Difference between revisions of "Venmo"

(→History) |

m (Rewording and clarification for Venmo/Privacy) |

||

| Line 50: | Line 50: | ||

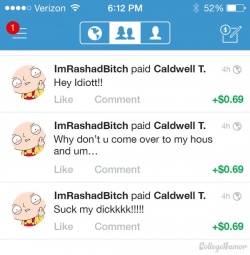

Because Venmo also has a social aspect associated to it, it deals with many of the same issues that social media sites deal with. Venmo has a “news feed” where users can see various transactions split into public transactions, friends’ transactions and personal transactions. Venmo has put a feature that allows a user to decide if a payment will be public, private or just for their friends. While this option is helpful for Venmo users to protect their privacy, some users do exploit the system by naming their payments inappropriately and using the public option to catch other people's attention for fun.<ref name="YouTube App Review"/> Venmo does not filter out most inappropriate content, which can be ethically damaging and scarring to innocent users, especially younger ones. | Because Venmo also has a social aspect associated to it, it deals with many of the same issues that social media sites deal with. Venmo has a “news feed” where users can see various transactions split into public transactions, friends’ transactions and personal transactions. Venmo has put a feature that allows a user to decide if a payment will be public, private or just for their friends. While this option is helpful for Venmo users to protect their privacy, some users do exploit the system by naming their payments inappropriately and using the public option to catch other people's attention for fun.<ref name="YouTube App Review"/> Venmo does not filter out most inappropriate content, which can be ethically damaging and scarring to innocent users, especially younger ones. | ||

| − | Venmo also allows users to link with other social media sites like Facebook, Twitter, and Foursquare which would then share their payments and posts on that social media. <ref>Venmo Aims to Make Mobile Payments Social http://www.pcworld.com/article/252261/venmo_aims_to_make_mobile_payments_social.html</ref> This social sharing will increase the privacy issues that Venmo has to deal with because it not only | + | Venmo also allows users to link with other social media sites like Facebook, Twitter, and Foursquare which would then share their payments and posts on that social media. <ref>Venmo Aims to Make Mobile Payments Social http://www.pcworld.com/article/252261/venmo_aims_to_make_mobile_payments_social.html</ref> This social sharing will increase the privacy issues that Venmo has to deal with because it not only has to contend with the privacy of users on their own application, but now other social media sites are involved as well. Within a Venmo user's social network, the company provides three levels of sharing privacy (public, friends only, or private) that can be toggled on the fly. Being transparent and open about privacy and sharing is a key factor for Venmo as their business deals with finances, which is an intrinsically private matter for most people. |

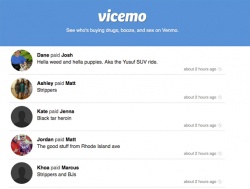

[[File:vicemo.jpg|right|250px|thumb|What a Venmo newsfeed might look like.]] | [[File:vicemo.jpg|right|250px|thumb|What a Venmo newsfeed might look like.]] | ||

| + | |||

===Case Study about Transparency=== | ===Case Study about Transparency=== | ||

In one case, Chris Grey, a 30-year-old Web developer from New York City saw a notification from [[Chase]] bank that debited his account $2850. He opened his Venmo account to see that his password no longer worked. After resetting his password, he was able to see that a new address was entered under his account and notifications had been disabled. The payment was made to a user he didn't know. Venmo did not notify Grey of any of this suspicious activity. Grey said, "I never got an email that my password had changes, that another email was added to my account, that another device was added to my account, or that a lot of my settings had changed." <ref name="Venmo security"/> Venmo does not notify users when login settings have changed, which can be a major ethical issue when accounts get hacked and the user does not know about it until it is too late.<ref name="security issues"/> To counter this, Venmo allows a user to set email, text, and phone notifications to receive instant updates on when a payment is made through their account. However, the process to correct a hacked or incorrect payment is still relatively slow. | In one case, Chris Grey, a 30-year-old Web developer from New York City saw a notification from [[Chase]] bank that debited his account $2850. He opened his Venmo account to see that his password no longer worked. After resetting his password, he was able to see that a new address was entered under his account and notifications had been disabled. The payment was made to a user he didn't know. Venmo did not notify Grey of any of this suspicious activity. Grey said, "I never got an email that my password had changes, that another email was added to my account, that another device was added to my account, or that a lot of my settings had changed." <ref name="Venmo security"/> Venmo does not notify users when login settings have changed, which can be a major ethical issue when accounts get hacked and the user does not know about it until it is too late.<ref name="security issues"/> To counter this, Venmo allows a user to set email, text, and phone notifications to receive instant updates on when a payment is made through their account. However, the process to correct a hacked or incorrect payment is still relatively slow. | ||

