Blockchain

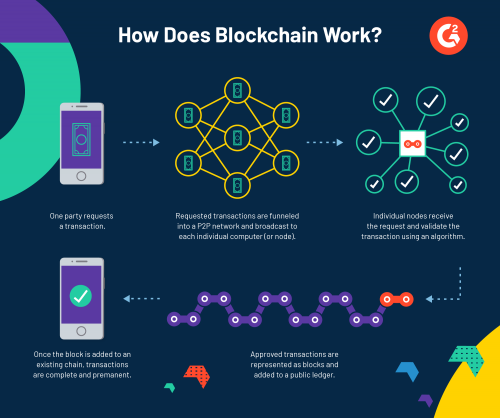

A blockchain is a distributed ledger that can be used to record transactions in a transparent, immutable, and verifiable way. Blockchains function as decentralized databases, but instead of storing data in a centralized server, a blockchain establishes a block organization protocol allowing any participant to append information to the temporally consistent chain of blocks, which can be secured by a variety of mechanisms. Each block stores the applicable data, a reference to the previous block, and a timestamp. A new block is appended to the previous block, and this linearly builds the “blockchain.”[1]

Blockchain was first widely introduced to the world in 2008 when a mysterious figure or group of figures under the pseudonym of named Satoshi Nakamoto, whose identity is still unknown, published a whitepaper Bitcoin: A Peer-to-Peer Electronic Cash System.[2] Bitcoin was then released to the open-source community in 2009. Although blockchain made its technological debut with Bitcoin, it’s applicable to many fields beyond just cryptocurrency.[3] The properties that blockchain provides makes it a valuable option whenever transparency, verifiability, and immutability are beneficial, and in the last decade the use cases of blockchain have grown quickly. Considering the last two decades of unfettered techno-corporate growth and a growing distrust in financial institutions and their mechanisms, the case for a new system of transparency has never seemed better.

Implementation

A blockchain is built on the existing technological foundations of private key cryptography and distributed systems.[4] These help resolve two of the fundamental problems of any secure system: authentication and authorization. A user’s private key and the cryptographic public key combine to create a digital signature that can be used for ownership and authentication. For authorization, a peer-to-peer distributed network of node computers is used to approve transactions and add to the blockchain.[4] This network of distributed nodes hosting the blockchain itself undertakes a procedure to determine consensus of the transactions that have occurred each time a new bock is to be added onto the blockchain. There are different means of consensus, the most well-known being Proof of Work (PoW) wherein nodes ‘mine’ away at an algorithm to compete for which nodes can add the transactions to the blockchain, along the way earning the native token – Bitcoin runs with Proof of Work[1]. Other consensus mechanisms include Proof of Stake, Proof of Capacity, Proof of Identity, and a whole host of others[5] specific to the particular purposes of that blockchain system.

Decentralization

Instead of one company or group owning and controlling the computers that stores the data, blockchain uses a decentralized approach. A blockchain ledger is stored on thousands of computers around the globe that are operated by different groups and individuals. These computers act as nodes, and together they form a peer-to-peer network that is able to moderate and authorize transactions on the blockchain without one person having the ultimate say.[1]

This large network of different actors lends trust to the information that is stored in a blockchain. A blockchain allows you to see all of the different transactions by tracing from each block to the previous block until the root block is reached. Once a block is added to the chain, it is not allowed to be modified. In order to change the transaction within that block, another block must be appended to the chain. [4]

A distributed network prevents one bad actor or node outage from destroying the validity of the whole chain. If one node has different information than the other nodes, it can use the other nodes as a reference to correct it information. This creates where chains that different from those held by the majority are cast away and determined to be illegitimate.[1]

Limitations and Alternatives

In progress by William Babbitt

Use Cases

Although the linked list technology behind blockchain is no longer novel, having gained popularity as the core driver behind cryptocurrency with the introduction of Bitcoin in 2008, its application as a transparent and immutable ledger in other fields is still limited.[2] Potential solutions utilizing blockchain technology exist for many areas such as the Internet of Things (IoT), energy, finance, healthcare, and government.[3]

Cryptocurrency

Most cryptocurrency systems are built on blockchain. Bitcoin, the first platform built on blockchain in 2009 and the most popular cryptocurrency, recently reached a market cap of 1 trillion dollars. All forms of cryptocurrencies combined have a market cap of 1.7 trillion. One bitcoin currently costs over $50,000.[6]

