Difference between revisions of "Cryptocurrency and its Impact on the Environment"

| (48 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | '''{{initial|C}}ryptocurrency''' is a digital currency designed to work as a medium of exchange through a computer network | + | '''{{initial|C}}ryptocurrency''' is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on a central authority, such as a government or central bank, to uphold and maintain it. Many cryptocurrencies are decentralized networks based on blockchain technology, which is a distributed ledger enforced by a disparate network of computers. <ref> https://www.investopedia.com/terms/c/cryptocurrency.asp </ref>. New cryptocurrencies are released through mining, which is the process of validating and recording new transactions within the blockchain. Miners must verify the validity of a number of bitcoin transactions which are then bundled into a block. This can include checking 20-30 different variables. The process of trying to come up with the right nonce that will generate the target hash is trial and error. With hundreds and thousands or more of computers churning out these guesses, some ethical concerns become the energy consumption and greenhouse gas emissions from crypto mining <ref>https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/</ref>. |

| + | {| class="wikitable" style="float: right; margin: 0px 10px 10px 20px; width:300px" border="1" | ||

| + | |+ {{{NAME|Cryptocurrency}}} | ||

| + | | | ||

| + | {| border="0" style="float:center" | ||

| + | |+ | ||

| + | |align="center" width="300px"|[[File:cryptocurrency.jpg|frameless|center|175px|]] | ||

| + | |- | ||

| + | |align="center" style="font-size:80%"|{{{CAPTION|Cryptocurrencies}}} | ||

| + | |} | ||

| + | {|style="font-size:90%" | ||

| + | |- valign="top" | ||

| + | |- style="vertical-align:top;" | ||

| + | |'''Abbreviation''' | ||

| + | |{{{Abbreviation|AJL}}} | ||

| + | |- style="vertical-align:top;" | ||

| + | |'''Founder''' | ||

| + | |{{{Founder|Sotshi Nakomoto (Bitcoin)}}} | ||

| + | |- style="vertical-align:top;" | ||

| + | |'''Established''' | ||

| + | |{{{Established|2008}}} | ||

| + | |- style="vertical-align:top;" | ||

| + | |'''Mission''' | ||

| + | |{{{MISSION|Cryptocurrencies area class of digital assets in which encryption techniques regulate the generation of units of currency and verify transactions }}} | ||

| + | |- style="vertical-align:top;" | ||

| + | |'''Website''' | ||

| + | |{{{WEBSITE|https://www.bitcoin.org}}} | ||

| + | |- style="vertical-align:top;" | ||

| + | |'''More Information''' | ||

| + | |{{{More Information|https://www.crypto.com}}} | ||

| + | |- style="vertical-align:top;" | ||

| + | |} | ||

| + | |} | ||

==Origins== | ==Origins== | ||

In 2008, an anonymous person under the pseudonym, Satoshi Nakomoto, published a paper titled "Bitcoin: A Peer to Peer Electronic Cash System"<ref>Nakamoto, S. (2018). Bitcoin: A Peer-to-Peer Electronic Cash System (pp. 1-9). www.bitcoin.org. Retrieved from https://bitcoin.org/bitcoin.pdf</ref>. On January 3rd, 2009, Satoshi mined the genesis block of the Bitcoin blockchain. The Bitcoin protocol is open source code and has received contributions from numerous developers including, most notably, [[Wikipedia:Hal Finney|Hal Finney]], [[Wikipedia:Nick Szabo|Nick Szabo]], and [[Wikipedia:Gavin Andresen|Gavin Andresen]]. In the years since, many other projects have been released that utilize Bitcoin's source code, as well as many other cryptocurrencies that have developed their own blockchain. These are known as altcoins. | In 2008, an anonymous person under the pseudonym, Satoshi Nakomoto, published a paper titled "Bitcoin: A Peer to Peer Electronic Cash System"<ref>Nakamoto, S. (2018). Bitcoin: A Peer-to-Peer Electronic Cash System (pp. 1-9). www.bitcoin.org. Retrieved from https://bitcoin.org/bitcoin.pdf</ref>. On January 3rd, 2009, Satoshi mined the genesis block of the Bitcoin blockchain. The Bitcoin protocol is open source code and has received contributions from numerous developers including, most notably, [[Wikipedia:Hal Finney|Hal Finney]], [[Wikipedia:Nick Szabo|Nick Szabo]], and [[Wikipedia:Gavin Andresen|Gavin Andresen]]. In the years since, many other projects have been released that utilize Bitcoin's source code, as well as many other cryptocurrencies that have developed their own blockchain. These are known as altcoins. | ||

| + | |||

| + | After Bitcoin appeared in 2009, approximately 1500 other cryptocurrencies have been introduced, of which nearly 600 are actively traded<ref>ElBahrawy, Abeer, et al. "Evolutionary dynamics of the cryptocurrency market." Royal Society open science 4.11 (2017): 170623.https://doi.org/10.1098/rsos.170623</ref>. All cryptocurrencies share the underlying blockchain technology and reward mechanism, however, they live on isolated transaction networks. Many of them are basically clones of Bitcoin, although with different parameters such as different supplies, transaction validation times, and other factors<ref>ElBahrawy, Abeer, et al. "Evolutionary dynamics of the cryptocurrency market." Royal Society open science 4.11 (2017): 170623.https://doi.org/10.1098/rsos.170623</ref>. This results in other emerging altcoins possibly having more significant innovations of the underlying blockchain technology. | ||

==Examples of Cryptocurrencies== | ==Examples of Cryptocurrencies== | ||

===Bitcoin=== | ===Bitcoin=== | ||

| − | In 2008 Satoshi Nakamoto released a paper through metzdowd.com called ''Bitcoin: A Peer to Peer Electronic Cash System''.<ref name = " | + | In 2008 Satoshi Nakamoto released a paper through metzdowd.com called ''Bitcoin: A Peer to Peer Electronic Cash System''.<ref name = "ProQuest"> Madey, Robert Stanley. “A Study of the History of Cryptocurrency and Associated Risks and Threats.” ProQuest Dissertations & Theses Global, Utica College, 2017. https://search.proquest.com/docview/2008188467?accountid=14667.</ref> In the paper, Satoshi discusses a solution to the double-spending problem. The double-spending problem refers to the ability of individuals to copy tokens and re-use them if security measures are not present.<ref name = "Double Spending Problem" > Pérez-Solà, Cristina, et al. “Double-Spending Prevention for Bitcoin Zero-Confirmation Transactions.” Semantic Scholar, IACR Cryptology EPrint Archive, 2017, http://www.semanticscholar.org/paper/Double-spending-Prevention-for-Bitcoin-transactions-Pérez-Solà-Delgado-Segura/7837b2e4b8e883e6874b99a6a7aaa2006e0f7938.</ref> In the paper Satoshi also describes a decentralized system for transactions, eliminating the need for third-party involvement. [[Bitcoin|Bitcoin]] allows for pseudo-anonymous transactions to take place and relies on a computer network of miners who perform algorithms to approve transactions. |

| − | Bitcoin is unregulated by the government, and has grown since it first opened to the public in 2009: there are 12,000 transactions per/hour, 18.5 million blockchain.info wallets, and 715,000 active addresses | + | Bitcoin is unregulated by the government, and has grown since it first opened to the public in 2009: there are 12,000 transactions per/hour, 18.5 million blockchain.info wallets, and 715,000 active addresses per daily average.<ref name="Bitcoin Statistics"> “Bitcoin by Numbers: 21 Statistics That Reveal Growing Demand for the Cryptocurrency.” Bitcoin News, 13 Nov. 2017, https://news.bitcoin.com/bitcoin-numbers-21-statistics-reveal-growing-demand-cryptocurrency/.</ref>. |

| − | + | ||

===Altcoins=== | ===Altcoins=== | ||

| Line 19: | Line 52: | ||

An extensible crypto platform that allows for smart contracting <ref> Ethereum https://www.ethereum.org/ </ref> | An extensible crypto platform that allows for smart contracting <ref> Ethereum https://www.ethereum.org/ </ref> | ||

