Future of Blockchain

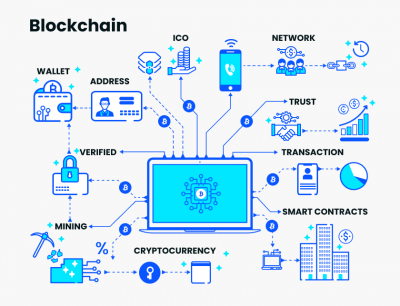

Blockchain is a digital ledger technology that allows for secure and transparent record-keeping. It is the technology that underlies cryptocurrencies like Bitcoin[1]. In a blockchain, transactions are recorded in blocks linked together in a chain. Each block contains a list of transactions and a reference to the previous block, creating a chain of blocks. The blocks in a blockchain are secured through cryptography[2], making them resistant to tampering. Blockchain has since been adapted for a wide range of other use cases. Some of the most common applications of blockchain include Payments and remittances, Supply chain management, Digital identity, Decentralized finance (DeFi), Gaming, and digital collectibles (e.g NFTs). Blockchain technology can create unique and indestructible digital assets, such as in-game items, virtual real estate, and digital art, which can be bought, sold, and traded securely and transparently[3].

Cryptocurrency is a digital or virtual currency that uses blockchain technology for secure and decentralized transactions. Bitcoin is the first and most well-known cryptocurrency, but there are now thousands of different types of cryptocurrencies. These digital currencies can be bought and sold on digital currency exchanges and used to purchase goods and services. Cryptocurrency is a digital or virtual form of currency that uses cryptography to secure its transactions and control the creation of new units. Cryptocurrencies are decentralized, meaning that they are not subject to government or financial institution control.[4]

Cryptocurrencies have a number of potential use cases, including: Financial transactions, Digital asset storage, Decentralized applications, Microtransactions, Remittances.[5] Overall, the use cases for cryptocurrency are diverse and constantly evolving as technology and market development.

The ethics of blockchain and cryptocurrency are a topic of much debate and discussion within the technology and business communities. While some view these technologies as having the potential to increase transparency, security, and financial freedom, others see the potential for harm, particularly in areas such as privacy, decentralization, and the use of cryptocurrency for illegal activities.[6]

Contents

History

Creation

Blockchain technology was first described in 2008 by an individual or group of individuals operating under the pseudonym "Satoshi Nakamoto" in a white paper entitled "Bitcoin: A Peer-to-Peer Electronic Cash System." The paper outlined a system for electronic transactions that would be recorded in a decentralized, public ledger using cryptography to ensure the integrity of the data.[7]

This technology is the backbone of the first and most well-known blockchain, the Bitcoin blockchain. The first block, or "genesis block," was mined on January 3, 2009. Since then, blockchain technology has been adapted and used in various other applications, such as smart contracts and supply chain management.[8]

Early Development

The idea of a decentralized ledger dates back to the early 1990s and the concept of "hashcash." However, it was not until the publication of Nakamoto's white paper that a practical implementation for such a system was proposed. Nakamoto's work built upon the existing concepts of cryptography and distributed systems and proposed a novel solution for the problem of double-spending in electronic cash transactions.[9]

The first implementation of the technology was the Bitcoin blockchain, which was launched on January 3, 2009, with the mining of the "genesis block." The Bitcoin blockchain served as a proof-of-concept for the broader potential of blockchain technology and has since been used as a basis for the development of other blockchain platforms, such as Ethereum and Litecoin.

Since its introduction, blockchain technology has been adapted and used in a wide range of applications, such as smart contracts, supply chain management, and digital identity. It has also been the subject of significant research and development in academia and industry, leading to the development of new consensus mechanisms, such as proof-of-stake, and new applications, such as decentralized finance (DeFi).

Cryptocurrency

How does it work?

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. Cryptocurrencies are decentralized, meaning they operate on a network of computers around the world, rather than through a central authority like a government or a bank.

Here's a step-by-step explanation of how cryptocurrency works:

- Transactions: A transaction is the transfer of value from one person to another. In the case of cryptocurrency, transactions are recorded on a public ledger called a blockchain.

- Blocks: The blockchain is a chain of blocks that contains a record of all transactions. Each block is verified and added to the blockchain by network participants called "miners."

- Mining: Mining is the process of verifying transactions and adding blocks to the blockchain. Miners use specialized software to solve complex mathematical problems, and in exchange for their work, they are awarded new units of cryptocurrency. This process also helps to secure the network and prevent fraud.

