Difference between revisions of "Klarna"

m |

(→Partnerships During the COVID-19 Pandemic: edited in links) |

||

| (15 intermediate revisions by 4 users not shown) | |||

| Line 1: | Line 1: | ||

| − | Klarna is a Swedish financial technology company that offers a number of payment options, such as direct payments, pay after delivery and installment plans.<ref>Klarna. (2021, April 9). Shopping freedom with Klarna. https://www.klarna.com/us/about-us/</ref> Klarna "makes shopping smoooth" with the flexibility of payment method options, interest-free payments, and no credit score impact.<ref | + | Klarna is a Swedish financial technology company that offers a number of payment options, such as direct payments, pay after delivery and installment plans.<ref name="KlarnaSite">Klarna. (2021, April 9). Shopping freedom with Klarna. ''Klarna.com.'' https://www.klarna.com/us/about-us/</ref> Klarna "makes shopping smoooth" with the flexibility of payment method options, interest-free payments, and no credit score impact.<ref name="KlarnaSite"/><ref name="Flexible payments for pet owners">(2019, June 22). Flexible payments for pet owners. The Veterinary Record. https://search.proquest.com/openview/53823c68fa6c8044a5e49165b56f42f2/1?pq-origsite=gscholar&cbl=2041027</ref> <br /> |

[[File:Klarna Smoooth Payments OG.png|thumbnail]] | [[File:Klarna Smoooth Payments OG.png|thumbnail]] | ||

| − | Klarna | + | Klarna allows customers to forego credit card use when shopping online.<ref name="Making Sense of Klarna"> O'Hear, Steve. (2020, December 8). "Making Sense of Klarna." ''TechCrunch.'' https://techcrunch.com/2020/12/08/making-sense-of-klarna/ </ref> Klarna started garnering international success in 2005 and gained prominent investors such as H&M and Snoop Dogg.<ref name="15 years of making shopping smooth">Klarna. 15 years of making shopping smooth. ''Klarna.com.'' https://www.klarna.com/international/klarna-15/ </ref><ref name="Smoooth Dogg and Klarna release unique collection"> Klarna. Smoooth Dogg and Klarna release unique collection. ''Klarna.com.'' https://www.klarna.com/international/press/smoooth-dogg-and-klarna-release-unique-collection/</ref> Through Klarna's shopping app, Klarna offers a vast variety of well-known retailers that accept Klarna. <ref name="There's a new way to shop in town."> Klarna. There is a new way to shop in town. ''Klarna.com.'' https://www.klarna.com/us/</ref> Klarna allows users in the United States to pay in 4 interest-free installments and users in the UK to pay in 3 interest-free installments. Klarna also has flexible payment methods that users can use when buying something through Klarna, with the payments being not connected to the users' credit score. <ref name="Ethical Instructions for Merchants"> Klarna. (2021, January 29). Ethical Instructions for Merchants. https://cdn.klarna.com/1.0/shared/content/policy/ethic/en_gb/merchant.pdf</ref> |

| − | https://www.klarna.com/international/press/smoooth-dogg-and-klarna-release-unique-collection/ | + | |

| − | + | ||

| − | + | ||

==History== | ==History== | ||

| − | + | Klarna, first called Kreditor Europe AB, began in 2005 when the three founders, Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson, started the company after being ranked last in a pitch holding audition. Kreditor Europe AB found success and expanded to international markets. This marked the start of allowing the payment of online purchases to occur in three or four different installments rather than all at once.<ref name="15 years of making shopping smooth"> 15 years of making shopping smooth https://www.klarna.com/international/klarna-15/ accessed March 12 2021. </ref> | |

| − | Kreditor Europe AB | + | Kreditor Europe AB expanded their service to Norway, Finland, and Denmark between 2006 and 2008. Between 2009 and 2011, they expanded to other countries outside of Europe and rebranded to the current name of Klarna. Many large companies and retailers invested in Klarna because of their popularity and expansion overseas. <ref name="15 years of making shopping smooth"></ref>In 2019, Klarna was ranked as the highest valued private fintech company in Europe and 6th highest in the world. Today, Klarna is used by over 90 million consumers and partners with 200,000 retail companies, and continues to grow.<ref name="15 years of making shopping smooth"></ref> |

| − | Klarna is available | + | Klarna is available in three continents and completes, on average, one million transactions per day. Klarna has grown exponentially since its inception and now has over 3,500 racially and ethnically diverse employees.<ref name="15 years of making shopping smooth"> </ref> |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