====Zcash (ZEC)==== | ====Zcash (ZEC)==== | ||

| − | + | A pseudonymous cryptocurrency is more private and has less transparency in transactions. The parent company, ZcashCo is only a link in the chain and cant see transactions without being provided the appropriate view key. This is the main premise of Zcash becoming one of the only privacy-first, decentralized cryptocurrencies. ZcashCo's role instead is to help provide updates to Zcash which users can choose to utilize or ignore. <ref> Zcash https://z.cash/ </ref> | |

====Dash==== | ====Dash==== | ||

| Line 28: | Line 61: | ||

Cryptocurrency deemphasizing traceability and emphasizing privacy. <ref>Monero https://getmonero.org/</ref> | Cryptocurrency deemphasizing traceability and emphasizing privacy. <ref>Monero https://getmonero.org/</ref> | ||

| − | == | + | ==Environmental Implications of the Cryptocurrency Market== |

| − | === | + | Blockchain systems, especially, the use of cryptocurrencies are quite energy-intensive, and there are many natural resources and environmental services considerations that are relevant to low-income countries engaging with these in a global framework<ref>Jeyanthi, P. Mary. "THEORIES OF CRYPTOCURRENCY, BLOCKCHAIN AND DISTRIBUTED SYSTEMS AND ENVIRONMENTAL IMPLICATIONS." Cryptocurrencies and Blockchain Technology Applications (2020): 215-238. https://doi.org/10.1002/9781119621201.ch12</ref>. The annual energy of Bitcoin and Ethereum combined exceeds 40 Trillion Watts/hour<ref>Jeyanthi, P. Mary. "THEORIES OF CRYPTOCURRENCY, BLOCKCHAIN AND DISTRIBUTED SYSTEMS AND ENVIRONMENTAL IMPLICATIONS." Cryptocurrencies and Blockchain Technology Applications (2020): 215-238. https://doi.org/10.1002/9781119621201.ch12</ref>. Furthermore, nearly .19% of the world's electricity is used by Bitcoin and Ethereum combined. And, a single Bitcoin transaction could power nearly 9 U.S. households for a full day, with the same energy consumed<ref>Jeyanthi, P. Mary. "THEORIES OF CRYPTOCURRENCY, BLOCKCHAIN AND DISTRIBUTED SYSTEMS AND ENVIRONMENTAL IMPLICATIONS." Cryptocurrencies and Blockchain Technology Applications (2020): 215-238. https://doi.org/10.1002/9781119621201.ch12</ref>. The ethical implications of the cryptocurrency markets are also concerned with the overall environmental impact of crypto mining and the volume of transactions. |

| − | + | ||

| + | ===Energy Consumption=== | ||

| + | Mining is the process of adding transaction records to certain cryptocurrencies' public ledgers of past transactions. The blockchain serves to confirm transactions to the rest of the network, and specific crypto nodes use the blockchain to distinguish legitimate transactions from attempts to respend coins. This process is energy-intensive and often causes power consumption issues. Moreover, for every 5 cents that were spent on operational costs in mining cryptocurrencies, nearly 1 kiloWatt-hour (kWh) was consumed<ref>Jeyanthi, P. Mary. "THEORIES OF CRYPTOCURRENCY, BLOCKCHAIN AND DISTRIBUTED SYSTEMS AND ENVIRONMENTAL IMPLICATIONS." Cryptocurrencies and Blockchain Technology Applications (2020): 215-238. https://doi.org/10.1002/9781119621201.ch12</ref>. | ||

| + | |||

| + | |||

| + | Moreover, to produce bitcoins and other cryptocurrencies the electricity footprint per unique transaction can range from 491.1 kWh to 765.4 kWh.<ref>M. R. Rabbani, A. Alshaikh, A. Jreisat, A. Bashar and M. A. Moh'd Ali, "Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective," 2021 International Conference on Sustainable Islamic Business and Finance, 2021, pp. 103-108, doi: 10.1109/IEEECONF53626.2021.9686332.</ref>. For comparison, the banking system processes nearly 500 billion non-cash transactions per year, and the average processing footprint for such a transaction is only 0.4 kWh at most<ref>M. R. Rabbani, A. Alshaikh, A. Jreisat, A. Bashar and M. A. Moh'd Ali, "Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective," 2021 International Conference on Sustainable Islamic Business and Finance, 2021, pp. 103-108, doi: 10.1109/IEEECONF53626.2021.9686332.</ref>. Certain cryptocurrencies have larger environmental footprints compared to others. The Bitcoin Energy Consumption Index states that Bitcoin's energy use in 2018 converted to a carbon footprint of nearly 300 kg of CO2 per transaction<ref>M. R. Rabbani, A. Alshaikh, A. Jreisat, A. Bashar and M. A. Moh'd Ali, "Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective," 2021 International Conference on Sustainable Islamic Business and Finance, 2021, pp. 103-108, doi: 10.1109/IEEECONF53626.2021.9686332.</ref>. This can be compared to the energy use of a visa transaction of only about 0.4g of CO2 per transaction or 0.2g of CO2 emitted per google search<ref>M. R. Rabbani, A. Alshaikh, A. Jreisat, A. Bashar and M. A. Moh'd Ali, "Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective," 2021 International Conference on Sustainable Islamic Business and Finance, 2021, pp. 103-108, doi: 10.1109/IEEECONF53626.2021.9686332.</ref>. | ||

| + | |||

| + | ===Carbon Emissions and Global Warming=== | ||

| + | There is an increasing causality generating a higher consumption of electricity for the higher trading of cryptocurrencies. Specifically, look at Bitcoin, the arguably largest cryptocurrency, estimates have shown that the annual carbon footprint exceeds 30,000 Kt of CO2 emissions, which is more than the emissions produced by Sri Lanka or Jordan<ref>Christophe Schinckus, The good, the bad, and the ugly: An overview of the sustainability of blockchain technology, Energy Research & Social Science, Volume 69,2020,101614, ISSN 2214-6296,https://doi.org/10.1016/j.erss.2020.101614.</ref>. Furthermore, Bitcoin's annualized global mining costs exceed nearly 3 billion US dollars <ref>Christophe Schinckus, The good, the bad and the ugly: An overview of the sustainability of blockchain technology, Energy Research & Social Science, Volume 69,2020,101614, ISSN 2214-6296,https://doi.org/10.1016/j.erss.2020.101614.</ref>. | ||