- Encryption: Cryptocurrencies use cryptography to secure transactions and prevent double-spending. The public ledger is encrypted, and only those with the correct keys can access it.

- Wallet: A wallet is a software program that stores the user's private and public keys, allowing them to send and receive cryptocurrency.

- Public and private keys: A public key is like an address that can be used to receive cryptocurrency, while a private key is used to sign transactions and must be kept secure.

- Decentralization: One of the key features of cryptocurrency is its decentralization, meaning that it operates on a network of computers, rather than through a central authority. This allows for faster, more secure, and more transparent transactions, as there is no central point of control or failure.

History and Uses

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and control the creation of new units. Cryptocurrencies are decentralized, meaning that they are not subject to government or financial institution control. Bitcoin, created in 2009, was the first decentralized cryptocurrency and remains the most well-known and widely used.

Cryptocurrency operates on a decentralized ledger called a blockchain, which records and verifies transactions. The use of blockchain technology allows for secure, transparent, and tamper-proof transactions without the need for intermediaries such as banks.[10].

The use of cryptocurrency is constantly evolving and its potential future use cases are varied and exciting. Some potential future uses for cryptocurrency include:

- Mainstream Adoption: As more people become familiar with and trust cryptocurrency, it is possible that it could be widely adopted for daily transactions, in much the same way as fiat currency is used today.

- Digital Identity Management: Cryptocurrency technology could be used to create secure digital identities, making it easier for individuals to control and manage their personal information online.

- Decentralized Finance (DeFi): Cryptocurrency has already made a big impact in the world of decentralized finance, enabling the creation of financial products and services that operate outside of traditional financial institutions. In the future, DeFi could become even more sophisticated, offering a wider range of financial products and services to a global audience.

- Supply Chain Management: Cryptocurrency and blockchain technology could be used to improve supply chain transparency, making it easier to track the journey of products from production to delivery.

- Real Estate: Cryptocurrency and blockchain could potentially be used to streamline real estate transactions, making it easier to buy, sell, and transfer ownership of property.

As technology and market conditions continue to develop, the possibilities for cryptocurrency are exciting and unlimited.

Uses

Current Use Cases

Blockchain technology, originally developed as the underlying technology for the digital currency Bitcoin, has since been adapted and applied to a wide range of use cases. These use cases fall into several broad categories, including[11]:

- Digital currencies and payments: Bitcoin remains the most well-known and widely-used application of blockchain technology, but other digital currencies, such as Ethereum and Litecoin, have also been developed using similar technology. Blockchain-based digital currencies have the potential to increase financial inclusion by allowing for peer-to-peer transactions without the need for a centralized intermediary.

- Supply chain management: Blockchain technology can be used to create tamper-proof and transparent records of transactions in supply chains. This can be used to increase transparency, traceability, and accountability in supply chains, particularly in industries such as agriculture and logistics.

- Smart contracts: Blockchain technology can be used to create self-executing contracts with the terms of the agreement written into code. These smart contracts can be used to automate processes, such as the transfer of assets and the execution of legal agreements.

- Digital identity: Blockchain technology can be used to create decentralized digital identities that are owned and controlled by the individual. This can be used to increase security and privacy in online identity verification and to provide individuals with more control over their personal data.

- Decentralized finance (DeFi): Blockchain technology has been used to create decentralized financial systems, such as decentralized exchanges and lending platforms, that are not controlled by any single entity. These platforms have the potential to increase financial inclusion and to provide new opportunities for financial innovation.

Future Use Cases

Blockchain technology has the potential to be applied to a wide range of use cases in the future, as the technology continues to evolve and mature. Some potential future use cases of blockchain technology include:

- Healthcare: Blockchain technology can be used to create secure and transparent medical records that can be shared between healthcare providers. This can help to improve the quality of care and to reduce administrative costs.

- Voting: Blockchain technology can be used to create secure and transparent voting systems that can be used in elections. This can help to increase voter turnout and to reduce the risk of voter fraud.

- Energy: Blockchain technology can be used to create decentralized energy systems that can be used to trade and manage renewable energy. This can help to increase the use of renewable energy and to reduce the environmental impact of energy production.

- Real estate: Blockchain technology can be used to create tamper-proof and transparent records of property ownership and transactions. This can help to reduce fraud and to increase the efficiency of real estate transactions.

- Government: Blockchain technology can be used to create decentralized systems for the management of public services. This can help to increase transparency, reduce corruption, and increase citizen participation in governance.

