Difference between revisions of "Klarna"

m |

|||

| Line 40: | Line 40: | ||

Afterpay is an Australian company, with operations in the United States, Canada, the United Kingdom, New Zealand, and its home country of Australia. The company was founded in 2015 by Nick Molnar and Anthony Eisen <ref name="AfterPay"> AfterPay https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ accessed April 9 2021. </ref>. The company is now valued at $3.3 billion. | Afterpay is an Australian company, with operations in the United States, Canada, the United Kingdom, New Zealand, and its home country of Australia. The company was founded in 2015 by Nick Molnar and Anthony Eisen <ref name="AfterPay"> AfterPay https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ accessed April 9 2021. </ref>. The company is now valued at $3.3 billion. | ||

| − | Afterpay is currently the far-and-away leader in terms of US BNPL transactions. The company leads the market with 70% of the transactions here in the United States<ref name="BNPL market report"> BNPL market report https://www.cbinsights.com/reports/CB-Insights_Buy-Now-Pay-Later-Outlook.pdf accessed April 9 2021. </ref>. | + | Afterpay is currently the far-and-away leader in terms of US BNPL transactions. The company leads the market with 70% of the transactions here in the United States<ref name="BNPL market report"> BNPL market report https://www.cbinsights.com/reports/CB-Insights_Buy-Now-Pay-Later-Outlook.pdf accessed April 9 2021. </ref>. In just four months since entering the US market, Afterpay has joined with more than 900 retailers, including Urban Outfitters, Free People, Anthropologie, Revolve, Morphe and Quay. An additional 1300 retailers are in the pipeline to join AfterPay, including Kylie Cosmetics, Skechers, and Steve Madden. |

| − | + | ||

| − | + | ||

=== Affirm === | === Affirm === | ||

| + | Affirm was created in 2012 by multiple founders including Max Levchin, former Co-founder of Paypal who also has been involved with highly successful startups like Yelp and Slide. | ||

| + | Affirm is partnered with big players such as Peloton, Casper, Expedia, Eventbrite, and over 900 other companies. The company has issued over a million loans since inception <ref name="Affirm"> Affirm https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ accessed April 9 2021. </ref> | ||

=== Zip === | === Zip === | ||

Revision as of 15:32, 9 April 2021

Klarna is a Swedish financial technology company that offers a number of payment options, such as direct payments, pay after delivery and installment plans.[1] Klarna "makes shopping smoooth" with the flexibility of payment method options, interest-free payments, and no credit score impact.[2][3].

Klarna gives consumers an option where using a credit card is their last resort when online shopping.[4] Klarna made this possible thanks to their international success that started in 2005 and the growing numbers of investors, such as H&M and Snoop Dogg, complimenting the option of buying something online instantly while being able to pay it off fully in 4 payments.[5][6] Through Klarna's shopping app, Klarna offers a vast variety of well-known retailers that accept Klarna. When shopping through the app, Klarna appears as one of the payment options when users are ready to purchase.[7]

The goals and objectives of Klarna come full circle with the relationship that is fostered with their users, investors, and employees everywhere. As the company continues to grow, Klarna hopes to branch into a fully-fledged bank.[5]

Contents

History

Klarna began in 2005 when three entrepreneurs, Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson, decided to act on their vision and start up their company after being ranked last in a pitch holding audition. Their motto for this pitch was and remains "Buy now, pay later" but was first named Kreditor Europe AB for the reason it sounded more serious and trustworthy. Klarna's success and expansion to international markets has changed the online shopping experience for many people who prefer the option of paying in 3 or 4 different installments than all at once [5]..

Kreditor Europe AB continued to expand to Norway, Finland, and Denmark from 2006 to 2008. From 2009-2011, they expanded to international countries outside of Europe leaving behind their starting name and rebranding as what it is known today, Klarna. Big name companies and retailers were investing in Klarna because of the increase in success of the company and large expansion overseas. Not only was Klarna expanding and succeeding, but on the other end of the spectrum, their retail partners also noted double to triple the amount of sales overnight[5].. It is a win-win situation for both Klarna and its investors and their retail partners. In 2019, Klarna had many more investors. While this is happening, Klarna is ranked the highest valued private fintech company in Europe as well as ranked 6th in the world. Current data shows that Klarna is still growing and improving their company. Their rankings are well accompanied by the little over 90 millions consumers who use Klarna as well as their 200,000 retail partners to date [5].

