Difference between revisions of "Bitcoins"

(→Energy Consumption) |

|||

| Line 1: | Line 1: | ||

[[File:Bitcoin header.PNG|thumbnail|right|Bitcoin Visualization]] | [[File:Bitcoin header.PNG|thumbnail|right|Bitcoin Visualization]] | ||

| − | + | '''Bitcoin''' is a type of digital cryptocurrency that allows transaction between entities with minimal trace and no intermediaries. While many other forms of cryptocurrency exist, bitcoin is the first cryptocurrency ever introduced. Oftentimes many parallel forms of cryptocurrency that are available today tend to be based on the principles laid out by bitcoin, however there are numerous subtleties that may differentiate one cryptocurrency from the other. Bitcoin is created through a process called "mining" and is capped at a total quanitity of 22 million bitcoins. <ref>"Here's a Simple, 60-second primer on Bitcoin" https://www.washingtonpost.com/news/wonk/wp/2013/04/03/heres-a-simple-60-second-primer-on-bitcoin/?noredirect=on&utm_term=.f516fd994ffb</ref>Bitcoin is known for the invention of blockchain technology to safeguard the validity of its transaction. Blockchain technologies utilize complex algorithms to fend off hacking by having millions of copies stored in each bitcoin miner’s computer so that when a block is tampered with, it can be identified and discredited. <ref name="Berkeley">"Blockchain Technology: Beyond Bitcoin" https://scet.berkeley.edu/wp-content/uploads/BlockchainPaper.pdf</ref> | |

Bitcoin is an open source software created by someone or some group known only as Satoshi Nakamoto with an unknown motive. Due to Bitcoin's digital nature and unknown creator, it is not currently regulated by any central bank. | Bitcoin is an open source software created by someone or some group known only as Satoshi Nakamoto with an unknown motive. Due to Bitcoin's digital nature and unknown creator, it is not currently regulated by any central bank. | ||

Despite Bitcoin’s anonymity and security, it receives frequent criticism for being utilized for illegal transactions. Its lack of regulation means it is extremely volatile and prone to inflation in the sense that the creation of an economic bubble is sure to follow.<ref>"More Nobel Prize Winners Snub Bitcoin"https://finance.yahoo.com/news/good-drug-dealers-nobel-prize-winners-snub-bitcoin-184903784.html</ref> | Despite Bitcoin’s anonymity and security, it receives frequent criticism for being utilized for illegal transactions. Its lack of regulation means it is extremely volatile and prone to inflation in the sense that the creation of an economic bubble is sure to follow.<ref>"More Nobel Prize Winners Snub Bitcoin"https://finance.yahoo.com/news/good-drug-dealers-nobel-prize-winners-snub-bitcoin-184903784.html</ref> | ||

Revision as of 13:42, 14 April 2019

Bitcoin is a type of digital cryptocurrency that allows transaction between entities with minimal trace and no intermediaries. While many other forms of cryptocurrency exist, bitcoin is the first cryptocurrency ever introduced. Oftentimes many parallel forms of cryptocurrency that are available today tend to be based on the principles laid out by bitcoin, however there are numerous subtleties that may differentiate one cryptocurrency from the other. Bitcoin is created through a process called "mining" and is capped at a total quanitity of 22 million bitcoins. [1]Bitcoin is known for the invention of blockchain technology to safeguard the validity of its transaction. Blockchain technologies utilize complex algorithms to fend off hacking by having millions of copies stored in each bitcoin miner’s computer so that when a block is tampered with, it can be identified and discredited. [2] Bitcoin is an open source software created by someone or some group known only as Satoshi Nakamoto with an unknown motive. Due to Bitcoin's digital nature and unknown creator, it is not currently regulated by any central bank. Despite Bitcoin’s anonymity and security, it receives frequent criticism for being utilized for illegal transactions. Its lack of regulation means it is extremely volatile and prone to inflation in the sense that the creation of an economic bubble is sure to follow.[3]

Contents

History

Creation

Although there are theories circulating about bitcoin being created as a means of a Ponzi scheme, it is believed an anonymous individual with the pseudonym, Satoshi Nakamoto created bitcoin to fight against the flaws of the established centralized banking system. [4]Soon after the Lehman Brothers in 2008, the domain bitcoin.org was registered and Satoshi Nakamoto published a paper called "Electronic Cash System" explaining how cryptocurrency can be functional alternative form of currency. On January 3rd, 2009 the genesis block was created with the hidden message of “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” It is the first block of the bitcoin’s blockchain. [5][6]Bitcoin is unique because of the fact that Satoshi Nakamoto created it as an open source project. This means that anyone has the ability to see the code behind the blockchain technology that sets the foundation for bitcoin. They also have the ability to copy that code and expand upon it in order to improve its functionality. Therefore, after the creation of bitcoin, Satoshi Nakamoto encouraged other cryptographers to improve the bitcoin's source code. On April 23rd, a statement was released by Satoshi Nakamoto announcing his departure from the digital currency. It read, "I've moved on to other things."[7] There has been no reported activity of Satoshi Nakamoto since.