== Klarna's Competitors == | == Klarna's Competitors == | ||

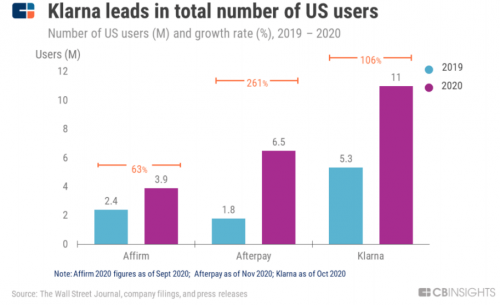

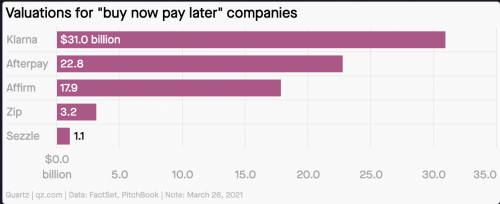

| − | As of April 2021, Klarna's valuation topped $31 billion, | + | As of April 2021, Klarna's valuation topped $31 billion, putting it at the top of the buy now, pay later (BNPL) market.<ref name="Klarna valuation"> Klarna Valuation https://www.reuters.com/article/idUSKCN2AT22U/ accessed April 9 2021. </ref> Klarna leads the market in terms of US users with 11 million as of late 2020. This represented a 106% increase in US usage compared to 2019.<ref name="BNPL market report"> BNPL market report https://www.cbinsights.com/reports/CB-Insights_Buy-Now-Pay-Later-Outlook.pdf </ref> However, there are still other viable firms in competition with the new tech company. Most notable are Afterpay, Affirm, Zip, and Sezzle. |

[[File:US_BNPL.png|500px|thumb|right|]] | [[File:US_BNPL.png|500px|thumb|right|]] | ||

| − | [[File:BNPL.png|500px|thumb| | + | [[File:BNPL.png|500px|thumb|right|]] |

| − | + | ||

| − | + | ||

=== Afterpay === | === Afterpay === | ||

| − | Afterpay is an Australian company, with operations in the United States, Canada, the United Kingdom, New Zealand, and its home country of Australia. The company was founded in 2015 by Nick Molnar and Anthony Eisen <ref name="AfterPay"> AfterPay https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ | + | Afterpay is an Australian company, with operations in the United States, Canada, the United Kingdom, New Zealand, and its home country of Australia. The company was founded in 2015 by Nick Molnar and Anthony Eisen. <ref name="AfterPay"> AfterPay https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ </ref> The company is now valued at $3.3 billion. |

| − | Afterpay is currently the far-and-away leader in terms of US BNPL transactions. The company leads the market with 70% of the transactions here in the United States<ref name="BNPL market report"> BNPL market report https://www.cbinsights.com/reports/CB-Insights_Buy-Now-Pay-Later-Outlook.pdf accessed April 9 2021. </ref> | + | Afterpay is currently the far-and-away leader in terms of US BNPL transactions. The company leads the market with 70% of the transactions here in the United States.<ref name="BNPL market report"> BNPL market report https://www.cbinsights.com/reports/CB-Insights_Buy-Now-Pay-Later-Outlook.pdf accessed April 9 2021. </ref> In just four months since entering the US market, Afterpay has joined with more than 900 retailers, including Urban Outfitters, Free People, Anthropologie, Revolve, Morphe and Quay. An additional 1300 retailers are in the pipeline to join AfterPay, including Kylie Cosmetics, Skechers, and Steve Madden. |

=== Affirm === | === Affirm === | ||

Affirm was created in 2012 by multiple founders including Max Levchin, former Co-founder of Paypal who also has been involved with highly successful startups like Yelp and Slide. | Affirm was created in 2012 by multiple founders including Max Levchin, former Co-founder of Paypal who also has been involved with highly successful startups like Yelp and Slide. | ||

| − | Affirm is partnered with big players such as Peloton, Casper, Expedia, Eventbrite, and over 900 other companies. The company has issued over a million loans since inception <ref name="Affirm"> Affirm https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ | + | Affirm is partnered with big players such as Peloton, Casper, Expedia, Eventbrite, and over 900 other companies. The company has issued over a million loans since inception. <ref name="Affirm"> Affirm https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/ </ref> |