Klarna is available to people across three continents that averages at one million transactions per day. Klarna has grown exponentially since its early start up day and now has over 3,500 racially and ethnically diverse employees [5].

Ethical Implications

Klarna allows users in the United States to pay in 4 interest free installments and users in the UK to pay in 3 interest free installments. Klarna also has flexible payment methods that users can use when buying something through Klarna with the payments disconnected to the impact on the users’ credit score [8].

Klarna, along with other buy now and pay later services, have taken the attention away from credit cards and focused it on the simple act normalizing shopping in separate payments without the worry of the user's credit score being affected. Klarna can be perceived differently by different groups of people. It may appear as a guilty pleasure that allows them to spend money that is not yet available; arbitrary and weird innovative concepts; or impacting the societal handling of money and societal monetary implications [4]. All in all, Klarna is available to the users who are interested in trying it out, users who need the 3 or 4 payment installments to pay off a purchase, or users who just want to see what the hype is about [8].

Customers who have used Klarna’s buy now and pay later service have spoken of an issue where Klarna claimed to not have received payment from the customers even though the customers have sent the payment through bank transfer.[9] Back in 2019, Erin Phillips, a college student who often used Klarna experienced her credit score being cut half from the original score she had. Her credit score had cut to half due to Erin’s mistake of not knowing that her credit score would decrease if she went a few days over the 30 day deadline.[10] When Erin’s payments were overdue, Klarna sent her a letter stating “Since the purchase was not paid on time we have extended your due date by 7 days. Please make your payment as soon as possible to ensure that you can continue to benefit from using Klarna’s Pay later and Slice it payment services”. By the letter’s wording, Erin believed she received 7 days of grace period where she could pay without any negative consequences.[11]

Online shopping in 2005 was not as prominent as it is currently in 2021, but the success of Klarna over the years has proved to be well needed by many people who use it in the present day. Online shopping has become an essential part of everyday life with. wide audience target being millennials and Gen Z. People who want to purchase but do not have the upfront payment for it depend on services like Klarna to purchase what they want and need in four equal payments. Klarna's services are attractive to people who want to keep up to date with media trends like clothing and technology who are interested in 0% loans provided by Klarna. As long as the borrower pays their payments in full and on time, the 0% interest fee remains until late payments begin to occur, and it interferes with Klarna's Terms of Service.

Opening up a Klarna account is simple. Almost anyone is accepted to use it, and it beneficial to those who want to utilize Klarna for their online shopping needs. If the borrower pays their payments on time, Klarna transparently does not charge hidden fees or interest fees. However, if a Klarna user is overusing Klarna and not paying their payments on time, Klarna has the right to report that credit usage to credit unions and reduce, or even prevent, the loan usage they are afforded. The irresponsible and dangerous credit usage demonstrated by a user are red flags; that is when problems begin to rise for users. This behavior is unacceptable with Klarna, and it is possible for that behavior to affect the user's financial and credit record. To prevent a decrease in credit score, the user must adhere to the guidelines that Klarna has set up, and the user should pay their payments before the payment is due or on the day off to not pay interest [8].

Klarna's Offices

Klarna’s main offices in the United States are located in Los Angeles, California and New York City, New York. The CEOs of Klarna have been constantly advised to move their offices out of Sweden, LA, and NYC into Silicon Valley due to the immersive and exponential growth it can create for them [4]. However, Klarna’s CEO has set that advice to the side because they are happy with the growth the company has experienced in Sweden. Sweden is one of the most successful countries and societies altogether in the world that generates a platform for people to be successful. This is clearly visible with the success Klarna has experienced, and that in itself demonstrates the characteristics and morals of the country [4].