| + | |||

| + | |||

| + | With the increasing energy demand due to increased mining activities, the carbon emissions released can have a large negative externality. Certain studies have warned that global temperature could increase by 2°C by 2034 due to the exponential growth in bitcoin trading<ref>Mora, C., Rollins, R.L., Talalay, K. et al. Bitcoin emissions alone could push global warming above 2°C. Nature Clim Change 8, 931–933 (2018). https://doi.org/10.1038/s41558-018-0321-8</ref>. Although this statistic is specific to Bitcoin, his problem of high electricity consumption is common to several cryptocurrencies, suggesting that any further development of cryptocurrencies will only increase the rate at which cryptocurrencies add to the issue of global warming<ref>Mora, C., Rollins, R.L., Talalay, K. et al. Bitcoin emissions alone could push global warming above 2°C. Nature Clim Change 8, 931–933 (2018). https://doi.org/10.1038/s41558-018-0321-8</ref>. In addition, according to certain studies, GDP and energy are uni-directionally related to CO2 emissions, and the parallel movement of crypto-volume and GDP is an indication of a long-run negative impact on environmental quality<ref>Mohsin, Muhammad, et al. "The crypto‐trade volume, GDP, energy use, and environmental degradation sustainability: An analysis of the top 20 crypto‐trader countries." International Journal of Finance & Economics (2020).https://doi.org/10.1002/ijfe.2442</ref>. This leads to the results of an impulse response function of positive energy confirming a significant increase of CO2 emissions, and a decrease in the sustainability of energy use on CO2 emissions<ref>Mohsin, Muhammad, et al. "The crypto‐trade volume, GDP, energy use, and environmental degradation sustainability: An analysis of the top 20 crypto‐trader countries." International Journal of Finance & Economics (2020).https://doi.org/10.1002/ijfe.2442</ref>. | ||

| + | |||

| + | |||

| + | Furthermore, as of May 2021, Ethereum was found to emit nearly 24.76 Mt of CO2 per year<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. Variations in the price of Ether influence the greenhouse gas emissions of the Ethereum network as a whole. The impact of a transaction, however, does not depend only on the gas used but is rather proportional to the transaction fee of the cryptocurrency<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. Within a single transaction, there are several processes that emit these greenhouse gases: minting, buying, transferring, and bidding. A certain study showed that the emission of minting a single Ethereum coin, assuming that the gas usage was 450k, which is industry standard, emitted nearly 101.33 kg CO2<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. The entire process of a single coin emitted nearly 200 kg CO2<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. | ||

| + | |||

| + | ===Water Issues and E-Waste=== | ||

| + | Power plants, such as Greenidge, also happen to consume large amounts of water annually. Greenidge, specifically, draws up to 139 million gallons of freshwater each day, and even discharges some water that is 30 to 50 degrees hotter than the lake's average temperature<ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref> . This can endanger the lake's natural ecosystem, as well as the plant's large intake pipes killing larvae, fish, and other wildlife. The e-waste problem also begs another ethical dilemma. Miners search for the most efficient hardware, which can become obsolete almost every year, and cannot be reprogrammed for other purposes. This leads to an estimation of 11.5 kilotons of e-waste each year from the Bitcoin network alone<ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref>. | ||

| + | |||

| + | ===Human Health Impacts of Cryptocurrency Mining=== | ||

| + | Expanding upon previously calculated energy use patterns for mining four prominent cryptocurrencies (Bitcoin, Ethereum, Litecoin, and Monero), certain studies estimate the per coin economic damages of air pollution emissions and associated human mortality and climate impacts of mining such Cryptocurrencies within the US and China. Results from these studies indicate that in 2018 alone, each $1 of Bitcoin value created was responsible for $0.49 in health and climate damages in the US and $0.37 in China<ref>Andrew L. Goodkind, Benjamin A. Jones, Robert P. Berrens, Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining, Energy Research & Social Science, Volume 59, 2020, 101281, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2019.101281. (https://www.sciencedirect.com/science/article/pii/S2214629619302701)</ref>. The electricity consumption of mining cryptocurrencies is large and growing rapidly. For example, in January of 2016, each Bitcoin mined required 1005 kWh of electricity, however, by June of 2018 each Bitcoin mined required 60,461 kWh<ref>Andrew L. Goodkind, Benjamin A. Jones, Robert P. Berrens, Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining, Energy Research & Social Science, Volume 59, 2020, 101281, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2019.101281. (https://www.sciencedirect.com/science/article/pii/S2214629619302701)</ref>. Although the number of total coins mined dropped in 2018 compared to 2016, electricity consumption increased to 47.9 billion kWh from 2.5 billion kWh<ref>Andrew L. Goodkind, Benjamin A. Jones, Robert P. Berrens, Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining, Energy Research & Social Science, Volume 59, 2020, 101281, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2019.101281. (https://www.sciencedirect.com/science/article/pii/S2214629619302701)</ref>. | ||

| + | |||

| + | ===Cryptocurrency "Mining" and Community Responses=== | ||

| + | Chelan County has a population of roughly 74,000 and is located in the North Central region of Washington State. The region attracted cryptocurrency miners due to its abundance of cheap electricity in 2018, as well as the fact that the Chelan PUD charged residential customers 2.7 cents per kWh, which was among the lowest rates in the country in 2018<ref>Pierce Greenberg, Dylan Bugden, | ||

| + | Energy consumption boomtowns in the United States: Community responses to a cryptocurrency boom, Energy Research & Social Science, Volume 50, | ||

| + | 2019, Pages 162-167, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2018.12.005.(https://www.sciencedirect.com/science/article/pii/S2214629618308260)</ref>. This led to a cryptocurrency mining boom which led to Chelan County permitting 17 crypto mining businesses by February 2016. However, the community has seen several environmental concerns. In 2017, an unauthorized miner overtaxed electrical lines and started a small brush fire in Chelan County, according to the PUD<ref>Pierce Greenberg, Dylan Bugden, | ||

| + | Energy consumption boomtowns in the United States: Community responses to a cryptocurrency boom, Energy Research & Social Science, Volume 50, | ||

| + | 2019, Pages 162-167, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2018.12.005.(https://www.sciencedirect.com/science/article/pii/S2214629618308260)</ref>. Furthermore | ||

| + | |||

| + | |||

| + | Certain Cryptocurrency technologies require a ''Proof of Work'' method. The Proof of Work (PoW) method uses an algorithm where blocks are validated by solving an energy-intensive computational puzzle. The energy consumption required to validate or mine a block is proportional to the block difficulty<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. The computational power of a miner is measured by its ''hash rate''. While Bitcoin is mined using ASICs (application-specific integrated circuits), other altcoins are mined using GPUs (graphical processing units). Based on a study from 2019, which looked at different regions using the PoW method, it was found that a single GPU, over a 2-year period, will approximately cost 980 US dollars and will have an impact of 1128 kg CO2 emitted. This finding leads to an estimate of nearly 1.151 kg CO2 emitted/$, or in other words, the average GPU impact can be estimated at emitting 1.151kg CO2 per every US dollar spent on electricity<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. Furthermore, when looking at certain regions, North America only accounted for about 12% of the hash rate, or computational power, of GPUs, yet had nearly 0.331 kG CO2 emitted per kWh and emitted nearly 4.061 kg CO2 per US dollar spent on electricity<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. On the other hand, Europe accounted for nearly 50% of the computational power of GPUs, or hash rate, but emitted 0.230 kg CO2 emitted per kWh and 1.621 kg CO2 per US dollar spent on electricity<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. | ||