Revision as of 17:02, 26 April 2016

|

Contents

History

In 2012, Braintree acquired Venmo for $26.2 million.[3] Then, in 2013, PayPal acquired Braintree for $800 million in an all-cash deal.[4] In Quarter 2 of 2015, company earnings showed that people sent $1.6 billion over Venmo.[5]

The founders of Venmo are Andrew Kortina and Iqram Magdon-Ismail. The two met at the University of Pennsylvania in 2001 where they were randomly assigned to be each other's roommates. Throughout senior year and for a few years after graduation, they began working on various projects and launched Venmo in August 2009. However, their original idea was a music startup where people could send a text to a band and then receive an [MP3] via email. The idea for sending payments with technology supposedly came during a night where Magdon-Ismail forgot his wallet and owed Kortina money. The original design was for users to send and receive payments via text message. [6] This idea eventually evolved into becoming today's version of Venmo, where users can send money using the mobile application or web.

Service

How it Works

Users begin to set up their Venmo account and must choose how they want to pay other users. There are three options for this:

- Venmo balance

- Credit/debit card

- U.S. Bank account

Users can then pay and receive money using their Venmo account and the pay option that they have chosen. Contact will appear in the user's address book and they are able to search for someone by username, phone number or email.[7] They can make a payment by clicking a pen and paper icon that will load a screen titled "New Transaction." The user will then enter the name of the person they are sending it to, the amount of the transaction, and the description of what the transaction is for. Users have the option to pay the person or request a payment from them.[8] If the user were to send a request for someone to pay them, it would send that other person a notification asking them to make a payment. [7]

It is possible to have the money in a Venmo balance be transferred to a bank account. The user must add a bank account (savings or checking) to their Venmo account. They can then go to their profile and click the "transfer to bank" button. The user can enter the amount they want to cash out. Transfers to a user’s bank account will take about 1 business day. [7]

There is a 3% fee on credit cards and some debit cards, but receiving money through the Venmo app is always free.[9]

Ethical Implications

Personal information and financial information is protected by Venmo's security systems and data encryption. Financial information is protected on secure servers.[10] Because Venmo is a mobile application, its security goes beyond just the application. Phone security remains an issue because it is the platform for the application. There has been debate about how secure Venmo really is. Unlike other mobile applications, Venmo experiences another level of security due to the fact that it deals with bank accounts and confidential and sensitive information. Venmo does not have a phone line to deal directly with customer issues regarding stolen funds or other security concerns. [11] This means that customer that need urgent help may not receive immediate attention because Venmo relies on an email system that is known for being slow to respond.[12] This process is very slow and unfair to Venmo users, especially given the fact that Venmo users transfer over $1.6 billion dollars in just a couple months and has the potential of hundreds of incorrect transactions per month.[13]

Security

Although PayPal, Venmo's parent company, has two-factor authentication for every transaction and password reset, Venmo does not. [14] This means that anyone with access to applications on someone else's phone could potentially transfer large sums of money through Venmo in an instant. In July 2011, Venmo released an iPhone application update, which added a passcode lock features. Users can now lock their Venmo app with a four-digit PIN or Touch ID (for iPhone 6 users).[15] If the user chooses to create a PIN for their account, they will be asked for their PIN or Touch ID every time they log in or open the app.[16] This added security measure serves to provide a little more security for Venmo users. Venmo limits users to $300 transfers per week or $2,900 with identity verification. Although Venmo has these limits there have been instances were users were able to transfer over the $300 limit without identity verification and it went through. That can be dangerous especially if someone else were to get into someone else's Venmo account to send large sums of money. The apps convenience is why so many users are not too worried about anything bad happening to them, which is something Venmo has to realize. Yes, they have a great app that helps a lot of people, but it is their job to also make sure their app is secure. [17]

E-Hackings

There have been a few alarming cases of security breaches in Venmo's Platform. One of the victims of these security breaches was a senior at Cal State Long Beach who lives in Westminster, California. The 21 year old was robbed of three thousand dollars and later alerted by his Chase bank account, but not by the app. He claims he was not alerted when the other person logged on to his account, and did not get a notice of the transaction. Since the event, Venmo has updated their policy, as now they send emails to alert you of when a transaction has been completed. Another victim of hacking was a professional poker player by the name of Moshin Charania. His account was hacked for more than two thousand dollars. He was later reimbursed by Venmo, but the issue of account safety was still brought into question. [18]

Privacy

Because Venmo also has a social aspect associated to it, it deals with many of the same issues that social media sites deal with. Venmo has a “news feed” where users can see various transactions split into public transactions, friends’ transactions and personal transactions. Venmo has put a feature that allows a user to decide if a payment will be public, private or just for their friends. While this option is helpful for Venmo users to protect their privacy, some users do exploit the system by naming their payments inappropriately and using the public option to catch other people's attention for fun.[7] Venmo does not filter out most inappropriate content, which can be ethically damaging and scarring to innocent users, especially younger ones.

