. This difference is distinguished by a symbol on the right side of each post, with a symbol of friends for the user's friends and the globe for others. Each post shows between whom the transaction was made, a photo of the sender, the comment and the time it occurred. It does not state the amount being transferred. The user is also given the option to like or comment on the post. Often times users like each other's post to show that they are aware they received the transfer. The personal news feed is specific to each user and shows their transactions that have occurred over time. The major difference with this timeline is that shows the transaction amount which is green when money is received and red when a payment is made. It also shows the user when a transfer has been made to their bank.

Business Model

While Venmo is not a revenue-generating entity of PayPal, the child company still extends the reach of PayPal's user base by a significant amount. As of early 2017, Venmo was only responsible for around five percent of PayPal’s total payment volume[13], but its mobile capabilities are becoming far more popular than PayPal's original application and website. The social nature of Venmo's platform has allowed it to take off among younger audiences in a way that the PayPal application did not manage to do. While Venmo itself is a transaction fee-free platform for payments made from user bank accounts or existing Venmo balances, payments made by debit and credit cards do include a three percent transaction fee[14]. Venmo continues to be a strong competitor against similar mobile payment methods like ApplePay, Google Wallet, and various other mobile payment options available through social media platforms (Facebook offers a payment option through its messenger service, Twitter offers Square Cash through its app, and Snapchat recently released SnapCash as a method of in-app payment)[15]. In coming years, Venmo is looking to expand its reach in various contexts, most prominently by means of in-store payment options that will shift the tide further away from traditional in-store payment methods.

Social Culture

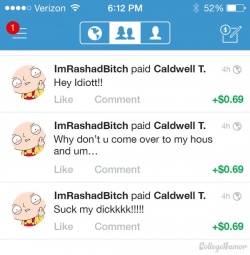

The familiar design of the newsfeed encourages users to like and comment on interactions. For this reason, many users thoroughly ponder the short description that will be used to represent their transaction. Although, many do not use Venmo as their prime social media platform, Venmo promotes social interactions through different posts. Friends and the users they interact with are able to see each others interactions and read the short description that describes the money transfer. Many users use this feed as a way to keep up with friends and to see who their friends are interacting with. [16] A common theme among these descriptions follow humorous descriptions, sexual innuendos or simple emojis, that may or may not properly describe the reason for the money transaction. [17]

Competitors

Venmo competes with many other money sharing applications, with the most popular including Square Cash, Paypal, Apple Pay, CashApp, and Zelle.

Square Cash

One of the best advantages of using Square Cash is that the person you're paying does not need a Square Cash account, making it a lot easier to transfer money without having the recipient download an application. The application is free to use but does enforce a three percent fee for using credits (similarly to Venmo's policy). The application has been noted for its simplistic design and ease-of-use, making it easy to track payments and history. [18]

PayPal

Paypal, Venmo's parent company, has been around for years now which makes it it the most enduring competitor of Venmo. The company still offers its own service for sending and receiving payments, which differs from Venmo's service. The user does need a bank account or card linked to PayPal in order to draw the balance from, or alternatively a positive balance in their account. While sending money straight from an account is free, by using a linked card the user is charged $0.30 plus 2.9 percent of the amount. This makes PayPal the most costliest app to use out of all the competitors. Although, PayPal is the only application that allows you to send money to people outside of the U.S.

As of 2015, PayPal acquired 184 million active users and 14.5 million merchants, with a generated revenue of $9.2 billion. This proves that the parents company of Venmo still remains one of the giants in the payments world. [19]

Apple Pay

In 2017, Apple launched its first ever person-to-person payments service that allows iOS users to send payments all through the Messages app on any iOS device, including the iPhone, iPad, and even Apple Watch. Before sending money through the service, the user must securely authenticate the transaction through either Face ID facial recognition on the iPhone X, or the touch ID fingerprint on other iPhones. Any payments that a user receives are added to a new Apple Pay Cash card, while any money that is sent is users from an already stored card on the Apple Wallet app or the Apple Cash Card on a device. While there are no fees to dispatch money using your debit or Apple Pay Cash card, there is a typical 3% fee to send money through a credit card (similar to other competitors).

The attraction here lies within the simplicity of sending payments directly through the Messages app and the payments capability that's already built in with Apple Pay. While many existing iOS already use Apple Pay, this feature only further enhances the simplicity of making payments. On the other hand, one obvious downside to this application is that it's not available with Android users, which may make sending payments difficult for users using different operating systems. [20]

Zelle

A wide range of banks, including Bank of America, Capital One, Citi, Chase, TD Bank, U.S. Bank and Wells Fargo among others, partnered in early 2017 to create their own service called Zelle as part of their own bid for this competing market. The application is built directly into each bank’s mobile app, making the system easy to use for customers. To send money through Zelle, the sender enters the recipients phone number and email address, built on the assumptions that each of those criteria is unique to one person.