Decentralized Finance: DeFi

Decentralized Finance, or DeFi, has been championed by those in the developer space as one of the ‘killer-application’ for banking[9] in a new decentralized system of finance. Decentralized finance as a whole is a developing ecosystem of financial applications which are inherently decentralized because they run on a blockchain. These tools give those who are unbanked or living in unstable financial conditions a means of making their money work for them with the prowess of any other high-brow financial institution of old, so long as they have a computer with internet access. Some examples of the kinds of tools available currently include stablecoins, lending and borrowing, decentralized exchanges, and (though still very early) insurance mechanisms.

Non-Fungible Tokens

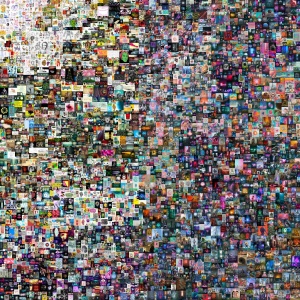

Non-fungible tokens, abbreviated as NFTs, are one-of-a-kind units of currency first attempted with Bitcoin 'color coins'[10], the concept later growing in popularity on ETH with CryptoKitties. No two NFTs are the same, even on the same platform, and being “non-fungible” means they cannot be exchanged for something else of equal value, like a bitcoin for a bitcoin or a dollar for a dollar.[11] NFTs have been applied to a wide range of objects like artwork, trading cards, and music. In purchasing an NFT, you’re purchasing something that is guaranteed to be authentic. Physical art can be forged, luxury designers can be knocked-off, but NFTs will always have a clear origin and owner.

Digital Art

NFT art is increasingly becoming more popular and mainstream. The artist Grimes recently sold 6 million dollars worth of art that included images and videos set to music.[12] The famous auction house Christie’s just offered their first piece of purely digital art for sale by the popular digital artist Beeple, titled Everydays: The First 5000 Days.[13] The piece sold for 69 million dollars.[14]

Digital Collectibles

Collectible items that used to be physical property are continuing to go digital. NBA Top Shot, which is backed by the NBA itself, allows users to acquire digital trading cards that are produced in limited numbers and are dropped in packs.[15] Due to the artificial scarcity of some of the cards and the fact that they are verifiable by being NFTs, cards hold value and can often quickly and easily sell for more than they were purchased for. One card of Lebron James dunking sold for $208,000.[15]

Identity Management

Since blockchain technology can facilitate accountability through the consistent and distributed storage of information, another practical application of the technology is identity management.[16] Because trust is not required, blockchain protocols offer a decentralized environment without third-party authority, which traditionally has access to or control of the data. Contemporary identity authentication systems afford users the convenience of carrying their personal data or credentials on their mobile devices or hardware tokens, which can then be validated against the data stored on a trusted blockchain service.[17]

Access and control is achieved using blockchain-issued cryptographic credentials and the use of a '’show and present protocol such as the Attribute Based Credential (ABC), which does not require revealing personal data, and instead enables the validation of ownership for credentials associated with the data, often referred to as a zero-knowledge proof.[17]

Medical Records Management

The healthcare industry is regulated by rigid legal and security requirements due to the private nature of consumer healthcare data. Despite the proliferation of cloud computing and distributed systems, many Electronic Health Record (EHR) systems still rely on a centralized approach to storing the data.[18] Blockchain technology has the potential to change this by shifting the management of medical records away from established centralized models, where healthcare networks manage patient data and exercise control over it, to one offering individuals control over their healthcare data and promoting increased privacy, accountability and trust.[18]

Regulatory Attempts

Many countries are currently discussing how to regulate the blockchain industry. Two of the significant questions that surround regulation are “Who should regulate?” and “How should it be regulated?"[19] The United States, the second largest market for cryptocurrencies, is one of the actors that is trying resolve the ambiguity regarding the categorization of blockchain legislatively and financially. The Securities and Exchange Commission (SEC) categorizes cryptocurrencies as a marketable security, whereas The Commodity Futures Trading Commission (CFTC) classifies cryptocurrencies as a commodity. [20] While the legal framework for blockchain has not yet been determined by most countries, some have started to build an applicable framework. As of March 19th, 2021, Switzerland, Singapore, Japan and South Korea have recognized Bitcoin as a legal tender and exchanges on a blockchain to be legal. However, certain countries like China and United Kingdom do not view Bitcoin or other cryptocurrencies as legal tender.[20] In the absence of a consensus regarding the legal framework for cryptocurrencies, it is unclear how cross-border exchanges, transactions in which one party of the transaction does not recognize cryptocurrencies as legal whereas the other party fully acknowledges the legality, will take place.