| + | |||

| + | ===Environmental Impact of Bitcoin=== | ||

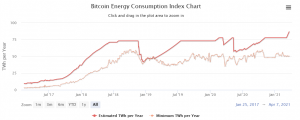

| + | Bitcoin is thought to consumer 707kwH per transaction, and according to a University of Cambridge analysis, it is estimated that bitcoin mining consumers use almost 121.36 terawatt-hours a year, which is more than all of Argentina consumes, or more than the consumption of Google, Apple, Facebook, and Microsoft combined <ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref>. Between 2015 and March of 2021, Bitcoin energy consumption had nearly increased almost 62-fold, and only about 39 percent of this energy comes from hydropower, which can have harmful impacts on ecosystems and biodiversity. Many miners within the US are converting abandoned factories and power plants into large bitcoin mining facilities <ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref>. One example of this is Greenidge Generation, which was a coal power plant, which has not been transformed into a bitcoin mining facility running on natural gas. AS it became one of the largest cryptocurrency miners in the United States, its greenhouse gas emissions increased almost 10x between 2019 and 2020. Globally, Bitcoin's power consumption has implications for the goals outlined in the Paris Accord as it translates into an estimated 22 to 22.9 million metric tons of CO2 emissions each year <ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref>. This is nearly equivalent to the energy use of almost 2.6 billion homes a year. With more mining moving to the U.S. and other countries, this amount could grow even larger unless more renewable energy is used. This growing correlation can be depicted by the diagram below showing the Bitcoin Energy Consumption Index. | ||

| + | <ref name="Bitcoin Statistics"> “Bitcoin by Numbers: 21 Statistics That Reveal Growing Demand for the Cryptocurrency.” Bitcoin News, 13 Nov. 2017, https://news.bitcoin.com/bitcoin-numbers-21-statistics-reveal-growing-demand-cryptocurrency/.</ref>. | ||

| + | [[File:Bitcoin.png|thumbnail|''Bitcoin Energy Consumption Index''|right]]<ref name="Bitcoin Statistics"> “Bitcoin by Numbers: 21 Statistics That Reveal Growing Demand for the Cryptocurrency.” Bitcoin News, 13 Nov. 2017, https://news.bitcoin.com/bitcoin-numbers-21-statistics-reveal-growing-demand-cryptocurrency/.</ref>. | ||

| + | |||

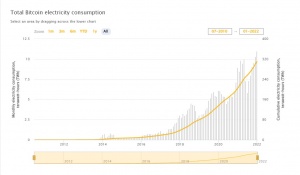

| + | Another diagram shows the total Bitcoin electricity consumption<ref>Cambridge Bitcoin Electricity Consumption Index. Cambridge Bitcoin Electricity Consumption Index (CBECI). (n.d.). Retrieved February 11, 2022, from https://ccaf.io/cbeci/index</ref>. | ||

| − | + | [[File:bitcoin21.jpg|thumbnail|''Total Bitcoin electricity consumption''|right]]<ref>Cambridge Bitcoin Electricity Consumption Index. Cambridge Bitcoin Electricity Consumption Index (CBECI). (n.d.). Retrieved February 11, 2022, from https://ccaf.io/cbeci/index</ref>. | |

| − | + | <ref>/** | |

| + | * To the extent possible under law, I, Sohil Jain, have waived all copyright and | ||

| + | * related or neighboring rights to Hello World. This work is published from the | ||

| + | * the United States. | ||

| + | * | ||

| + | * @copyright CC0 https://ccaf.io/cbeci/index< | ||

| + | * @author Sohil Jain | ||

| + | */</ref>. | ||

| − | == | + | ===Policy Implications=== |

| − | + | The cryptocurrency markets can also reveal the exigency of policy implementations. According to S. Erodgan, S. Sarkodie, and M. Ahmed politicians could immediately focus on detecting whether certain characteristics of causal effects of cryptocurrency markets are negative or positive<ref>Erdogan, S., Ahmed, M.Y. & Sarkodie, S.A. Analyzing asymmetric effects of cryptocurrency demand on environmental sustainability. Environ Sci Pollut Res (2022). https://doi.org/10.1007/s11356-021-17998-y</ref>. Furthermore, policymakers could also establish financial and environmental legislation to regulate the cryptocurrency market in an efficient manner. Another implication outlined by the authors is to have policymakers consider imposing an environmental tax on cryptocurrency transactions and revenues in order to reduce the environmental burden of cryptocurrency markets to bolster profit expectations from crypto mining<ref>Erdogan, S., Ahmed, M.Y. & Sarkodie, S.A. Analyzing asymmetric effects of cryptocurrency demand on environmental sustainability. Environ Sci Pollut Res (2022). https://doi.org/10.1007/s11356-021-17998-y</ref>. Lastly, policymakers could also pay attention to formalizing cryptocurrency transactions by establishing legal procedures; the license implementation on cryptocurrency trade would enable the controlling environmental effects, whereas environmental taxes could help the internalization of the negatives externalities caused by the mining activities and transactions<ref>Erdogan, S., Ahmed, M.Y. & Sarkodie, S.A. Analyzing asymmetric effects of cryptocurrency demand on environmental sustainability. Environ Sci Pollut Res (2022). https://doi.org/10.1007/s11356-021-17998-y</ref>. | |

| − | == | + | ==Some Possible Solutions== |

| − | === | + | ===Bitcoin Mining Council=== |

| − | + | Tesla CEO Elon Musk met with the CEOs of the top North American crypto mining companies about their energy use, which led to the creation of a new Bitcoin Mining Council in order to promote energy transparency<ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref>. Another initiative is the Crypto Climate Accord, which is supported by 40 projects, with the goal of allowing blockchains to run on 100 percent renewable energy by 2025 and have the entire cryptocurrency industry achieve net-zero emissions by 2040. This can be achieved by attempting to decarbonize the blockchains by using the most efficient validation methods, specifically to situate work systems in areas with excess renewable energy that can be used. The encouragement of purchasing certificates can also support renewable energy generators, much like carbon offsets support green projects. | |

| − | |||

| − | === | + | ===Proof of Stake Method=== |

| − | + | Ethereum is also aiming to reduce its energy by almost 99.5 percent by 2022, by transitioning to the ''proof of stake'' method, which does not require computational power to solve puzzles for the right to verify transactions. The system ensures security because if validators cheat, they lose their stake and are banned from the network. When prices increase, so does the network security, but the energy demands remain constant. Some worry, however, is that the ''proof of stake'' method could give people with the most ETH more power, leading to a decentralized system. | |

| − | === | + | ===Layer 2=== |

| − | + | Layer 2 is a collective term for solutions designed to help scale applications by handling transactions off the main chain (referred to as layer 1). Generally | |

