Cash App

|

Cash App, a subsidiary of Block, Inc. (formerly known as Square, Inc.), is a mobile app launched in 2013 as a peer-to-peer (P2P) payments service.[1] Since its inception, Cash App has expanded to provide banking and brokerage services.[2] The app, which is only available in the United States and the United Kingdom, can be downloaded for free through the Google Play Store and App Store on the Android and iOS mobile operating systems, respectively.[3][4] With its power to simplify payments and personal finance, Cash App is an incredibly popular platform with millions of users at its disposal.[2][5] Nevertheless, concerns regarding its use in illicit activity and the app’s data policy remain.[6][7]

History

App development

When it initially launched in 2013, Cash App solely served as a P2P payments service.[3] In 2017, the Cash Card, which functions as a Visa debit card, was released by Cash App.[8] In the same year, Cash App also introduced a new service that allowed Bitcoin to be traded.[1] Cash App additionally developed the ability to trade stocks in late 2019.[9]

Giveaways and growth

Due to competitive pressures arising from many other companies existing in the market for mobile payments, Cash App has taken a unique measure to expand its user base.[10] Cash App engages with current and prospective users by conducting cash giveaways. Through a marketing campaign created in late 2017 called “Cash App Friday,” Cash App gives random users hundreds of dollars every Friday. In fact, Cash App has partnered with numerous hip-hop artists who take part in these giveaways: Cardi B and Megan Thee Stallion each worked with Cash App to give 500 dollars to 2,000 different individuals in 2019.

In addition to Cash App itself giving away money, the app has made its way into the 450 billion dollar charity industry.[10] Charitable individuals hoping to help those struggling with financial hardships have found directly donating to people through Cash App to be more effective than donating to non-profit organizations since a direct giveaway more urgently reaches people.

With such techniques being deployed to gain more users, Cash App has grown its number of active users from 7 million in 2017 to over 70 million in late 2021.[5][10] In addition, the app has generated over 1.8 billion in gross profit from Q4 of 2020 to Q3 of 2021.[5]

App features

$Cashtag

Upon creating a Cash App account, users select a unique identifier, which is referred to as a “$Cashtag”.[11] Once a $Cashtag is claimed by a user, a shareable URL that can be used to receive money is created.[11] A $Cashtag must be between one and 20 characters, and it can only be changed twice.[11][12]

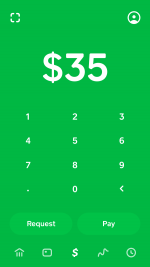

P2P payments

The first service Cash App supported upon its launch was P2P payments.[1][3] This service allows individuals to exchange money with friends, family, and businesses.[3] To take part in a P2P payment, Cash App users need to link a debit or credit card from American Express, Discover, MasterCard, or Visa.[14] If a user chooses to use a credit card, they will need to pay a three percent fee on payments that they send.[15] In addition to linking a debit or credit card, users can link a prepaid card.[14] Deposits cannot be made to prepaid cards.[14]

When sending money over Cash App, an individual must provide the phone number, email address, or $Cashtag of their intended recipient.[16] Receivers do not need to take any action; however, if they wish to examine the details of a particular payment, they can view their activity feed on Cash App.[17] Before providing additional information to verify their identity, a user can only send and receive 1,000 dollars over a 30-day period.[15] Once a user verifies their identity, this limit is increased.

It can take between one and three business days to transfer money into a bank account from Cash App.[3][18] However, instant transfers can be made if a 1.5 percent fee is paid.[3][18]

Prior to 2022, Cash App had to file a Form 1099-K form to the internal revenue service (IRS) for only those who took part in over 200 commercial transactions that resulted in over 20,000 dollars of gross income.[19][20][21] Beginning in 2022, Cash App must file a Form 1099-K to the IRS for anyone who receives over 600 dollars in gross income through commercial means.[19][20]

Cash Card

The Cash Card is a Visa debit card offered by Cash App and issued by Sutton Bank.[15][22] It is linked to an individual’s Cash App account balance but not any personal banking account.[8][15] The card can be used to make both offline and online purchases.[22] Additionally, the Cash Card has spending and withdrawal limits.[15] Individuals can spend at most 7,000 dollars per transaction, 7,000 dollars per day, 10,000 dollars per week, and 25,000 dollars per 30-day period.[15][23]

Direct Deposit

Cash App users also have the option to set up direct deposit.[24] Paychecks and tax returns are among the items that can be directly deposited into an individual’s Cash App balance. As with most services provided by Cash App, their direct deposit comes with limits: at most 25,000 dollars can be received per direct deposit and at most 50,000 dollars can be received per day.