Ethical Considerations

Blockchain was created to solve many of the issues that come with the consolidation of power in centralized technology. However, as a relatively new but quickly booming technology, the ethical implications associated with blockchain remains unclear.

Energy Usage

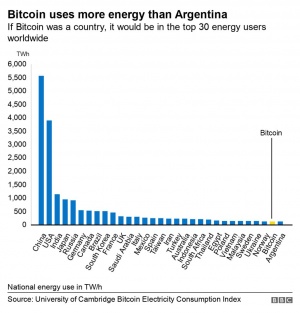

Proof of Work blockchain systems, like Bitcoin, have been set up is incredibly energy dependent. Blocks are added to the bitcoin ledger through a process called mining, and the computer that mines the bitcoin is rewarded. As this mining can generate lots of revenue, thousands of computers across the globe are constantly running energy-intensive machines in an attempt to mine. Most of these computers are getting their energy from networks that heavily rely on fossil fuels. Due to all of these energy-dependent computational systems, bitcoin alone has a carbon footprint equal to that of New Zealand and uses more electrical energy than Argentina.[21][22] The energy that is required to verify transactions makes blockchain a less environmentally friendly option than traditional methods. However, as blockchains become institutionally usable, and new methods of consensus are created, these costs will drop dramatically. For example, switching from Proof of Work (like Bitcoin) to Proof of Stake (like Avalanche)[23] could significantly reduce power consumption.

An Inherently Decentralizing Force

Blockchains are, by inherent design, forces for decentralizing control. Ethically, this is a highly important consideration when evaluating systems of value distribution. Presently, the information and value protocols built on the internet centralize power in the hands of the “big other” described by Zuboff's concept of surveillance capitalism[24], and furthermore create a market “knowable” only to those within “big other” corporations and entities. This has a drastic effect on reality, forcing smaller participants in the market into a game skewed against them, creating a feedback loop wherein “big other” churns out new means of measurement to gain a clearer picture of the psychology of the market. Blockchains interrupt this process, and a new kind of internet built on blockchain protocol known as “Web3”[25] will be one tool that resets the societal balance between the masses, the market, and “big other”. Web3 is, as a collection of platforms, a means of creating value between parties without the need for truster intermediaries. In comparison, Web2 as a collection of platforms was partially a means of creating value between parties, but more so means of extracting value from the personal information of users on these platforms.

Cryptocurrencies and Criminal Activity

As cryptocurrencies rise in popularity, so have concerns surrounding their usage in criminal activities.[26] Some of these activities include money laundering, financing terrorism, and financing black-market activities. While law enforcement around the world is becoming more experienced with tracking the flow of cryptocurrency funds, at least 13% of all criminal proceeds in 2020 passed through a privacy wallet, the hardest form of blockchain ledger to track.[26] Similarly, Simon Dyson and William Buchanan, both professors at Edinburgh Napier University, articulate in their paper ‘’The Challenges of Investigating Cryptocurrencies and Blockchain Related Crime’’ that in order to protect anonymity and escape law enforcement, criminals are now adding additional anonymization layers in order to conceal the amounts and recipients of their transactions.[27] These layers make it difficult for law-enforcement to catch these criminals.

References

- ↑ 1.0 1.1 1.2 1.3 Conway, Luke. “Blockchain Explained.” Investopedia, Investopedia, 18 Nov. 2020, www.investopedia.com/terms/b/blockchain.asp.

- ↑ 2.0 2.1 Marr, Bernard. “A Very Brief History Of Blockchain Technology Everyone Should Read.” Forbes, Forbes Magazine, 20 Mar. 2018, www.forbes.com/sites/bernardmarr/2018/02/16/a-very-brief-history-of-blockchain-technology-everyone-should-read/?sh=421a941a7bc4.