| + | speaking, transactions are submitted to layer 2 nodes, which batch them into groups before storing them on layer 1<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. Layer 2 technologies that are based on Ethereum have a nontrivial impact on the environment. However, layer 2 transactions require significantly less gas and therefore represent a preferable alternative to executing them directly on-chain. | ||

| + | The main types of layer 2 solutions are sidechains and rollups<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. | ||

| − | |||

| − | + | Using off-chain bids, that are predominant in Rollups or other classes of Layer 2 would reduce emissions by 55%<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. Furthermore, it is estimated that executing transactions using the minimum required gas price would reduce transaction fees, and therefore emissions, by 26%<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. Similarly, executing these transactions during the times of the day with a lower minimum gas price, such as 5 P.M. UTC, could reduce Greenhouse Gas emissions by an additional 31%<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. | |

| − | + | ||

| − | + | ||

| − | === | + | ====Rollups==== |

| − | + | Rollups are a class of layer 2 technologies that store their data on the blockchain, and this process guarantees that it is always possible to recover all performed transactions. The same transaction, if executed on a rollup, requires two to three orders of magnitude less gas compared to the layer 1 counterparts<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. Two rollups that have been gaining attention within the Cryptocurrency markets, Optimism and Arbitrum, are currently still in development<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. | |

| − | + | ===Carbon Offsets=== | |

| + | Carbon offsets represent an alternative solution to reduce the Greenhouse Gas (GHG) impact of blockchains. By purchasing carbon offsets, a user compensates for their emissions by funding activities that have a negative GHG balance, which could include planting trees or funding the commercial viability of renewable energy<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. For example, some Crypto art platforms, such as Immutable X, compensate for their GHG emissions by automatically purchasing carbon offsets<ref>Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).</ref>. Certain platforms, such as KnownOrigin, offer artists an interface to donate a portion of their revenue to sustainable causes. | ||

| − | === | + | ===Location=== |

| − | + | Some other ideas for the greening of cryptocurrencies involve moving bitcoin operations in close proximity to oil fields, where the miners can tap into the waste that methane gas emits, pipe it into generators, and use that power for bitcoin mining. There are also some mines that are planning to be built in West Texas, where wind power is abundant. Since there is sometimes more powerful than transmission lines can handle, bitcoin mining situated near wind farms can use their excess energy<ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref>. R.A. Farrokhnia, Columbia Business School professor and executive director of the Columbia Fintech Initiative states that some of the ideas require very high upfront capital expenditures, and as a result, they might not be pragmatic<ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref>. Farrokhnia fears that as soon as bitcoin prices drop below a certain threshold, then the expensive solutions would no longer be feasible, as she begs the question "Who in reality would make those investments given the volatility in the price of bitcoin and the uncertainty about the future of it?" <ref>20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ </ref>. | |

| − | + | ||

==References== | ==References== | ||

[[Category:BlueStar2018]] | [[Category:BlueStar2018]] | ||

Latest revision as of 22:03, 11 February 2022

|

Contents

Origins

In 2008, an anonymous person under the pseudonym, Satoshi Nakomoto, published a paper titled "Bitcoin: A Peer to Peer Electronic Cash System"[3]. On January 3rd, 2009, Satoshi mined the genesis block of the Bitcoin blockchain. The Bitcoin protocol is open source code and has received contributions from numerous developers including, most notably, Hal Finney, Nick Szabo, and Gavin Andresen. In the years since, many other projects have been released that utilize Bitcoin's source code, as well as many other cryptocurrencies that have developed their own blockchain. These are known as altcoins.

After Bitcoin appeared in 2009, approximately 1500 other cryptocurrencies have been introduced, of which nearly 600 are actively traded[4]. All cryptocurrencies share the underlying blockchain technology and reward mechanism, however, they live on isolated transaction networks. Many of them are basically clones of Bitcoin, although with different parameters such as different supplies, transaction validation times, and other factors[5]. This results in other emerging altcoins possibly having more significant innovations of the underlying blockchain technology.

Examples of Cryptocurrencies

Bitcoin

In 2008 Satoshi Nakamoto released a paper through metzdowd.com called Bitcoin: A Peer to Peer Electronic Cash System.[6] In the paper, Satoshi discusses a solution to the double-spending problem. The double-spending problem refers to the ability of individuals to copy tokens and re-use them if security measures are not present.[7] In the paper Satoshi also describes a decentralized system for transactions, eliminating the need for third-party involvement. Bitcoin allows for pseudo-anonymous transactions to take place and relies on a computer network of miners who perform algorithms to approve transactions.

Bitcoin is unregulated by the government, and has grown since it first opened to the public in 2009: there are 12,000 transactions per/hour, 18.5 million blockchain.info wallets, and 715,000 active addresses per daily average.[8].

Altcoins

Altcoins are prolific alternative cryptocurrencies that were released after Bitcoin. They are often created in an attempt to improve on the existing blockchain technology.[9]

Litecoin (LTC)

Another proof-of-work cryptocurrency, similar to Bitcoin. [10]

Ethereum (ETH)

An extensible crypto platform that allows for smart contracting [11]

Zcash (ZEC)

A pseudonymous cryptocurrency is more private and has less transparency in transactions. The parent company, ZcashCo is only a link in the chain and cant see transactions without being provided the appropriate view key. This is the main premise of Zcash becoming one of the only privacy-first, decentralized cryptocurrencies. ZcashCo's role instead is to help provide updates to Zcash which users can choose to utilize or ignore. [12]

Dash

Originally known as Darkcoin. Dash allows improved anonymity to users. [13]

Ripple (XRP)

A cryptocurrency with a goal for easy international payments. [14]

Monero (XMR)

Cryptocurrency deemphasizing traceability and emphasizing privacy. [15]

Environmental Implications of the Cryptocurrency Market

Blockchain systems, especially, the use of cryptocurrencies are quite energy-intensive, and there are many natural resources and environmental services considerations that are relevant to low-income countries engaging with these in a global framework[16]. The annual energy of Bitcoin and Ethereum combined exceeds 40 Trillion Watts/hour[17]. Furthermore, nearly .19% of the world's electricity is used by Bitcoin and Ethereum combined. And, a single Bitcoin transaction could power nearly 9 U.S. households for a full day, with the same energy consumed[18]. The ethical implications of the cryptocurrency markets are also concerned with the overall environmental impact of crypto mining and the volume of transactions.

Energy Consumption

Mining is the process of adding transaction records to certain cryptocurrencies' public ledgers of past transactions. The blockchain serves to confirm transactions to the rest of the network, and specific crypto nodes use the blockchain to distinguish legitimate transactions from attempts to respend coins. This process is energy-intensive and often causes power consumption issues. Moreover, for every 5 cents that were spent on operational costs in mining cryptocurrencies, nearly 1 kiloWatt-hour (kWh) was consumed[19].