Usage

The first recorded transaction using bitcoin was when programmer Laszlo Hanyecz offered 10,000 bitcoins for a pizza. A British man took the offer and ordered a pizza to Laszlo’s Florida residence. [8]In 2011 Ross Ulbricht founded Silk Road, an online dark-web marketplace with a cash flow of at least 213 million dollars.[9] Initially, his intention was to empower consumer and producer privacy, so he made bitcoin the only form of transaction allowed on the website. The fact that bitcoin is an internet currency means that it cannot be traced, allowing Ulbricht to accomplish what he set out to do. However, the anonymity also made it a perfect platform for trading illegal items such as drugs and fake IDs. [10]

Evaluation

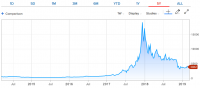

When Bitcoin was first created, Bitcoin was evaluated to $0.30 per coin. However, as it became an acceptable form of payment in more locations and as more methods of liquidating bitcoin to cash emerged, its value began to skyrocket. [4]The biggest jump of bitcoin's value occurred in 2017, when Bitcoin had 58% of the cryptocurrency market share, and had a market capitalization upwards of 124 Billion dollars, whereby the price started at $998 per coin in 2017 and rose to all-time high of $19,666 per coin on December 17th, 2017.[11][12] Transactions using Bitcoin were exceeding 4.1 Billion daily whereas Ethereum, Bitcoin’s top competitor, had daily transactions of 0.7 Billion. Bitcoin’s major advantage of having lower transaction costs, “making credit cards a little more than 5.5 times more costly” to use in transaction, and substantially faster verification speeds limiting fraudulent double spending was a main factor in Bitcoin’s success in the beginning.[12] Soon after, the bubble popped and bitcoin's value dropped back down to $3845 per coin.

Design

Blockchain

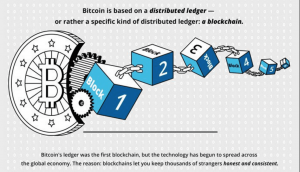

Bitcoin is one of the first advocates of using blockchain as a means of protecting its information from potential hackers looking to get monetary gains by manipulating its data. [13]The idea of blockchain was first conceptualized at 1991 by W. Scott Stornetta, and it is essentially a linked list of blocks where the blocks are linked by storing the hash of the previous block. [14]It is a distributed ledger anyone can access, and once a block is created it is essentially immutable. [2]In addition to hash of previous block, each block contains transaction record and hash of the block. A hash is best understood as a fingerprint that identifies each block and is always unique.[15]

Security

One of the fundamental protection mechanisms of a blockchain is its unique alphanumeric hash value, calculated using the SHA-256 function using the information within the block. [16]Meaning if the transaction data within the block is to be changed, its hash value will have to change causing a discrepancy between said block and the block in front of it and it can’t be fixed unless all the hash values of every block in front of said block is changed. [17]Using the SHA-256 function each block has what’s known as proof of work because it takes a lot of computational time to calculate the hash values, making it infeasible to edit every block in a blockchain. [18]In addition, using the fact that it is publicly accessible the blockchain utilizes peer-to-peer network as its second line of defense in which every miner known as node has a copy of the block chain. As a result, when a new block is added, it is verified by the peer-to-peer network and needs to be approved by more than 50% of the network to be accepted. As a result, to tamper the block chain one would need to tamper almost every block on 50% of the network. [16]

Mining

Each person mines bitcoin by being a node for the peer-to-peer network of the blockchain of bitcoins. Moreover, the miners computers are used to do the calculation for proof-of-work for new blocks, by running the bitcoin’s software. [19]Since the function to calculate such proof-of-work requires lots of computational power, it causes huge electricity consumption. [20]Add that to the fact that the more nodes there are in a peer-to-peer network the more secure bitcoin is, miners are rewarded with bitcoins for their work. The implication of this reality is that, unlike the majority of contemporary currencies including the US dollar, the quantity of Bitcoins isn't controlled by a regulatory body. The number of Bitcoins in circulation depends entirely on the rate at which they're being mined.