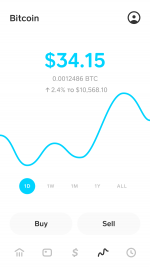

Investing

Cash App provides a service that allows its users to invest in stocks.[25] With just one dollar, users are able to invest. Currently, Cash App provides access to over 1,600 publicly traded stocks and exchange-traded funds.[26] Cash App has also made its way into the cryptocurrency industry as it allows its users to buy and sell Bitcoin.[27] The app additionally provides its users the ability to send Bitcoin directly to other users.[25]

Competitors

Venmo

Venmo, which is owned by PayPal, is one of Cash App’s largest competitors.[3][28] As with Cash App, Venmo's primary service is P2P payments. Venmo charges the same credit card and instant transfer fees as Cash App.[29] Moreover, Venmo is similar to Cash App in that it allows users to set up direct deposits and trade cryptocurrency.[30] Venmo, like Cash App, also supplies debit cards that are linked to a user’s account balance.[31] However, differences between Cash App and Venmo exist. Unlike Cash App, which only allows its users to trade Bitcoin, Venmo provides its users the opportunity to trade Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.[32] Another key difference is that Venmo is only available in the United States and P2P transactions that occur on Venmo can be made public for others to view.[33]

PayPal

PayPal became one of the world’s first digital payments platforms when it was founded in 1998.[34] It is quite similar to Cash App and Venmo as it also offers P2P payments, its own debit card, and the ability to trade cryptocurrencies.[34][35][36] Nonetheless, PayPal differs from Cash App and Venmo in a few ways. For one, unlike Venmo, which only allows payments within the United States, and Cash App, which only allows international payments between the United States and the United Kingdom, PayPal is available in over 200 countries and international payments can be made across these countries.[4][33][34] PayPal also has a much larger footprint in carrying out transactions between businesses and consumers than Cash App and Venmo.[34][37] Furthermore, PayPal differs from these two in that it offers a line of credit.[38]

Zelle

Zelle operates in a much different manner than Cash App, Venmo, and PayPal.[31] Zelle’s main service is P2P payments but unlike these three other apps, Zelle does not allow its users to maintain a cash balance. Without such a feature, Zelle transfers money directly between its users’ bank accounts. These transfers are free of any fees and happen within a few minutes. Zelle also does not offer its own debit card or a service to trade cryptocurrency. On top of that, Zelle differs from Cash App, Venmo, and PayPal as it does not need to report any transactions to the IRS or file Forms 1099-K to the IRS.[19][39]

Over 1,000 United States banks and credit unions work with Zelle. Some of these banks include Bank of America, Chase Bank, Capital One, Wells Fargo Bank, and PNC Bank.[40] The mobile apps of most banks that work with Zelle have built-in functionality that allows Zelle P2P payments to take place within their own app.[31]

Apple Cash

Apple Cash, which was developed by Apple, is yet another competitor of Cash App.[41] Apple Cash allows P2P payments to take place on iPhone, Apple Watch, and iPad devices.[41] As opposed to Cash App, Venmo, PayPal, and Zelle, which have their own apps, Apple Cash uses iMessage to conduct P2P payments.[41] Additionally, while its competitors are available on Android, Apple Cash is restricted to those using iOS devices.[3]

Ethical concerns

Criminal activity

Cash App has been used by numerous individuals to engage in criminal activity. Though other mobile payment apps are also by criminals, statistics collected after analyzing reviews of these apps have determined that most cases of fraud are tied to Cash App.[7][42] In fact, Cash App experienced a 169 percent increase in the number of app reviews mentioning the terms “scam” or “fraud” from 2019 to 2020.[42] In this time span, Venmo suffered a much smaller increase of 97 percent while Zelle experienced a decrease of 8 percent.[42] Moreover from January 2021 to June 2021, the Federal Trade Commision (FTC) received more complaints regarding fraud that were tied to Cash App than any other P2P payment service.[43] While the FTC received just 191 complaints about Zelle during this time period and 845 complaints about Venmo, they received 2,431 complaints about Cash App.[43] The median loss for individuals filing these complaints about Cash App was around 500 dollars, and there are some who lost tens of thousands of dollars.[43] On the dark web, a portion of the Internet where criminals can communicate and engage in illicit activity, Cash App was mentioned 10,577 times in August 2020, far more than Venmo, which had 2,782 mentions, and Zelle, which had 2,972 mentions.[42]