=== Zip === | === Zip === | ||

| + | Zip is an Australian company founded in 2013 and is headquartered in Sydney. The company now has operations in Australia, the United States, the United Kingdom, New Zealand, South Africa, the Czech Republic, and the United Arab Emirates. In September 2020, Zip acquired the US-based BNPL company Quadpay to enter the US market as a bigger player.<ref name="Zip"> Zip https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02275813-2A1247261?access_token=83ff96335c2d45a094df02a206a39ff4 </ref> It currently has around 38,500 retail partners and over 5,700,000 customers.<ref name="Zip 2"> Zip 2 https://www.fool.com.au/2018/01/30/is-zip-co-ltd-still-a-buy-after-20-surge/ </ref> As of March 2021, Zip's valuation was estimated to be around $5.83 billion. | ||

| + | |||

| + | ==Partnerships During the COVID-19 Pandemic== | ||

| + | The covid-19 pandemic led to an increase in online shoppers and Klarna saw a growth in its userbase. Some notable partnerships arose out of this growth. | ||

| + | ===Flybuys=== | ||

| + | In April of 2021, a partnership was announced between Klarna and Flybuys, a popular loyalty program from Australia that works with large retailers such as Coles, Kmart, and Target.<ref>Bradney-George, Amy. (2021, March 26). "Guide to Flybuys rewards program." ''Finder.com.'' https://www.finder.com.au/frequent-flyer/flybuys</ref> Under the partnership, beginning in May, the 8 million active users of Flybuys are able to earn points whenever they use Klarna.<ref name="FR">Mitchell, Sue. (2021, April 13). "Buy now, pay later twist: Flybuys links with Klarna." ''Financial Review.'' https://www.afr.com/companies/retail/buy-now-pay-later-twist-flybuys-links-with-klarna-20210412-p57idr</ref> The partnership allows for further expansion of Klarna's userbase in Australia, including older populations as Klarna's demographic has mostly consisted of younger users.<ref>Feiam, Ally. (2021, April 15). "Inside Klarna and FlyBuys’ New Partnership – Will They Reap the Rewards?" ''PowerRetail.'' https://powerretail.com.au/payment-systems/inside-klarna-and-flybuys-new-partnership-will-they-reap-the-rewards/</ref> The covid-19 pandemic was cited to be one of the reasons influencing the formation of the partnership; the general manager of Klarna stated that a wider range of customers had begun using the buy now, pay later method due to limited access to in-store shopping.<ref name="FR" /> | ||

| + | ===Bluemercury=== | ||

| + | Cosmetics company Bluemercury began working with Klarna in 2021 to offer customers a "secure and contactless way to pay for goods online or in a store" in its 183 U.S. locations.<ref name="BM">Zaczkiewicz, Arthur. (2021, April 7). "Bluemercury Rolls Out Klarna to 183 Stores, Nationwide." ''WWD.'' https://wwd.com/business-news/retail/bluemercury-klarna-rollout-1234795308/</ref> The covid-19 pandemic and younger userbase of Klarna also influenced the formation of this partnership; co-founder and CEO of Bluemercury, Marla Beck, stated that the pandemic "taught us that offering alternative purchasing options is an essential pillar for success. The introduction of Klarna in-store following our online integration allows Bluemercury to reach a new generation of shoppers."<ref name="BM"/> | ||

| + | |||

| + | ==Ethical Implications== | ||

| + | |||

| + | ===Payment Errors & Consequences=== | ||

| + | Customers who have used Klarna’s buy now and pay later service have spoken of an issue where Klarna claimed to not have received payment from the customers even though the customers have sent the payment through bank transfer.<ref>Manavis, Sarah. (2020, December 9). Why Klarna’s millennial customers are losing faith. NewStatesman. https://www.newstatesman.com/business/finance/2020/12/klarna-millennial-empire-started-crumble-credit-score</ref> Back in 2019, Erin Phillips, a college student who often used Klarna experienced her credit score being cut half from the original score she had. Her credit score had cut to half due to Erin’s mistake of not knowing that her credit score would decrease if she went a few days over the 30 day deadline.<ref>Jones, Lora. (2019, November 11). Payment firm Klarna messed up my credit score, says student. BBC News. https://www.bbc.com/news/business-50306563</ref> When Erin’s payments were overdue, Klarna sent her a letter stating “Since the purchase was not paid on time we have extended your due date by 7 days. Please make your payment as soon as possible to ensure that you can continue to benefit from using Klarna’s Pay later and Slice it payment services”. By the letter’s wording, Erin believed she received 7 days of grace period where she could pay without any negative consequences.<ref>Linning, Stephanie. (2019, November 15). Student, 21, issues warning over 'buy now, pay later' firms after late payments cut her credit score by HALF - as a debt charity urges companies to be more transparent with customers. Daily Mail. https://www.dailymail.co.uk/femail/article-7690243/Student-21-issues-warning-buy-pay-later-firms.html</ref> | ||