Zelle has suffered recently from hackers and con artists who have used to system to steal from users. Aspects of Zelle's design have been pinpointed as a probable cause of this, as it does not always notify customers when money is transferred. Some banks have been accused of not properly monitoring Zelle's system, as they have "just implemented it without any protections, such as two factor authentication and user-behavior monitoring." [21]

The obvious appeal to Zelle is direct relation to a user's banking account, making the payments streamlined and quickly deposited. But, in recent events of hackers becoming increasingly present within the system, it may prevent users from returning back to the application.

Ethical Implications

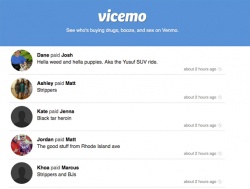

Personal information and financial information is protected by Venmo's security systems and data encryption. Financial information is protected on secure servers.[22] Venmo is a mobile application, meaning its security goes beyond just the application. Venmo if primarily accessed through mobile phones causing security issues that developers cannot control. Unlike other mobile applications, Venmo experiences another level of security with the presence of bank account details as well as other confidential and sensitive information. Venmo does not have a phone line to service customer issues regarding stolen funds or other security concerns[23], which means that customers in need of urgent assistance may not receive immediate attention. Instead, Venmo relies on an email system that is slow in response time.[24] The most prominent ethical problem being addressed by the popular press and various users of mobile payment methods, is the problem of informed consent.[25] Upon signing up for a Venmo account, users are not made "explicitly" aware of the risks associated with connecting their bank account and credit card information to the platform. This is seen to some as a breach of ethics, while alternatively the blame could be put on those who do not read the fine print. The issue of confidentiality is another major ethical concern that arises with Venmo. Venmo's platform is highly social, one of its affordances being the inclusion of the global news feed, in which all transactions are published regardless of any one user's interest in maintaining a more private existence on the application. Usernames are easily searchable and can be accessed even by those who are not connected with any particular user, which in some cases allows for increased convenience but also means a sacrifice of privacy.

Security

Although PayPal, Venmo's parent company, has two-factor authentication for every transaction and password reset, Venmo does not. [26] This lack of authentication means that anyone with access to the application on another smartphone could potentially transfer large sums of money instantly, without the user being able to stop it. In July 2011, Venmo released an iPhone application update that added a passcode lock feature enabling users to lock their Venmo app with a four-digit PIN or Touch ID (the Touch ID function is only available for iPhone 6 users).[27] If the user chooses to create a PIN for their account, they will be asked for their PIN or Touch ID every time they log in or open the app.[28] This added security measure serves to provide a little more security for Venmo users. Venmo limits users to $300 transfers per week or up to $2,900 with identity verification. Although Venmo requires these transfer limits, there have been instances in which users managed to successfully transfer more than the $300 limit without identity verification. This kind of loophole can be dangerous especially if one user were to access another user's Venmo account to send large sums of money. The application's convenience is why so many users are not too worried about anything bad happening to them, but Venmo has been working harder to ensure that users don't need to sacrifice security for convenience. In dealing with sensitive information like bank account details, it should be even more crucial to the company to ensure that their users can expect a secure experience. [29]

Still with a lack of a dedicated support line, important urgent issues regarding stolen funds and lost funds are met with slow email responses in which nothing is really resolved.

Security Breaches

There have been several security breaches reported through Venmo's platform. One victim of these security breaches was Bryant Trinh, a senior at California State University, Long Beach. The 21-year-old was robbed of $3,000 and was alerted of the suspicious activity by his Chase bank bank as opposed to the application itself. Trinh claimed that he received no notifications of another user logging into his account, and furthermore received no notice of any transactions taking place.[30] Since the event, Venmo has updated their policy, and now sends emails to notify users of when a transaction has been completed. Professional poker player Moshin Charania was another victim of Venmo's negligence when dealing with security flaws in their application. Charania's account was hacked for more than two thousand dollars. While Charania was later reimbursed for his loss by Venmo, the issue of account safety was still brought into question by Venmo users, most of whom voiced their concern for the platform's security over various social media accounts.[31]

In another case, Chris Grey, a 30-year-old web developer from New York City, received a notification from his Chase bank account informing him that his account had been charged the amount of $2,850. Grey checked his Venmo account to find that his password no longer allowed him to successfully log into his account. After resetting the password, Grey was able to see that a new address had been entered under his account information and transaction notifications had been disabled. A payment of $2,850 had been made to a user that Grey didn't know. Security concerns followed as Venmo again had failed to notify Grey of any of this suspicious activity on his account.[32] Failure to notify users when account settings have been changed is one of the applications greatest security concerns, and has been the focus of many security breaches. In most cases, users are alerted of suspicious transactions through their linked bank accounts; however, as some users do not have automatic alerts for unusual or unexpected transactions, it would be in the best interests of the users if Venmo's alert system were updated to reflect this need. After numerous hacking cases came to the company's attention, Venmo adjusted the application by implementing a feature through which users can set up email and text notifications to receive instant updates on when a payment is made through their account. Despite these improvements, the process for correcting a hacked or incorrect payment remains relatively slow.