Aware of the criminal activity taking place on its app, Cash App has enhanced its safety features.[44] The app includes security locks, which, if enabled, require personal identification number entry, touch identification, or facial identification to verify payments.[44] Cash App is also Payment Card Industry Data Security Standard level 1 certified, and as a result, it provides state-of-the-art encryption of user data.[44] Furthermore, though Cash App does not insure against fraud, it utilizes elaborate fraud detection infrastructure to monitor Cash App transactions.[45] Cash App’s website additionally provides its users with guidelines on avoiding fraud.[45]

Despite these efforts to limit some forms of crime that could take place through Cash App, criminals have continued to use the app to perform illicit activity in a variety of manners.

Fake goods and services

One common way in which fraud takes place on Cash App involves attempting to sell products that do not exist.[7] In other words, criminals advertise a product, receive money over Cash App from someone who expects to receive the product, and then do not send the product to this individual. To complicate matters, criminals take advantage of people by posing to work as Cash App customer service employees.[42][43] Until late 2020, Cash App had only provided an email for customer service.[42] This had the effect of those looking for help with Cash App dialing fake customer service phone numbers they found online.[42] Even with Cash App now supplying a phone number for customer service, criminals have utilized spamdexing to drive fake Cash App customer service phone numbers to the top of search engine results.[43] Once criminals have people on the phone, they utilize numerous techniques to steal money. Charee Mobley, a middle school teacher in Texas, fell victim when she dialed a fake Cash App customer service number and was asked to download a piece of software to help with her complaints.[42] After following this order, the person she was speaking with used the software to take control of her Cash App account and steal 166 dollars that belonged to her. Tamika Waddle, a travel nurse in Texas, also fell victim when someone pretending to be a customer service employee convinced her to download a third-party app and conducted P2P payments through the app.[46]

Flipping fraud

Flipping involves one individual receiving money with the promise of giving the sender a larger sum of money at a later time.[7][42] Fraudsters have used Cash App to fraudulently flip as they receive money through Cash App and do not return the promised larger sum of money.[7] This generally takes place on social media platforms, particularly Instagram, Facebook, and Twitter.[7][42] Detective Ricardo Pena, who works for the police department in Coral Springs, Florida, has evaluated elaborate conversations between fraudsters and their victims.[7][42] The conversations he has seen typically involve the fraudster initially establishing trust with their victim in order to eventually steal a large sum of money. He has seen these conversations go as follows: “They’ll be like, ‘Hey, listen, that $1 you send me, I could make it $10.’ And they’ll be like, ‘OK, so what is there to lose? One dollar is not a big deal. Then what we will see is that develops the trust. They’re like, ‘All right, it worked with the dollar. Let me do $10.’ So $10 will maybe turn into $20, maybe $50. So that way they continue developing the trust.”[7]

The Cash App Friday campaign has also been taken advantage of by fraudsters on Twitter.[42] Criminals have stolen money by posing to be Cash App employees taking part in Cash App Friday giveaways. For instance, a Twitter account with the handle @CashappG uses the tagline “Hi welcome to Cash App give away! Send money and we will send you double back!” Such fraudulent flipping resulted in Emily Bradford, an unemployed woman in Washington, losing 75 dollars as she used her Cash App account to send this money to someone promising 3,000 dollars in return. The fraudster to whom she sent her money never paid her the 3,000 dollars.

COVID-19 relief fraud

During the COVID-19 pandemic, criminals have fraudulently obtained money intended to support those struggling financially.[7] One manner in which they do this is that they pretend to be an influencer hoping to help the struggling individuals.[47] Deceived people send them money through Cash App without realizing that the money will never reach those who need it; rather, it is kept by the fraudster.

Moreover, utilizing Cash App to launder money has increased dramatically during the COVID-19 pandemic.[7] After illegally obtaining funds dedicated toward COVID-19 relief, criminals are laundering this money through Cash App’s P2P payments service. These criminals attempt to spread the money across multiple accounts in order to hide the money’s origin. One such individual, Fontrell Baines, stole 1.2 million dollars in Pandemic Unemployment Assistance benefits and moved a portion of these funds to a Cash App account through P2P payment transfers, making it difficult for law enforcement to trace the origin of the money.