Moreover, to produce bitcoins and other cryptocurrencies the electricity footprint per unique transaction can range from 491.1 kWh to 765.4 kWh.[20]. For comparison, the banking system processes nearly 500 billion non-cash transactions per year, and the average processing footprint for such a transaction is only 0.4 kWh at most[21]. Certain cryptocurrencies have larger environmental footprints compared to others. The Bitcoin Energy Consumption Index states that Bitcoin's energy use in 2018 converted to a carbon footprint of nearly 300 kg of CO2 per transaction[22]. This can be compared to the energy use of a visa transaction of only about 0.4g of CO2 per transaction or 0.2g of CO2 emitted per google search[23].

Carbon Emissions and Global Warming

There is an increasing causality generating a higher consumption of electricity for the higher trading of cryptocurrencies. Specifically, look at Bitcoin, the arguably largest cryptocurrency, estimates have shown that the annual carbon footprint exceeds 30,000 Kt of CO2 emissions, which is more than the emissions produced by Sri Lanka or Jordan[24]. Furthermore, Bitcoin's annualized global mining costs exceed nearly 3 billion US dollars [25].

With the increasing energy demand due to increased mining activities, the carbon emissions released can have a large negative externality. Certain studies have warned that global temperature could increase by 2°C by 2034 due to the exponential growth in bitcoin trading[26]. Although this statistic is specific to Bitcoin, his problem of high electricity consumption is common to several cryptocurrencies, suggesting that any further development of cryptocurrencies will only increase the rate at which cryptocurrencies add to the issue of global warming[27]. In addition, according to certain studies, GDP and energy are uni-directionally related to CO2 emissions, and the parallel movement of crypto-volume and GDP is an indication of a long-run negative impact on environmental quality[28]. This leads to the results of an impulse response function of positive energy confirming a significant increase of CO2 emissions, and a decrease in the sustainability of energy use on CO2 emissions[29].

Furthermore, as of May 2021, Ethereum was found to emit nearly 24.76 Mt of CO2 per year[30]. Variations in the price of Ether influence the greenhouse gas emissions of the Ethereum network as a whole. The impact of a transaction, however, does not depend only on the gas used but is rather proportional to the transaction fee of the cryptocurrency[31]. Within a single transaction, there are several processes that emit these greenhouse gases: minting, buying, transferring, and bidding. A certain study showed that the emission of minting a single Ethereum coin, assuming that the gas usage was 450k, which is industry standard, emitted nearly 101.33 kg CO2[32]. The entire process of a single coin emitted nearly 200 kg CO2[33].

Water Issues and E-Waste

Power plants, such as Greenidge, also happen to consume large amounts of water annually. Greenidge, specifically, draws up to 139 million gallons of freshwater each day, and even discharges some water that is 30 to 50 degrees hotter than the lake's average temperature[34] . This can endanger the lake's natural ecosystem, as well as the plant's large intake pipes killing larvae, fish, and other wildlife. The e-waste problem also begs another ethical dilemma. Miners search for the most efficient hardware, which can become obsolete almost every year, and cannot be reprogrammed for other purposes. This leads to an estimation of 11.5 kilotons of e-waste each year from the Bitcoin network alone[35].

Human Health Impacts of Cryptocurrency Mining

Expanding upon previously calculated energy use patterns for mining four prominent cryptocurrencies (Bitcoin, Ethereum, Litecoin, and Monero), certain studies estimate the per coin economic damages of air pollution emissions and associated human mortality and climate impacts of mining such Cryptocurrencies within the US and China. Results from these studies indicate that in 2018 alone, each $1 of Bitcoin value created was responsible for $0.49 in health and climate damages in the US and $0.37 in China[36]. The electricity consumption of mining cryptocurrencies is large and growing rapidly. For example, in January of 2016, each Bitcoin mined required 1005 kWh of electricity, however, by June of 2018 each Bitcoin mined required 60,461 kWh[37]. Although the number of total coins mined dropped in 2018 compared to 2016, electricity consumption increased to 47.9 billion kWh from 2.5 billion kWh[38].

Cryptocurrency "Mining" and Community Responses

Chelan County has a population of roughly 74,000 and is located in the North Central region of Washington State. The region attracted cryptocurrency miners due to its abundance of cheap electricity in 2018, as well as the fact that the Chelan PUD charged residential customers 2.7 cents per kWh, which was among the lowest rates in the country in 2018[39]. This led to a cryptocurrency mining boom which led to Chelan County permitting 17 crypto mining businesses by February 2016. However, the community has seen several environmental concerns. In 2017, an unauthorized miner overtaxed electrical lines and started a small brush fire in Chelan County, according to the PUD[40]. Furthermore

Certain Cryptocurrency technologies require a Proof of Work method. The Proof of Work (PoW) method uses an algorithm where blocks are validated by solving an energy-intensive computational puzzle. The energy consumption required to validate or mine a block is proportional to the block difficulty[41]. The computational power of a miner is measured by its hash rate. While Bitcoin is mined using ASICs (application-specific integrated circuits), other altcoins are mined using GPUs (graphical processing units). Based on a study from 2019, which looked at different regions using the PoW method, it was found that a single GPU, over a 2-year period, will approximately cost 980 US dollars and will have an impact of 1128 kg CO2 emitted. This finding leads to an estimate of nearly 1.151 kg CO2 emitted/$, or in other words, the average GPU impact can be estimated at emitting 1.151kg CO2 per every US dollar spent on electricity[42]. Furthermore, when looking at certain regions, North America only accounted for about 12% of the hash rate, or computational power, of GPUs, yet had nearly 0.331 kG CO2 emitted per kWh and emitted nearly 4.061 kg CO2 per US dollar spent on electricity[43]. On the other hand, Europe accounted for nearly 50% of the computational power of GPUs, or hash rate, but emitted 0.230 kg CO2 emitted per kWh and 1.621 kg CO2 per US dollar spent on electricity[44].

Environmental Impact of Bitcoin

Bitcoin is thought to consumer 707kwH per transaction, and according to a University of Cambridge analysis, it is estimated that bitcoin mining consumers use almost 121.36 terawatt-hours a year, which is more than all of Argentina consumes, or more than the consumption of Google, Apple, Facebook, and Microsoft combined [45]. Between 2015 and March of 2021, Bitcoin energy consumption had nearly increased almost 62-fold, and only about 39 percent of this energy comes from hydropower, which can have harmful impacts on ecosystems and biodiversity. Many miners within the US are converting abandoned factories and power plants into large bitcoin mining facilities [46]. One example of this is Greenidge Generation, which was a coal power plant, which has not been transformed into a bitcoin mining facility running on natural gas. AS it became one of the largest cryptocurrency miners in the United States, its greenhouse gas emissions increased almost 10x between 2019 and 2020. Globally, Bitcoin's power consumption has implications for the goals outlined in the Paris Accord as it translates into an estimated 22 to 22.9 million metric tons of CO2 emissions each year [47]. This is nearly equivalent to the energy use of almost 2.6 billion homes a year. With more mining moving to the U.S. and other countries, this amount could grow even larger unless more renewable energy is used. This growing correlation can be depicted by the diagram below showing the Bitcoin Energy Consumption Index. [8].

[8].Another diagram shows the total Bitcoin electricity consumption[48].

[49].[50].