- Internet of Things (IoT): Blockchain technology can be used to create secure and transparent networks for the management of IoT devices. This can help to increase security and to reduce the risk of data breaches in IoT systems.

In the future, blockchain is expected to play an even larger role in shaping the world of transactions and record-keeping. For example, it has the potential to provide a secure and transparent platform for the creation and management of digital identities, as well as online voting. Blockchain could also revolutionize the real estate and energy industries by providing a secure and transparent platform for the exchange of property ownership and energy credits.

These are just a few examples of the potential future use cases of blockchain technology. As technology continues to evolve, it is likely that new applications will be discovered and developed.[12]

Ethics

Ethics of Blockchain

Blockchain technology raises a number of ethical concerns, as the decentralized and immutable nature of the technology can have significant implications for privacy, security, and governance. Some of the key ethical concerns related to blockchain technology include:

Privacy: Blockchain technology can be used to create transparent and tamper-proof records of transactions, but this can also make it more difficult to protect personal data and to maintain privacy.

Security: Blockchain technology can be used to create secure networks, but it also increases the risk of hacking and other cyber-attacks. Additionally, the decentralized nature of blockchain technology can make it difficult to regulate and to hold accountable those who engage in illegal or unethical activities on the blockchain.

Governance: Blockchain technology can be used to create decentralized systems that are not controlled by any single entity, but this can also make it difficult to make decisions and to resolve disputes. Additionally, the lack of regulation and oversight can make it difficult to prevent and to address illegal or unethical activities on the blockchain.

Decentralized Autonomy: The decentralization of blockchain allows for the creation of autonomous organizations and systems, increasing the risk of malicious actors taking advantage of the technology for illegal activities.

Environmental Impact: The process of creating and maintaining a blockchain, also known as mining, requires significant amounts of energy and resources, raising concerns about the environmental impact of the technology.

These ethical concerns are not unique to blockchain technology and are shared by other emerging technologies as well. However, the decentralized and immutable nature of blockchain technology can exacerbate these concerns and make it more difficult to address them.[13]- ↑ "What Is Bitcoin? How to Mine, Buy, and Use it. Investopedia. https://www.investopedia.com/terms/b/bitcoin.asp

- ↑ Cryptography In Blockchain. GeeksForGeeks. https://www.geeksforgeeks.org/cryptography-in-blockchain/

- ↑ Blockchain for beginners: What is blockchain technology? A step-by-step guide. Blockgeeks. Retrieved February 10, 2023, from https://blockgeeks.com/guides/what-is-blockchain-technology/

- ↑ Editorial StaffA team of Blockchain and Cryptocurrency experts.Trusted by over 1.1 million readers worldwide. (2022, December 16). Top 7 cryptocurrencies to invest in 2023. CoinSutra. Retrieved February 10, 2023, from https://coinsutra.com/top-10-cryptocurrencies-invest/

- ↑ Rosic, A., Baggetta, M., & Zapotochny, A. (2020, May 5). What is cryptocurrency Game theory: A basic introduction. Blockgeeks. Retrieved February 10, 2023, from https://blockgeeks.com/guides/cryptocurrency-game-theory/

- ↑ The truth about blockchain. Harvard Business Review. (2022, October 31). Retrieved February 10, 2023, from https://hbr.org/2017/01/the-truth-about-blockchain

- ↑ Satoshi Nakamoto. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved from https://bitcoin.org/bitcoin.pdf

- ↑ Genesis block. (n.d.). Bitcoin Wiki. Retrieved from https://en.bitcoin.it/wiki/Genesis_block

- ↑ Back, A., Corallo, M., Dashjr, L., Frey, W., Friedenbach, M., Maxwell, G., ... & Todd, P. (2014). Enabling blockchain innovations with pegged sidechains. ACM SIGSAC

- ↑ Bussler, F., Blockgks, & Rosic, A. (2020, May 13). Why security token offerings are the future. Blockgeeks. Retrieved February 10, 2023, from https://blockgeeks.com/guides/why-security-token-offerings-are-the-future/

- ↑ Frankenfield, J. (2023, February 11). Cryptocurrency explained with pros and cons for investment. Investopedia. Retrieved February 10, 2023, from https://www.investopedia.com/terms/c/cryptocurrency.asp

- ↑ Li, N., & Yang, X. (2019). Decentralized finance and its potential impact on financial markets. Journal of Financial Stability, 44, 100-110.

- ↑ De Filippi, P. (2018). Blockchain and the law: The rule of code. Harvard University Press.