Additionally, fraudsters have made use of Cash App allowing transactions to take place in Bitcoin.[42] Since Bitcoin can be sent to anonymous addresses, its movement is difficult to track. Fraudsters, as a result, use Bitcoin to relocate illicit gains.

Drug dealing

Since P2P payment transfers are done incredibly quickly on Cash App, money can be moved throughout the app and taken off the app rapidly.[7] Consequently, drug dealers have taken advantage of using Cash App to conduct their business.[48][49][50] In October 2019, a man was arrested after investigators found him selling narcotics to inmates at numerous prisons.[48] The man and the inmates used Cash App for payments. Similarly, in June 2021, sixty drug dealers were charged as part of an international methamphetamine distribution network.[49] Cash App was used to transfer proceeds from drug deals back to the leaders of the network. Additionally, in January 2022, two individuals were taken into custody after conspiring to sell a significant amount of fentanyl.[50] Police found the two to be making “continuous and constant” transactions on Cash App.

Third-party data sharing

According to Cash App representatives, their third-party data sharing policy is as follows: “Cash App sometimes use [sic] third-party services to analyze anonymous data about app usage to help us fix bugs, identify app crashes, understand marketing campaigns, and improve the customer experience. These services are common in the industry and we choose products that are designed with customer privacy in mind.”[6] Nevertheless, concerns regarding this policy remain, particularly with third-party data sharing that takes place as part of Cash App’s marketing campaigns. After Cash App concludes a marketing campaign, it determines whether or not the campaign was successful in gaining new users by sending user data to third parties. Some worry about this policy because Cash App sends data of all users, not just new users who were gained from the marketing campaign.

See also

References

- ↑ 1.0 1.1 1.2 Hale, K. (2020, September 22). Hip-hop's role in Square's $40 billion Cash App business success. Forbes. Retrieved January 24, 2022, from https://www.forbes.com/sites/korihale/2020/09/22/hip-hops-role-in-squares-40-billion-cash-app-business-success

- ↑ 2.0 2.1 Cash App. (n.d.). The easiest way to send, spend, bank, and invest. Cash App. Retrieved January 25, 2022, from https://cash.app

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 3.7 Graham, J. (2020, March 26). PayPal, Venmo, Apple Pay, Google and Facebook: rating the mobile payment apps. USA Today. Retrieved January 24, 2022, from https://www.usatoday.com/story/tech/2020/03/25/rating-paypal-venmo-apple-cash-facebook-google-zelle/5005537002

- ↑ 4.0 4.1 Cash App. (n.d.). International payments. Cash App. Retrieved February 9, 2022, from https://cash.app/help/us/en-us/3056-sent-payments-international

- ↑ 5.0 5.1 5.2 Levy, A. (2021, September 20). Don't look now: Square's Cash App is almost as big as Venmo. Nasdaq. Retrieved January 24, 2022, from https://www.nasdaq.com/articles/dont-look-now%3A-squares-cash-app-is-almost-as-big-as-venmo-2021-09-20

- ↑ 6.0 6.1 Graham, J. (2020, March 29). Apps like Venmo, Cash and PayPal are free, but here's who they are telling your business. USA Today. Retrieved January 24, 2022, from https://www.usatoday.com/story/tech/2020/03/25/how-private-is-your-paypal-venmo-cash-app-mobile-pay-data/5002726002

- ↑ 7.00 7.01 7.02 7.03 7.04 7.05 7.06 7.07 7.08 7.09 7.10 Zamost, S., Tausche, K., & Hernandez, K. (2020, November 18). Criminals launder coronavirus relief money, exploit victims through popular apps. CNBC. Retrieved January 25, 2022, from https://www.cnbc.com/2020/11/18/criminals-launder-coronavirus-relief-money-exploit-victims-through-popular-apps.html

- ↑ 8.0 8.1 Salinas, S. (2017, November 16). Square Cash users can now withdraw money from any ATM with their Cash Cards. CNBC. Retrieved January 24, 2022, from https://www.cnbc.com/2017/11/16/square-cash-atm-withdrawal-enabled-for-cash-app-users.html