Ethical Implications

Illegal Transactions

Due to the anonymous nature of bitcoin, it is used by many as a means of doing illegal transactions without leaving any trace behind. This means the police cannot build a case against neither the seller nor the buyer because technically bitcoins are not owned by any one entity and without digital footprint it’s impossible to prove ownership. Most notable example of such exploitation is the Silk Road founded by Ross Ulbricht where drug dealers sell drugs indiscriminately to anyone with access to internet. [9]Moreover, sites like idgod and fakeidvenders sells custom made fake ids through transaction using bitcoins. [21]The US government even claim that Russian hackers used bitcoins to fund their interference of US election without trace. [22]For the same reason bitcoin is good for trafficking illegal goods, it is also good for money laundering as it provides means of moving large amount of cash discretely. [23]

Energy Consumption

In order for bitcoin to be secure it needs to make sure every block have proof-of-work that requires enough computational power so that it is infeasible for potential hackers to tamper the transactions through brute force[2]It also requires lots of nodes in the peer-to-peer network to ensure fidelity when new blocks are added.[17]. In order to exert this much computation power and store this much data, a lot of energy is consumed by each bitcoin miner. In fact, by the end of 2017 it is estimated that bitcoin mining operation has combined to use between 1 to 4 gigawatt of energy, so its security and privacy is not without a high cost. [24]. Ron Eglash has studied the ways current technology has been developed in ways that harm society, and one can see that Bitcoin could fall under the same category[25]. If mining Bitcoin takes such a tremendous amount of energy, and this energy process is vital to the expansion and use of Bitcoin, then it follows to assume that Bitcoin's energy impact on the world is producing negative effects on society. A cryptocurrency which does not take so many resources to maintain might be a possible solution, but the current Bitcoin implementation relies on this design to survive. It offers a unique debate between the maintenance of the world's most popular cryptocurrency and the number of resources it costs, which future cryptocurrencies and Bitcoin must attempt to manage in their design.

Transparency and Security

The introduction of Bitcoins as a mainstream currency has raised ethical questions regarding the amount of transparency that Bitcoins transaction employ being a pseudonymous currency. It is important to note that despite popular beliefs, Bitcoin is not an anonymous currency, as the ledger is public information and personal details can be tied back to a Bitcoin address through a transaction [26]. Luciano Floridi and Matteo Turilli's work "The ethics of information transparency" gives a lens with which to examine the ethical implications of Bitcoin's transparent information[27]. Transparency is linked to ethical principles when the information involved is in a regulatory or dependent relationship with said ethical principles. When applied to Bitcoin we can see that these regulatory principles are very much anonymity and privacy, as Bitcoin's implementation prevents immediate personal details from being revealed at all times. In practice, Bitcoin's privacy and anonymity methods are so well implemented that criminals typically use it as the means of illegal transactions. Yet this raises yet another ethical dilemma as if the enabling of illegal transactions and platforms, such as the Silk Road, creates a dichotomy between a secure and private currency system being used for nefarious means. In terms of the dependent ethical principles Bitcoin achieves with its transparency, one can see that the openness of the implementation of the blockchain offers a very secure view of how and why Bitcoin works. This transparency is central to Kerchoff's principle for a cryptographic system. There are no central figures or corporations controlling Bitcoin, and miners contribute to the currency just from the cost of their computation machines. Compared to other currencies and financial institutions, one can even see that this transparency of this system is far more secure and accountable with the absence of a centralized and self-interested authority.

Virtual Trust

While much of the value of Bitcoin rests on the market availability of the currency, much of the integrity that supports the infrastructure for Bitcoin to function rests on principles of virtual trust. [28] Exchanges involving bitcoin often depend on implicit agreements between multiple parties, and the integrity of these transactions is ensured by the community of users who trust in Bitcoin to remain secure. The Bitcoin community shares characteristics with attributes one would find among "task groups" such as social cuing and reputation.

References

- ↑ "Here's a Simple, 60-second primer on Bitcoin" https://www.washingtonpost.com/news/wonk/wp/2013/04/03/heres-a-simple-60-second-primer-on-bitcoin/?noredirect=on&utm_term=.f516fd994ffb

- ↑ 2.0 2.1 2.2 "Blockchain Technology: Beyond Bitcoin" https://scet.berkeley.edu/wp-content/uploads/BlockchainPaper.pdf

- ↑ "More Nobel Prize Winners Snub Bitcoin"https://finance.yahoo.com/news/good-drug-dealers-nobel-prize-winners-snub-bitcoin-184903784.html

- ↑ 4.0 4.1 "The Cryptocurrency" https://www.newyorker.com/magazine/2011/10/10/the-crypto-currency

- ↑ "Genesis Block"https://www.blockchain.com/btc/block/000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f