Venmo also allows users to link with other social media sites like Facebook, Twitter, and Foursquare which would then share their payments and posts on that social media. [19] This social sharing will increase the privacy issues that Venmo has to deal with because it not only has to contend with the privacy of users on their own application, but now other social media sites are involved as well. Within a Venmo user's social network, the company provides three levels of sharing privacy (public, friends only, or private) that can be toggled on the fly. Being transparent and open about privacy and sharing is a key factor for Venmo as their business deals with finances, which is an intrinsically private matter for most people.

Case Study about Transparency

In one case, Chris Grey, a 30-year-old Web developer from New York City saw a notification from Chase bank that debited his account $2850. He opened his Venmo account to see that his password no longer worked. After resetting his password, he was able to see that a new address was entered under his account and notifications had been disabled. The payment was made to a user he didn't know. Venmo did not notify Grey of any of this suspicious activity. Grey said, "I never got an email that my password had changes, that another email was added to my account, that another device was added to my account, or that a lot of my settings had changed." [11] Venmo does not notify users when login settings have changed, which can be a major ethical issue when accounts get hacked and the user does not know about it until it is too late.[12] To counter this, Venmo allows a user to set email, text, and phone notifications to receive instant updates on when a payment is made through their account. However, the process to correct a hacked or incorrect payment is still relatively slow.

See Also

References

- ↑ Venmo-About the Product https://venmo.com/about/product/

- ↑ Questions About Security http://abcnews.go.com/Technology/venmo-app-users-raise-questions-security-peer-peer/story?id=29658676

- ↑ Cash is for Losers http://www.bloomberg.com/bw/articles/2014-11-20/mobile-payment-startup-venmo-is-killing-cash

- ↑ PayPal Acquires Braintree http://techcrunch.com/2013/09/26/paypal-acquires-payments-gateway-braintree-for-800m-in-cash/

- ↑ People Sent $1.6 Billion Over Venmo http://thenextweb.com/apps/2015/07/16/people-sent-1-6b-over-venmo-in-q2-2015-more-than-double-this-time-last-year/#gref

- ↑ 13 Fascinating Things We Learned About Payments Company Venmo http://www.businessinsider.com/venmo-origin-story-facts-andrew-kortina-2014-6

- ↑ 7.0 7.1 7.2 7.3 Venmo|App Review https://www.youtube.com/watch?v=QlJwgjN3lCY

- ↑ Venmo App Review https://www.youtube.com/watch?v=YEcikNNzOkI

- ↑ Venmo About Fees https://venmo.com/about/fees/

- ↑ Venmo About Security https://venmo.com/about/security/

- ↑ 11.0 11.1 Venmo Security http://www.slate.com/articles/technology/safety_net/2015/02/venmo_security_it_s_not_as_strong_as_the_company_wants_you_to_think.html

- ↑ 12.0 12.1 Venmo Security Issues http://www.engadget.com/2015/03/02/venmo-security-issues/

- ↑ Venmo Users Transfer $1.6 Billion in 3 Months http://www.businessadministrationinformation.com/news/venmo-users-transferred-1-6-billion-in-3-months

- ↑ Venmo Security and Hacking Threat http://www.theverge.com/2015/2/27/8120983/venmo-security-problem-hacking-theft

- ↑ Iphone Update Released http://blog.venmo.com/hf2t3h4x98p5e13z82pl8j66ngcmry/iphone-update-released?rq=email%20settings

- ↑ Add a Pin https://help.venmo.com/customer/portal/articles/1353616-can-i-add-a-pin-to-my-account

- ↑ Cash-free Pay Options http://www.cnet.com/how-to/square-vs-venmo-vs-google-wallet-vs-paypal/ Five Ways to Get People To Pay You Back

- ↑ Venmo Hackings http://nextshark.com/venmo-hacked/

- ↑ Venmo Aims to Make Mobile Payments Social http://www.pcworld.com/article/252261/venmo_aims_to_make_mobile_payments_social.html