Klarna's Competitors

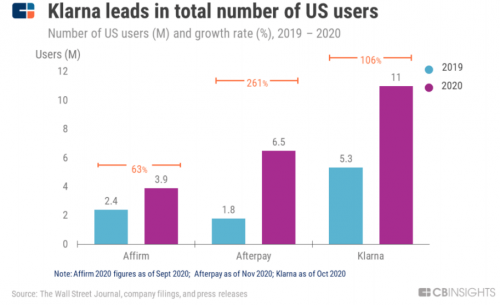

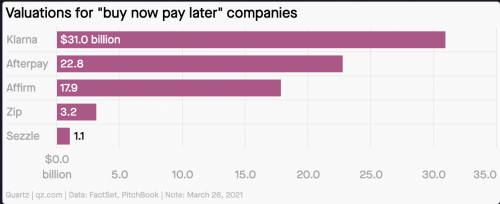

As of April 2021, Klarna's valuation topped $31 billion, easily putting it at the top of the BNPL (buy now pay later) market [12]. Klarna leads the market in terms of US users with 11 million as of late 2020. This represented a 106% increase in US usage compared to 2019, remarkable growth considering the economic implications of Covid-19 during 2020[13]. However, there are still other viable firms in competition with the new tech company. Most notable are Afterpay, Affirm, Zip, and Sezzle.

Afterpay

Afterpay is an Australian company, with operations in the United States, Canada, the United Kingdom, New Zealand, and its home country of Australia. The company was founded in 2015 by Nick Molnar and Anthony Eisen [14]. The company is now valued at $3.3 billion.

Afterpay is currently the far-and-away leader in terms of US BNPL transactions. The company leads the market with 70% of the transactions here in the United States[13]. In just four months since entering the US market, Afterpay has joined with more than 900 retailers, including Urban Outfitters, Free People, Anthropologie, Revolve, Morphe and Quay. An additional 1300 retailers are in the pipeline to join AfterPay, including Kylie Cosmetics, Skechers, and Steve Madden.

Affirm

Affirm was created in 2012 by multiple founders including Max Levchin, former Co-founder of Paypal who also has been involved with highly successful startups like Yelp and Slide.

Affirm is partnered with big players such as Peloton, Casper, Expedia, Eventbrite, and over 900 other companies. The company has issued over a million loans since inception [15]

Zip

Sezzle

References

- ↑ Klarna. (2021, April 9). Shopping freedom with Klarna. https://www.klarna.com/us/about-us/

- ↑ https://www.klarna.com/us/ accessed March 12 2021.

- ↑ Flexible payments for pet owners https://search.proquest.com/openview/53823c68fa6c8044a5e49165b56f42f2/1?pq-origsite=gscholar&cbl=2041027 accessed March 12 2021.

- ↑ 4.0 4.1 4.2 4.3 Making Sense of Klarna https://techcrunch.com/2020/12/08/making-sense-of-klarna/ accessed March 12 2021.

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 15 years of making shopping smooth https://www.klarna.com/international/klarna-15/ accessed March 12 2021.

- ↑ Smoooth Dogg and Klarna release unique collection https://www.klarna.com/international/press/smoooth-dogg-and-klarna-release-unique-collection/ accessed April 7 2021.

- ↑ There is a new way to shop in town. https://www.klarna.com/us/ accessed March 12 2021.

- ↑ 8.0 8.1 8.2 Ethical Instructions for Merchants https://cdn.klarna.com/1.0/shared/content/policy/ethic/en_gb/merchant.pdf accessed March 12 2021.

- ↑ Manavis, Sarah. (2020, December 9). Why Klarna’s millennial customers are losing faith. NewStatesman. https://www.newstatesman.com/business/finance/2020/12/klarna-millennial-empire-started-crumble-credit-score

- ↑ Jones, Lora. (2019, November 11). Payment firm Klarna messed up my credit score, says student. BBC News. https://www.bbc.com/news/business-50306563

- ↑ Linning, Stephanie. (2019, November 15). Student, 21, issues warning over 'buy now, pay later' firms after late payments cut her credit score by HALF - as a debt charity urges companies to be more transparent with customers. Daily Mail. https://www.dailymail.co.uk/femail/article-7690243/Student-21-issues-warning-buy-pay-later-firms.html

- ↑ Klarna Valuation https://www.reuters.com/article/idUSKCN2AT22U/ accessed April 9 2021.

- ↑ 13.0 13.1 BNPL market report https://www.cbinsights.com/reports/CB-Insights_Buy-Now-Pay-Later-Outlook.pdf accessed April 9 2021.

- ↑ AfterPay https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ accessed April 9 2021.

- ↑ Affirm https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ accessed April 9 2021.