| + | |||

| + | ===Policy Transparency=== | ||

| + | Debt charities such as Step Change have called for a more transparent policy for buy now and pay later services provided by Klarna and similar companies. <ref>Step Change. (2021, April 9). Buy now pay later: what if I can't pay later?. https://www.stepchange.org/debt-info/buy-now-pay-later.aspx</ref> While advertisements created by these fintech companies highlight no interest and no fees, the ads do not include any negative consequences customers may experience if the payments are not made on time. The flexibility of buy now pay later option and the non-transparent and misleading ads may cause customers to buy products that are out of their financial control, leading to huge drops in credit score and necessity to take out loans to cover the payments.<ref>ET Now Digital. (2021, April 9). Should you opt for buy now, pay later schemes?. ET Now News. https://www.timesnownews.com/business-economy/personal-finance/loans/article/should-you-opt-for-buy-now-pay-later-schemes/742634</ref> Klarna is currently under investigation by the Swedish Data Protection Authority for violating Sweden's Buy Now, Pay Later laws. Sweden's laws require direct, one time payments to be the default option when completing an online purchase, with Klarna and similar services as alternative options. However, Klarna's service was offered as a the default option on some websites, and customers unwittingly participated in the program without understanding its function and rules. <ref>Carter, Leonie (2021, February 3). Payment giant Klarna faces scrutiny over ‘buy now, pay later’ practices[https://www.politico.eu/article/klarna-payment-firm-scrutiny-buy-now-pay-later-business/]</ref> | ||

| + | |||

| + | ===Credit Impact=== | ||

| + | If a Klarna user makes their payments on time, Klarna does not charge hidden fees or interest fees. However, if someone is overusing Klarna and not making their payments on time, Klarna has the right to report that credit usage to credit unions and reduce, or even prevent, the loan usage they are afforded. This can negatively affect a user's credit score. To prevent a decrease in credit score, the user must adhere to the guidelines that Klarna has set up, and the user should pay their payments before the payment is due or on the day off to not pay interest <ref name="Ethical Instructions for Merchants"> Ethical Instructions for Merchants https://cdn.klarna.com/1.0/shared/content/policy/ethic/en_gb/merchant.pdf accessed March 12 2021. </ref>. | ||

| − | === | + | ===Personal Responsibility=== |

| + | Critics such as politicians and media outlets have expressed concerns about Klarna's business model. While Klarna's model can benefit users by allowing them to spend less money at once, it also allows customers to overspend. Klarna's current CEO Sebastian Siemiatkowski has questioned whether Klarna has made borrowing money too easy for users. Because of this reason, Klarna's critics state that the company is exploiting the vulnerable: those who don't have large sums of money to spend but are lured in by Klarna's zero-interest policies and pausing late fees in the United Kingdom. Users who default on payments face steep cuts to their credit score and increased debt. <ref name="sifted">Woodford, Isabel. (2020, December 4). Klarna’s CEO: I worry about debt too. I know we’re not perfect. [https://sifted.eu/articles/klarna-ceo-on-debt-and-competitors/]</ref> There is a growing consensus among media outlets that Klarna is pushing shoppers, particularly young adults, to spend more money than they can afford. Klarna refutes this claim, stating that they report a payment default rate of less than 1%. Because of this number, Klarna officials believe their product is not contributing to debt or reckless spending. However, debt charity StepChange claims that a growing number of their clients owe money to Klarna. <ref>Collinson, Patrick. (2020, October 3). Klarna: shopper's best friend or a fast track to debt?[https://www.theguardian.com/money/2020/oct/03/klarna-debt-buy-now-pay-later-fees-interest]</ref> In addition, Klarna's financial wellbeing points to issues regarding repayment. Largely because of personal payment defaults, Klarna reported losses of over 60 million dollars between January and June of 2020, despite having increasing sales. These losses are 7 times higher than Klarna's losses in 2019. <ref>Dean, Grace. (2020, August 28). Swedish 'buy now, pay later' fintech giant Klarna reports sevenfold jump in losses[https://www.businessinsider.com/personal-finance/klarna-fintech-giant-reports-sevenfold-increase-in-losses-2020-8]</ref> | ||