- ↑ Rooney, K. (2019, October 24). Square launches stock trading on its popular Cash App. CNBC. Retrieved February 10, 2022, from https://www.cnbc.com/2019/10/24/square-launches-stock-trading-on-its-popular-cash-app.html

- ↑ 10.0 10.1 10.2 Hale, K. (2020, December 18). Hip-hop helps Cash App disrupt the $450 billion charity space. Forbes. Retrieved January 25, 2022, from https://www.forbes.com/sites/korihale/2020/12/17/hip-hop-helps-cash-app-disrupt-the-450-billion-charity-space/?sh=74abe9ef6844

- ↑ 11.0 11.1 11.2 Cash App. (n.d.). What is a $Cashtag?. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/3123-cashtags

- ↑ Cash App. (n.d.). Change your $Cashtag. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/3132-cashtags

- ↑ 13.0 13.1 Cash App. (n.d.). Press Images & Contact. Cash App. Retrieved February 10, 2022, from https://cash.app/press

- ↑ 14.0 14.1 14.2 Cash App. (n.d.). Supported cards with Cash App. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/5588-supported-cards

- ↑ 15.0 15.1 15.2 15.3 15.4 15.5 Bessette, C. (2021, February 26). Cash App money transfer: what it is, how to use It. NerdWallet. Retrieved January 25, 2022, from https://www.nerdwallet.com/article/banking/cash-app-review

- ↑ Cash App. (n.d.). Sending a payment. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/1105-sending-a-payment

- ↑ Cash App. (n.d.). Receiving a payment. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/1111-receiving-a-payment

- ↑ 18.0 18.1 Cash App. (n.d.). Cash out speed options. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/3073-cash-out-speed-options

- ↑ 19.0 19.1 19.2 Fitzsimons, T. (2022, January 19). Venmo, PayPal and Zelle must report $600+ in transactions to IRS. NBCNews.com. Retrieved January 26, 2022, from https://www.nbcnews.com/news/venmo-paypal-zelle-must-report-600-transactions-irs-rcna11260

- ↑ 20.0 20.1 Cash App. (n.d.). Tax reporting with Cash for Business. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/5641-tax-reporting-with-cash-for-business

- ↑ Square. (n.d.). Square tax reporting and Form 1099-K overview. Square. Retrieved January 25, 2022, from https://squareup.com/help/us/en/article/5048-1099-k-overview

- ↑ 22.0 22.1 Cash App. (n.d.). Order Cash Card. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/3080-cash-card-get-started

- ↑ Cash App. (n.d.). Cash App prepaid card program agreement. Cash App. Retrieved January 25, 2022, from https://cash.app/legal/us/en-us/card-agreement

- ↑ Cash App. (n.d.). Direct deposit. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/1113-direct-deposit

- ↑ 25.0 25.1 Cash App. (n.d.). Investing. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/5000-investing

- ↑ Cash App. (n.d.). Supported stocks. Cash App. Retrieved January 25, 2022, from https://cash.app/help/us/en-us/50131-supported-stocks

- ↑ Cash App. (n.d.). My first bitcoin and the legend of Satoshi Nakamoto. Cash App. Retrieved January 25, 2022, from https://cash.app/bitcoin

- ↑ Venmo. (n.d.). Fast, safe, social payments. Venmo. Retrieved February 9, 2022, from https://venmo.com

- ↑ Venmo. (n.d.). The fun and easy way to send, spend, and receive money. Venmo. Retrieved February 9, 2022, from https://venmo.com/about/fees

- ↑ O'Halloran, S. (2021, April 20). Cryptos now part of Venmo's offerings. Fox Business. Retrieved February 9, 2022, from https://www.foxbusiness.com/markets/venmo-joins-paypal-in-crypto-offerings

- ↑ 31.0 31.1 31.2 Egan, J., & Foreman, D. (2021, December 7). Zelle vs. Venmo: which to use and when. Forbes. Retrieved February 9, 2022, from https://www.forbes.com/advisor/banking/zelle-vs-venmo

- ↑ O'Halloran, S. (2021, April 20). Cryptos now part of Venmo's offerings. Fox Business. Retrieved February 9, 2022, from https://www.foxbusiness.com/markets/venmo-joins-paypal-in-crypto-offerings

- ↑ 33.0 33.1 Cortez, J. (2021, November 4). How to send and receive money using Venmo. Time. Retrieved February 9, 2022, from https://time.com/nextadvisor/credit-cards/venmo-guide