In addition, because of the lack of security on the platform, it is easy for other people to steal phones and send themselves money. A common way to do this is by claiming to be giving someone their phone number, and while using their phone to input the number, they can Venmo themselves money. There is no way for users to protect themselves against this kind of situation currently.

Scams and Fraud

Multiple reports of Venmo scams and fraud have been reported throughout Venmo's history. Users are able to leverage and take advantage of Venmo's users guidelines to trick users into sending them items and not paying for them. In 2015, Kyle, a 32 year-old in South Florida was scammed out $2,400 after giving his NBA finals tickets to buyers. Kyle, had received a confirmation notification from Venmo telling him that his had successfully transferred $4,800 in his Venmo account to his bank account. However, when he checked his bank account the next day, only half of the $4,800 was in his account and $2,400 was missing. When contacting Venmo about this incident, Venmo responded by referencing their User Agreement and their explicit rule that "Business, commercial, or merchant transactions may not be conducted using personal accounts". Kyle is not the only person who have fallen victim to a Venmo scam. However, the ethics of these transactions are murky as Venmo is technically not in the wrong, and individuals like Kyle are at fault for breaching the user agreement. Unethical users who initiate the scams are also at fault, but bring a more complex layer to the ethical usage of Venmo by putting part of the fault on the other user completing the transaction.

Undo

Another problem with Venmo is that there is no way to 'undo' a transaction. For example, if a person was sending their friend $50 and added an extra 0, making it $500, there would be no way to undo this action without asking the friend to Venmo the person back. There is also no confirmation page when sending someone money on the application, making it easy to mistakenly send someone more money than intended.

Privacy

Because Venmo also has a social aspect associated with it, it deals with many of the same issues that social media sites deal with. Venmo has a “news feed” where users can see various transactions split into public transactions, friends’ transactions and personal transactions. Venmo has put a feature that allows a user to decide if a payment will be public, private or just for their friends. While this option is helpful for Venmo users to protect their privacy, some users do exploit the system by naming their payments inappropriately and using the public option to catch other people's attention for fun.[33] Venmo does not filter out most inappropriate content, which can be ethically damaging to innocent users, especially younger ones.

Venmo also allows users to link with other social media sites like Facebook, Twitter, and Foursquare which would then share their payments and posts on that social media. [34] This social sharing will increase the privacy issues that Venmo has to deal with because it not only has to contend with the privacy of users on their own application but now other social media sites are involved as well. Within a Venmo user's social network, the company provides three levels of sharing privacy (public, friends only, or private) that can be toggled on the fly. Being transparent and open about privacy and sharing is a key factor for Venmo as their business deals with finances, which is an intrinsically private matter for most people.

See Also

References

- ↑ Venmo: About the Product

- ↑ 13 Fascinating Things We Learned About Payments Company Venmo From Its Founder.

- ↑ Cash is for Losers

- ↑ PayPal Acquires Braintree

- ↑ People Sent $1.6 Billion Over Venmo

- ↑ PayPal rolls out Venmo payments to its U.S. retailers

- ↑ Venmo | User Agreement

- ↑ Introducing Venmo Codes: A New Way to Find Your Friends on Venmo.

- ↑ Venmo About Fees

- ↑ Venmo App Review

- ↑ YouTube App Review

- ↑ Venmo Card

- ↑ Venmo's monetization will be worth watching

- ↑ How Safe Is Venmo and Why Is It Free?

- ↑ Venmo: Its Business Model and Competition

- ↑ “Why Do You Stalk People on Venmo?”.

- ↑ The Emoji of Venmo: Food, Booze, Partying, and, Occasionally, Rent..

- ↑ The Best Apps for Sending Money, From Least to Most Annoying

- ↑ PayPal Is Okay If Millennials Don't Know It Owns Venmo

- ↑ Apple's Venmo rival launches in beta

- ↑ Zelle, the Banks’ Answer to Venmo, Proves Vulnerable to Fraud

- ↑ Venmo About Security

- ↑ Venmo Security

- ↑ Venmo Security Issues

- ↑ Ethics of Disclosure to Clients Who Pay With Plastic or Online Transfers

- ↑ Venmo Security and Hacking Threat

- ↑ iPhone Update Released

- ↑ Add a Pin

- ↑ Cash-free Pay Options

- ↑ College Student Hacked for $3,000 Serves as Warning of Venmo’s Security Issues

- ↑ Venmo Hackings

- ↑ Is Venmo Safe?

- ↑ YouTube App Review

- ↑ Venmo Aims to Make Mobile Payments Social