==References== | ==References== | ||

Latest revision as of 16:11, 16 April 2021

Klarna is a Swedish financial technology company that offers a number of payment options, such as direct payments, pay after delivery and installment plans.[1] Klarna "makes shopping smoooth" with the flexibility of payment method options, interest-free payments, and no credit score impact.[1][2]

Klarna allows customers to forego credit card use when shopping online.[3] Klarna started garnering international success in 2005 and gained prominent investors such as H&M and Snoop Dogg.[4][5] Through Klarna's shopping app, Klarna offers a vast variety of well-known retailers that accept Klarna. [6] Klarna allows users in the United States to pay in 4 interest-free installments and users in the UK to pay in 3 interest-free installments. Klarna also has flexible payment methods that users can use when buying something through Klarna, with the payments being not connected to the users' credit score. [7]

Contents

History

Klarna, first called Kreditor Europe AB, began in 2005 when the three founders, Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson, started the company after being ranked last in a pitch holding audition. Kreditor Europe AB found success and expanded to international markets. This marked the start of allowing the payment of online purchases to occur in three or four different installments rather than all at once.[4]

Kreditor Europe AB expanded their service to Norway, Finland, and Denmark between 2006 and 2008. Between 2009 and 2011, they expanded to other countries outside of Europe and rebranded to the current name of Klarna. Many large companies and retailers invested in Klarna because of their popularity and expansion overseas. [4]In 2019, Klarna was ranked as the highest valued private fintech company in Europe and 6th highest in the world. Today, Klarna is used by over 90 million consumers and partners with 200,000 retail companies, and continues to grow.[4]

Klarna is available in three continents and completes, on average, one million transactions per day. Klarna has grown exponentially since its inception and now has over 3,500 racially and ethnically diverse employees.[4]

Klarna's Competitors

As of April 2021, Klarna's valuation topped $31 billion, putting it at the top of the buy now, pay later (BNPL) market.[8] Klarna leads the market in terms of US users with 11 million as of late 2020. This represented a 106% increase in US usage compared to 2019.[9] However, there are still other viable firms in competition with the new tech company. Most notable are Afterpay, Affirm, Zip, and Sezzle.

Afterpay

Afterpay is an Australian company, with operations in the United States, Canada, the United Kingdom, New Zealand, and its home country of Australia. The company was founded in 2015 by Nick Molnar and Anthony Eisen. [10] The company is now valued at $3.3 billion.

Afterpay is currently the far-and-away leader in terms of US BNPL transactions. The company leads the market with 70% of the transactions here in the United States.[9] In just four months since entering the US market, Afterpay has joined with more than 900 retailers, including Urban Outfitters, Free People, Anthropologie, Revolve, Morphe and Quay. An additional 1300 retailers are in the pipeline to join AfterPay, including Kylie Cosmetics, Skechers, and Steve Madden.

Affirm

Affirm was created in 2012 by multiple founders including Max Levchin, former Co-founder of Paypal who also has been involved with highly successful startups like Yelp and Slide.

Affirm is partnered with big players such as Peloton, Casper, Expedia, Eventbrite, and over 900 other companies. The company has issued over a million loans since inception. [11]

Zip

Zip is an Australian company founded in 2013 and is headquartered in Sydney. The company now has operations in Australia, the United States, the United Kingdom, New Zealand, South Africa, the Czech Republic, and the United Arab Emirates. In September 2020, Zip acquired the US-based BNPL company Quadpay to enter the US market as a bigger player.[12] It currently has around 38,500 retail partners and over 5,700,000 customers.[13] As of March 2021, Zip's valuation was estimated to be around $5.83 billion.

Partnerships During the COVID-19 Pandemic

The covid-19 pandemic led to an increase in online shoppers and Klarna saw a growth in its userbase. Some notable partnerships arose out of this growth.