- ↑ 34.0 34.1 34.2 34.3 Gran, B., & Strohm, M. (2021, November 15). Venmo vs. PayPal: which to use and when. Forbes. Retrieved February 9, 2022, from https://www.forbes.com/advisor/banking/venmo-vs-paypal

- ↑ PayPal. (n.d.). Buy, sell, and hold crypto with confidence. PayPal. Retrieved February 9, 2022, from https://www.paypal.com/us/digital-wallet/manage-money/crypto

- ↑ PayPal. (n.d.). Get the PayPal Cash Card today. PayPal. Retrieved February 9, 2022, from https://www.paypal.com/us/digital-wallet/manage-money/paypal-debit-card

- ↑ Bessette, C. (2021, April 1). Top peer-to-peer payment apps: pros, cons and how to use them. NerdWallet. Retrieved February 9, 2022, from https://www.nerdwallet.com/article/banking/peer-to-peer-p2p-money-transfers

- ↑ PayPal. (n.d.). Buy now, pay over time with PayPal Credit. PayPal. Retrieved February 9, 2022, from https://www.paypal.com/us/webapps/mpp/paypal-credit-signin

- ↑ Zelle. (n.d.). Does Zelle report how much money I receive to the IRS?. Zelle. Retrieved February 9, 2022, from https://www.zellepay.com/faq/does-zelle-report-how-much-money-i-receive-irs

- ↑ Zelle. (n.d.). Get started with Zelle. Zelle. Retrieved February 9, 2022, from https://www.zellepay.com/get-started

- ↑ 41.0 41.1 41.2 Apple. (n.d.). Apple Cash. Apple. Retrieved February 9, 2022, from https://www.paypal.com/us/webapps/mpp/paypal-credit-signin

- ↑ 42.00 42.01 42.02 42.03 42.04 42.05 42.06 42.07 42.08 42.09 42.10 42.11 42.12 Popper, N. (2020, October 11). When your last $166 vanishes: 'fast fraud' surges on payment apps. The New York Times. Retrieved February 8, 2022, from https://www.nytimes.com/2020/10/11/technology/fraud-payment-apps.html

- ↑ 43.0 43.1 43.2 43.3 43.4 Fraud. (2021, June 1). Cash App scams on the rise. Fraud.org. Retrieved February 8, 2022, from https://fraud.org/cash_app_alert

- ↑ 44.0 44.1 44.2 Cash App. (n.d.). Security. Cash App. Retrieved February 9, 2022, from https://cash.app/security

- ↑ 45.0 45.1 Cash App. (n.d.). Keep your account safe on Cash App. Cash App. Retrieved February 9, 2022, from https://cash.app/help/us/en-us/3127-keeping-your-cash-app-secure

- ↑ Oberg, T., & Rafique, S. (2020, November 24). Cash App complaints on the rise as scams pose as customer service. ABC 13 Houston. Retrieved February 8, 2022, from https://abc13.com/cash-app-customer-service-complaints-phone-number-people-posing-as/8174650

- ↑ Suffolk Federal Credit Union. (2021, May 24). Cash App fraud. Suffolk Federal Credit Union. Retrieved February 8, 2022, from https://www.suffolkfcu.org/about-us/security-center/cash-app-fraud

- ↑ 48.0 48.1 Price, C. (2019, October 23). Warrant: Durham Man had a 'sophisticated system of smuggling narcotics into various prisons'. CBS 17. Retrieved February 8, 2022, from https://www.cbs17.com/news/warrant-durham-man-had-a-sophisticated-system-of-smuggling-narcotics-into-various-prisons

- ↑ 49.0 49.1 United States Department of Justice. (2021, June 29). Sixty defendants charged in nationwide takedown of Sinaloa Cartel methamphetamine network. United States Department of Justice. Retrieved February 8, 2022, from https://www.justice.gov/usao-sdca/pr/sixty-defendants-charged-nationwide-takedown-sinaloa-cartel-methamphetamine-network

- ↑ 50.0 50.1 Craven, E. (2022, January 25). Pair accused of conspiring to deliver fentanyl in Bismarck. KFYR TV. Retrieved February 8, 2022, from https://www.kfyrtv.com/2022/01/25/pair-accused-conspiring-deliver-fentanyl-bismarck