- ↑ "Simple Decryption of Satoshi Nakamoto’s Hidden Message in the Blockchain" https://medium.com/splytcore/simple-decryption-of-satoshi-nakamotos-hidden-message-in-the-blockchain-42b5fe9b3c72

- ↑ "Everything you need to know about Bitcoin, its mysterious origins, and the many alleged identities of its creator" https://www.businessinsider.com/bitcoin-history-cryptocurrency-satoshi-nakamoto-2017-12

- ↑ "First Recorded Bitcoin Transaction"https://www.investopedia.com/news/bitcoin-pizza-day-celebrating-20-million-pizza-order/

- ↑ 9.0 9.1 "Silk Road: A Cautionary Tale about Online Anonymity" https://medium.com/@marcell74/the-silk-road-a-real-thriller-and-the-truth-about-the-anonymity-of-bitcoin-198b519ca397

- ↑ "The Feds Just Collected $48 Million from Seized Bitcoins" http://fortune.com/2017/10/02/bitcoin-sale-silk-road/

- ↑ "Bitcoin Evaluation" https://www.cnbc.com/quotes/?symbol=BTC=

- ↑ 12.0 12.1 Dumitrescu, George Cornel. “Bitcoin – A Brief Analysis of the Advantages and Disadvantages.” Global Economic Observer, vol. 5, no. 2, 2017, pp. 63–67. Business Source Elite [EBSCO].

- ↑ "A Survey of Blockchain Security Issues and Challenges" https://pdfs.semanticscholar.org/f61e/db500c023c4c4ef665bd7ed2423170773340.pdf

- ↑ "How to Time-Stamp a Digital Document" https://www.anf.es/pdf/Haber_Stornetta.pdf

- ↑ "Bitcoin:A Peer-to-Peer Electronic Cash System" https://s3.amazonaws.com/academia.edu.documents/54517945/Bitcoin_paper_Original_2.pdf?AWSAccessKeyId=AKIAIWOWYYGZ2Y53UL3A&Expires=1552612583&Signature=zhmIP4Hmet5GfsgPTpUzyCPzTw8%3D&response-content-disposition=inline%3B%20filename%3DBitcoin_A_Peer-to-Peer_Electronic_Cash_S.pdf

- ↑ 16.0 16.1 "Bitcoin and Blockchain Security" http://zran.org/wp-content/uploads/2018/07/Bitcoin-and-Blockchain-Security-2017-Artech.pdf

- ↑ 17.0 17.1 "Decentralizing Privacy: Using Blockchain to Protect Personal Data" https://ieeexplore.ieee.org/abstract/document/7163223

- ↑ "Security Analysis of SHA-256 and Sisters" https://link.springer.com/chapter/10.1007/978-3-540-24654-1_13

- ↑ "The Economics of Bitcoin Mining or, Bitcoin in the Presence of Adversaries" https://pdfs.semanticscholar.org/c55a/6c95b869938b817ed3fe3ea482bc65a7206b.pdf

- ↑ "Bitcoin Mining and its Energy Footprint" https://digital-library.theiet.org/content/conferences/10.1049/cp.2014.0699

- ↑ "Bitcoins Worth $4.7 Million Seized in Fake ID Case" http://fortune.com/2018/02/09/bitcoin-seized-fake-id-case/

- ↑ "How Russian Spies Hid Behind Bitcoin in Hacking Campaign" https://www.nytimes.com/2018/07/13/technology/bitcoin-russian-hacking.html

- ↑ "Nobel-winning economist: Authorities will bring down 'hammer' on bitcoin" https://www.cnbc.com/2018/07/09/nobel-prize-winning-economist-joseph-stiglitz-criticizes-bitcoin.html

- ↑ "Why the bitcoin craze is using up so much energy" https://www.washingtonpost.com/news/energy-environment/wp/2017/12/19/why-the-bitcoin-craze-is-using-up-so-much-energy/?noredirect=on&utm_term=.ff7d8278d8f1

- ↑ Eglash, Ron. (2018). A Generative Perspective on Engineering: Why the Destructive Force of Artifacts Is Immune to Politics: Interplay between Engineering, Social Sciences, and Innovation. 10.1007/978-3-319-91134-2_9.

- ↑ “Some Things You Need to Know.” Bitcoin, bitcoin.org/en/you-need-to-know.

- ↑ Turilli, Matteo, and Luciano Floridi. “The Ethics of Information Transparency.” SpringerLink, Springer Netherlands, 10 Mar. 2009, link.springer.com/article/10.1007/s10676-009-9187-9.

- ↑ De Laat, Paul B. "Trusting virtual trust." Ethics and Information technology 7.3 (2005): 167-180.