Flybuys

In April of 2021, a partnership was announced between Klarna and Flybuys, a popular loyalty program from Australia that works with large retailers such as Coles, Kmart, and Target.[14] Under the partnership, beginning in May, the 8 million active users of Flybuys are able to earn points whenever they use Klarna.[15] The partnership allows for further expansion of Klarna's userbase in Australia, including older populations as Klarna's demographic has mostly consisted of younger users.[16] The covid-19 pandemic was cited to be one of the reasons influencing the formation of the partnership; the general manager of Klarna stated that a wider range of customers had begun using the buy now, pay later method due to limited access to in-store shopping.[15]

Bluemercury

Cosmetics company Bluemercury began working with Klarna in 2021 to offer customers a "secure and contactless way to pay for goods online or in a store" in its 183 U.S. locations.[17] The covid-19 pandemic and younger userbase of Klarna also influenced the formation of this partnership; co-founder and CEO of Bluemercury, Marla Beck, stated that the pandemic "taught us that offering alternative purchasing options is an essential pillar for success. The introduction of Klarna in-store following our online integration allows Bluemercury to reach a new generation of shoppers."[17]

Ethical Implications

Payment Errors & Consequences

Customers who have used Klarna’s buy now and pay later service have spoken of an issue where Klarna claimed to not have received payment from the customers even though the customers have sent the payment through bank transfer.[18] Back in 2019, Erin Phillips, a college student who often used Klarna experienced her credit score being cut half from the original score she had. Her credit score had cut to half due to Erin’s mistake of not knowing that her credit score would decrease if she went a few days over the 30 day deadline.[19] When Erin’s payments were overdue, Klarna sent her a letter stating “Since the purchase was not paid on time we have extended your due date by 7 days. Please make your payment as soon as possible to ensure that you can continue to benefit from using Klarna’s Pay later and Slice it payment services”. By the letter’s wording, Erin believed she received 7 days of grace period where she could pay without any negative consequences.[20]

Policy Transparency

Debt charities such as Step Change have called for a more transparent policy for buy now and pay later services provided by Klarna and similar companies. [21] While advertisements created by these fintech companies highlight no interest and no fees, the ads do not include any negative consequences customers may experience if the payments are not made on time. The flexibility of buy now pay later option and the non-transparent and misleading ads may cause customers to buy products that are out of their financial control, leading to huge drops in credit score and necessity to take out loans to cover the payments.[22] Klarna is currently under investigation by the Swedish Data Protection Authority for violating Sweden's Buy Now, Pay Later laws. Sweden's laws require direct, one time payments to be the default option when completing an online purchase, with Klarna and similar services as alternative options. However, Klarna's service was offered as a the default option on some websites, and customers unwittingly participated in the program without understanding its function and rules. [23]

Credit Impact

If a Klarna user makes their payments on time, Klarna does not charge hidden fees or interest fees. However, if someone is overusing Klarna and not making their payments on time, Klarna has the right to report that credit usage to credit unions and reduce, or even prevent, the loan usage they are afforded. This can negatively affect a user's credit score. To prevent a decrease in credit score, the user must adhere to the guidelines that Klarna has set up, and the user should pay their payments before the payment is due or on the day off to not pay interest [7].

Personal Responsibility

Critics such as politicians and media outlets have expressed concerns about Klarna's business model. While Klarna's model can benefit users by allowing them to spend less money at once, it also allows customers to overspend. Klarna's current CEO Sebastian Siemiatkowski has questioned whether Klarna has made borrowing money too easy for users. Because of this reason, Klarna's critics state that the company is exploiting the vulnerable: those who don't have large sums of money to spend but are lured in by Klarna's zero-interest policies and pausing late fees in the United Kingdom. Users who default on payments face steep cuts to their credit score and increased debt. [24] There is a growing consensus among media outlets that Klarna is pushing shoppers, particularly young adults, to spend more money than they can afford. Klarna refutes this claim, stating that they report a payment default rate of less than 1%. Because of this number, Klarna officials believe their product is not contributing to debt or reckless spending. However, debt charity StepChange claims that a growing number of their clients owe money to Klarna. [25] In addition, Klarna's financial wellbeing points to issues regarding repayment. Largely because of personal payment defaults, Klarna reported losses of over 60 million dollars between January and June of 2020, despite having increasing sales. These losses are 7 times higher than Klarna's losses in 2019. [26]

References

- ↑ 1.0 1.1 Klarna. (2021, April 9). Shopping freedom with Klarna. Klarna.com. https://www.klarna.com/us/about-us/

- ↑ (2019, June 22). Flexible payments for pet owners. The Veterinary Record. https://search.proquest.com/openview/53823c68fa6c8044a5e49165b56f42f2/1?pq-origsite=gscholar&cbl=2041027