Policy Implications

The cryptocurrency markets can also reveal the exigency of policy implementations. According to S. Erodgan, S. Sarkodie, and M. Ahmed politicians could immediately focus on detecting whether certain characteristics of causal effects of cryptocurrency markets are negative or positive[51]. Furthermore, policymakers could also establish financial and environmental legislation to regulate the cryptocurrency market in an efficient manner. Another implication outlined by the authors is to have policymakers consider imposing an environmental tax on cryptocurrency transactions and revenues in order to reduce the environmental burden of cryptocurrency markets to bolster profit expectations from crypto mining[52]. Lastly, policymakers could also pay attention to formalizing cryptocurrency transactions by establishing legal procedures; the license implementation on cryptocurrency trade would enable the controlling environmental effects, whereas environmental taxes could help the internalization of the negatives externalities caused by the mining activities and transactions[53].

Some Possible Solutions

Bitcoin Mining Council

Tesla CEO Elon Musk met with the CEOs of the top North American crypto mining companies about their energy use, which led to the creation of a new Bitcoin Mining Council in order to promote energy transparency[54]. Another initiative is the Crypto Climate Accord, which is supported by 40 projects, with the goal of allowing blockchains to run on 100 percent renewable energy by 2025 and have the entire cryptocurrency industry achieve net-zero emissions by 2040. This can be achieved by attempting to decarbonize the blockchains by using the most efficient validation methods, specifically to situate work systems in areas with excess renewable energy that can be used. The encouragement of purchasing certificates can also support renewable energy generators, much like carbon offsets support green projects.

Proof of Stake Method

Ethereum is also aiming to reduce its energy by almost 99.5 percent by 2022, by transitioning to the proof of stake method, which does not require computational power to solve puzzles for the right to verify transactions. The system ensures security because if validators cheat, they lose their stake and are banned from the network. When prices increase, so does the network security, but the energy demands remain constant. Some worry, however, is that the proof of stake method could give people with the most ETH more power, leading to a decentralized system.

Layer 2

Layer 2 is a collective term for solutions designed to help scale applications by handling transactions off the main chain (referred to as layer 1). Generally speaking, transactions are submitted to layer 2 nodes, which batch them into groups before storing them on layer 1[55]. Layer 2 technologies that are based on Ethereum have a nontrivial impact on the environment. However, layer 2 transactions require significantly less gas and therefore represent a preferable alternative to executing them directly on-chain. The main types of layer 2 solutions are sidechains and rollups[56].

Using off-chain bids, that are predominant in Rollups or other classes of Layer 2 would reduce emissions by 55%[57]. Furthermore, it is estimated that executing transactions using the minimum required gas price would reduce transaction fees, and therefore emissions, by 26%[58]. Similarly, executing these transactions during the times of the day with a lower minimum gas price, such as 5 P.M. UTC, could reduce Greenhouse Gas emissions by an additional 31%[59].

Rollups

Rollups are a class of layer 2 technologies that store their data on the blockchain, and this process guarantees that it is always possible to recover all performed transactions. The same transaction, if executed on a rollup, requires two to three orders of magnitude less gas compared to the layer 1 counterparts[60]. Two rollups that have been gaining attention within the Cryptocurrency markets, Optimism and Arbitrum, are currently still in development[61].

Carbon Offsets

Carbon offsets represent an alternative solution to reduce the Greenhouse Gas (GHG) impact of blockchains. By purchasing carbon offsets, a user compensates for their emissions by funding activities that have a negative GHG balance, which could include planting trees or funding the commercial viability of renewable energy[62]. For example, some Crypto art platforms, such as Immutable X, compensate for their GHG emissions by automatically purchasing carbon offsets[63]. Certain platforms, such as KnownOrigin, offer artists an interface to donate a portion of their revenue to sustainable causes.

Location

Some other ideas for the greening of cryptocurrencies involve moving bitcoin operations in close proximity to oil fields, where the miners can tap into the waste that methane gas emits, pipe it into generators, and use that power for bitcoin mining. There are also some mines that are planning to be built in West Texas, where wind power is abundant. Since there is sometimes more powerful than transmission lines can handle, bitcoin mining situated near wind farms can use their excess energy[64]. R.A. Farrokhnia, Columbia Business School professor and executive director of the Columbia Fintech Initiative states that some of the ideas require very high upfront capital expenditures, and as a result, they might not be pragmatic[65]. Farrokhnia fears that as soon as bitcoin prices drop below a certain threshold, then the expensive solutions would no longer be feasible, as she begs the question "Who in reality would make those investments given the volatility in the price of bitcoin and the uncertainty about the future of it?" [66].

References

- ↑ https://www.investopedia.com/terms/c/cryptocurrency.asp

- ↑ https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ Nakamoto, S. (2018). Bitcoin: A Peer-to-Peer Electronic Cash System (pp. 1-9). www.bitcoin.org. Retrieved from https://bitcoin.org/bitcoin.pdf

- ↑ ElBahrawy, Abeer, et al. "Evolutionary dynamics of the cryptocurrency market." Royal Society open science 4.11 (2017): 170623.https://doi.org/10.1098/rsos.170623

- ↑ ElBahrawy, Abeer, et al. "Evolutionary dynamics of the cryptocurrency market." Royal Society open science 4.11 (2017): 170623.https://doi.org/10.1098/rsos.170623

- ↑ Madey, Robert Stanley. “A Study of the History of Cryptocurrency and Associated Risks and Threats.” ProQuest Dissertations & Theses Global, Utica College, 2017. https://search.proquest.com/docview/2008188467?accountid=14667.

- ↑ Pérez-Solà, Cristina, et al. “Double-Spending Prevention for Bitcoin Zero-Confirmation Transactions.” Semantic Scholar, IACR Cryptology EPrint Archive, 2017, http://www.semanticscholar.org/paper/Double-spending-Prevention-for-Bitcoin-transactions-Pérez-Solà-Delgado-Segura/7837b2e4b8e883e6874b99a6a7aaa2006e0f7938.

- ↑ 8.0 8.1 8.2 “Bitcoin by Numbers: 21 Statistics That Reveal Growing Demand for the Cryptocurrency.” Bitcoin News, 13 Nov. 2017, https://news.bitcoin.com/bitcoin-numbers-21-statistics-reveal-growing-demand-cryptocurrency/.

- ↑ Bajpai, Prableen. “The 6 Most Important Cryptocurrencies Other Than Bitcoin.” Investopedia, 7 Dec. 2017, https://www.investopedia.com/tech/most-important-cryptocurrencies-other-than-bitcoin/.