- ↑ O'Hear, Steve. (2020, December 8). "Making Sense of Klarna." TechCrunch. https://techcrunch.com/2020/12/08/making-sense-of-klarna/

- ↑ 4.0 4.1 4.2 4.3 4.4 Klarna. 15 years of making shopping smooth. Klarna.com. https://www.klarna.com/international/klarna-15/

- ↑ Klarna. Smoooth Dogg and Klarna release unique collection. Klarna.com. https://www.klarna.com/international/press/smoooth-dogg-and-klarna-release-unique-collection/

- ↑ Klarna. There is a new way to shop in town. Klarna.com. https://www.klarna.com/us/

- ↑ 7.0 7.1 Klarna. (2021, January 29). Ethical Instructions for Merchants. https://cdn.klarna.com/1.0/shared/content/policy/ethic/en_gb/merchant.pdf

- ↑ Klarna Valuation https://www.reuters.com/article/idUSKCN2AT22U/ accessed April 9 2021.

- ↑ 9.0 9.1 BNPL market report https://www.cbinsights.com/reports/CB-Insights_Buy-Now-Pay-Later-Outlook.pdf

- ↑ AfterPay https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/

- ↑ Affirm https://www.news.com.au/finance/money/costs/how-a-recession-gave-one-aussie-guy-a-billiondollar-business-idea/news-story/47ea033152bfbdc85ccc4340e05580fe/

- ↑ Zip https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02275813-2A1247261?access_token=83ff96335c2d45a094df02a206a39ff4

- ↑ Zip 2 https://www.fool.com.au/2018/01/30/is-zip-co-ltd-still-a-buy-after-20-surge/

- ↑ Bradney-George, Amy. (2021, March 26). "Guide to Flybuys rewards program." Finder.com. https://www.finder.com.au/frequent-flyer/flybuys

- ↑ 15.0 15.1 Mitchell, Sue. (2021, April 13). "Buy now, pay later twist: Flybuys links with Klarna." Financial Review. https://www.afr.com/companies/retail/buy-now-pay-later-twist-flybuys-links-with-klarna-20210412-p57idr

- ↑ Feiam, Ally. (2021, April 15). "Inside Klarna and FlyBuys’ New Partnership – Will They Reap the Rewards?" PowerRetail. https://powerretail.com.au/payment-systems/inside-klarna-and-flybuys-new-partnership-will-they-reap-the-rewards/

- ↑ 17.0 17.1 Zaczkiewicz, Arthur. (2021, April 7). "Bluemercury Rolls Out Klarna to 183 Stores, Nationwide." WWD. https://wwd.com/business-news/retail/bluemercury-klarna-rollout-1234795308/

- ↑ Manavis, Sarah. (2020, December 9). Why Klarna’s millennial customers are losing faith. NewStatesman. https://www.newstatesman.com/business/finance/2020/12/klarna-millennial-empire-started-crumble-credit-score

- ↑ Jones, Lora. (2019, November 11). Payment firm Klarna messed up my credit score, says student. BBC News. https://www.bbc.com/news/business-50306563

- ↑ Linning, Stephanie. (2019, November 15). Student, 21, issues warning over 'buy now, pay later' firms after late payments cut her credit score by HALF - as a debt charity urges companies to be more transparent with customers. Daily Mail. https://www.dailymail.co.uk/femail/article-7690243/Student-21-issues-warning-buy-pay-later-firms.html

- ↑ Step Change. (2021, April 9). Buy now pay later: what if I can't pay later?. https://www.stepchange.org/debt-info/buy-now-pay-later.aspx

- ↑ ET Now Digital. (2021, April 9). Should you opt for buy now, pay later schemes?. ET Now News. https://www.timesnownews.com/business-economy/personal-finance/loans/article/should-you-opt-for-buy-now-pay-later-schemes/742634

- ↑ Carter, Leonie (2021, February 3). Payment giant Klarna faces scrutiny over ‘buy now, pay later’ practices[1]

- ↑ Woodford, Isabel. (2020, December 4). Klarna’s CEO: I worry about debt too. I know we’re not perfect. [2]

- ↑ Collinson, Patrick. (2020, October 3). Klarna: shopper's best friend or a fast track to debt?[3]

- ↑ Dean, Grace. (2020, August 28). Swedish 'buy now, pay later' fintech giant Klarna reports sevenfold jump in losses[4]