- ↑ Litecoin https://litecoin.org/

- ↑ Ethereum https://www.ethereum.org/

- ↑ Zcash https://z.cash/

- ↑ Dash https://www.dash.org/

- ↑ Ripple https://ripple.com/

- ↑ Monero https://getmonero.org/

- ↑ Jeyanthi, P. Mary. "THEORIES OF CRYPTOCURRENCY, BLOCKCHAIN AND DISTRIBUTED SYSTEMS AND ENVIRONMENTAL IMPLICATIONS." Cryptocurrencies and Blockchain Technology Applications (2020): 215-238. https://doi.org/10.1002/9781119621201.ch12

- ↑ Jeyanthi, P. Mary. "THEORIES OF CRYPTOCURRENCY, BLOCKCHAIN AND DISTRIBUTED SYSTEMS AND ENVIRONMENTAL IMPLICATIONS." Cryptocurrencies and Blockchain Technology Applications (2020): 215-238. https://doi.org/10.1002/9781119621201.ch12

- ↑ Jeyanthi, P. Mary. "THEORIES OF CRYPTOCURRENCY, BLOCKCHAIN AND DISTRIBUTED SYSTEMS AND ENVIRONMENTAL IMPLICATIONS." Cryptocurrencies and Blockchain Technology Applications (2020): 215-238. https://doi.org/10.1002/9781119621201.ch12

- ↑ Jeyanthi, P. Mary. "THEORIES OF CRYPTOCURRENCY, BLOCKCHAIN AND DISTRIBUTED SYSTEMS AND ENVIRONMENTAL IMPLICATIONS." Cryptocurrencies and Blockchain Technology Applications (2020): 215-238. https://doi.org/10.1002/9781119621201.ch12

- ↑ M. R. Rabbani, A. Alshaikh, A. Jreisat, A. Bashar and M. A. Moh'd Ali, "Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective," 2021 International Conference on Sustainable Islamic Business and Finance, 2021, pp. 103-108, doi: 10.1109/IEEECONF53626.2021.9686332.

- ↑ M. R. Rabbani, A. Alshaikh, A. Jreisat, A. Bashar and M. A. Moh'd Ali, "Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective," 2021 International Conference on Sustainable Islamic Business and Finance, 2021, pp. 103-108, doi: 10.1109/IEEECONF53626.2021.9686332.

- ↑ M. R. Rabbani, A. Alshaikh, A. Jreisat, A. Bashar and M. A. Moh'd Ali, "Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective," 2021 International Conference on Sustainable Islamic Business and Finance, 2021, pp. 103-108, doi: 10.1109/IEEECONF53626.2021.9686332.

- ↑ M. R. Rabbani, A. Alshaikh, A. Jreisat, A. Bashar and M. A. Moh'd Ali, "Whether Cryptocurrency is a threat or a revolution? An analysis from ESG perspective," 2021 International Conference on Sustainable Islamic Business and Finance, 2021, pp. 103-108, doi: 10.1109/IEEECONF53626.2021.9686332.

- ↑ Christophe Schinckus, The good, the bad, and the ugly: An overview of the sustainability of blockchain technology, Energy Research & Social Science, Volume 69,2020,101614, ISSN 2214-6296,https://doi.org/10.1016/j.erss.2020.101614.

- ↑ Christophe Schinckus, The good, the bad and the ugly: An overview of the sustainability of blockchain technology, Energy Research & Social Science, Volume 69,2020,101614, ISSN 2214-6296,https://doi.org/10.1016/j.erss.2020.101614.

- ↑ Mora, C., Rollins, R.L., Talalay, K. et al. Bitcoin emissions alone could push global warming above 2°C. Nature Clim Change 8, 931–933 (2018). https://doi.org/10.1038/s41558-018-0321-8

- ↑ Mora, C., Rollins, R.L., Talalay, K. et al. Bitcoin emissions alone could push global warming above 2°C. Nature Clim Change 8, 931–933 (2018). https://doi.org/10.1038/s41558-018-0321-8

- ↑ Mohsin, Muhammad, et al. "The crypto‐trade volume, GDP, energy use, and environmental degradation sustainability: An analysis of the top 20 crypto‐trader countries." International Journal of Finance & Economics (2020).https://doi.org/10.1002/ijfe.2442

- ↑ Mohsin, Muhammad, et al. "The crypto‐trade volume, GDP, energy use, and environmental degradation sustainability: An analysis of the top 20 crypto‐trader countries." International Journal of Finance & Economics (2020).https://doi.org/10.1002/ijfe.2442

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ Andrew L. Goodkind, Benjamin A. Jones, Robert P. Berrens, Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining, Energy Research & Social Science, Volume 59, 2020, 101281, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2019.101281. (https://www.sciencedirect.com/science/article/pii/S2214629619302701)

- ↑ Andrew L. Goodkind, Benjamin A. Jones, Robert P. Berrens, Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining, Energy Research & Social Science, Volume 59, 2020, 101281, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2019.101281. (https://www.sciencedirect.com/science/article/pii/S2214629619302701)

- ↑ Andrew L. Goodkind, Benjamin A. Jones, Robert P. Berrens, Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining, Energy Research & Social Science, Volume 59, 2020, 101281, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2019.101281. (https://www.sciencedirect.com/science/article/pii/S2214629619302701)

- ↑ Pierce Greenberg, Dylan Bugden, Energy consumption boomtowns in the United States: Community responses to a cryptocurrency boom, Energy Research & Social Science, Volume 50, 2019, Pages 162-167, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2018.12.005.(https://www.sciencedirect.com/science/article/pii/S2214629618308260)

- ↑ Pierce Greenberg, Dylan Bugden, Energy consumption boomtowns in the United States: Community responses to a cryptocurrency boom, Energy Research & Social Science, Volume 50, 2019, Pages 162-167, ISSN 2214-6296, https://doi.org/10.1016/j.erss.2018.12.005.(https://www.sciencedirect.com/science/article/pii/S2214629618308260)

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ Cambridge Bitcoin Electricity Consumption Index. Cambridge Bitcoin Electricity Consumption Index (CBECI). (n.d.). Retrieved February 11, 2022, from https://ccaf.io/cbeci/index

- ↑ Cambridge Bitcoin Electricity Consumption Index. Cambridge Bitcoin Electricity Consumption Index (CBECI). (n.d.). Retrieved February 11, 2022, from https://ccaf.io/cbeci/index

- ↑ /** * To the extent possible under law, I, Sohil Jain, have waived all copyright and * related or neighboring rights to Hello World. This work is published from the * the United States. * * @copyright CC0 https://ccaf.io/cbeci/index< * @author Sohil Jain */

- ↑ Erdogan, S., Ahmed, M.Y. & Sarkodie, S.A. Analyzing asymmetric effects of cryptocurrency demand on environmental sustainability. Environ Sci Pollut Res (2022). https://doi.org/10.1007/s11356-021-17998-y

- ↑ Erdogan, S., Ahmed, M.Y. & Sarkodie, S.A. Analyzing asymmetric effects of cryptocurrency demand on environmental sustainability. Environ Sci Pollut Res (2022). https://doi.org/10.1007/s11356-021-17998-y

- ↑ Erdogan, S., Ahmed, M.Y. & Sarkodie, S.A. Analyzing asymmetric effects of cryptocurrency demand on environmental sustainability. Environ Sci Pollut Res (2022). https://doi.org/10.1007/s11356-021-17998-y

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ Marro, Samuele, and Luca Donno. "Green NFTs: A Study on the Environmental Impact of Crypto art Technologies." arXiv preprint arXiv:2202.00003 (2022).

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/

- ↑ 20, R. C. |S., Cho, R., Dexfolio, J., S, E., Ishita, Nerad, S., Joad, T., & Dallaire, L. (2021, September 16). Bitcoin's impacts on climate and the environment. State of the Planet. Retrieved January 28, 2022, from https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/