- ↑ 3.0 3.1 Abou Jaoude, J., & George Saade, R. (2019). Blockchain applications – usage in different domains. IEEE Access, 7, 45360-45381. doi:10.1109/access.2019.2902501

- ↑ 4.0 4.1 4.2 Bauerle, Nolan. “Blockchain 101.” CoinDesk, CoinDesk, 9 Mar. 2017, www.coindesk.com/learn/blockchain-101/how-does-blockchain-technology-work.

- ↑ Tasca, Paulo. Tessone, Claudio J. (2019). [1]. A Taxonomy of Blockchain Technologies: Principles of Identification and Classification. Retrieved Apr 8, 2021.

- ↑ Reuters. “Bitcoin Hits $1 Trillion Market Cap, Surges above $56,000.” The Economic Times, Economic Times, 20 Feb. 2021, economictimes.indiatimes.com/markets/stocks/news/bitcoin-hits-1-trillion-market-cap-surges-above-55000/articleshow/81121700.cms.

- ↑ United States Securities and Exchange Commision. (2020). [2]. SECURITIES AND EXCHANGE COMMISSION, Plaintiff, - against - : RIPPLE LABS, INC., BRADLEY GARLINGHOUSE, and CHRISTIAN A. LARSEN. Retrieved Apr 8, 2021.

- ↑ Bank of International Settlements Innovation Hub. (2020). [3]. Central bank digital currencies: foundational principles and core features. Retrieved Apr 8, 2021.

- ↑ Vasilisin, Ras. (2020). [4]. Why DeFi Could Foster the Killer App of Banking. Retrieved Apr 8, 2021.

- ↑ Steinwold, Andrew"The History of Non-Fungible Tokens (NFT's)". Colored Bitcoins. Retrieved March 18, 2021

- ↑ Allyn, Bobby. “What's An NFT? And Why Are People Paying Millions To Buy Them?” NPR, NPR, 6 Mar. 2021, www.npr.org/2021/03/05/974089381/whats-an-nft-and-why-are-people-paying-millions-to-buy-them.

- ↑ Kastrenakes, Jacob. “Grimes Sold $6 Million Worth of Digital Art as NFTs.” The Verge, The Verge, 1 Mar. 2021, www.theverge.com/2021/3/1/22308075/grimes-nft-6-million-sales-nifty-gateway-warnymph.

- ↑ “Beeple's Masterwork: the First Purely Digital Artwork Offered at Christie's.” Christie's, Christie's, 12 Feb. 2021, www.christies.com/features/Monumental-collage-by-Beeple-is-first-purely-digital-artwork-NFT-to-come-to-auction-11510-7.aspx.

- ↑ Reyburn, Scott. “JPG File Sells for $69 Million, as 'NFT Mania' Gathers Pace.” The New York Times, The New York Times, 11 Mar. 2021, www.nytimes.com/2021/03/11/arts/design/nft-auction-christies-beeple.html.

- ↑ 15.0 15.1 Fernandez Mar 2, Gabriel. “NBA Top Shot: Everything You Need to Know about 'next Level Collectibles' and What It Means for the League.” CBSSports.com, 2 Mar. 2021, www.cbssports.com/nba/news/nba-top-shot-everything-you-need-to-know-about-next-level-collectibles-and-what-it-means-for-the-league/.

- ↑ Chow, S. S., Choo, K. R., & Han, J. (2021). Editorial for accountability and privacy issues in blockchain and cryptocurrency. Future Generation Computer Systems, 114, 647-648. doi:10.1016/j.future.2020.08.039

- ↑ 17.0 17.1 Sarier, N. D. (2021). Comments on biometric-based non-transferable credentials and their application in blockchain-based identity management. Computers & Security, 105, 102243. doi:10.1016/j.cose.2021.102243

- ↑ 18.0 18.1 Miyachi, K., & Mackey, T. K. (2021). Hocbs: A privacy-preserving blockchain framework for healthcare data leveraging an on-chain and off-chain system design. Information Processing & Management, 58(3), 102535. doi:10.1016/j.ipm.2021.102535

- ↑ Sharma, R. (2020, December 08). Bitcoin has a regulation problem. Retrieved March 19, 2021, from https://www.investopedia.com/news/bitcoin-has-regulation-problem/

- ↑ 20.0 20.1 Rooney, K. (2018, March 27). Your guide to cryptocurrency regulations around the world and where they are headed. Retrieved March 19, 2021, from https://www.cnbc.com/2018/03/27/a-complete-guide-to-cyprocurrency-regulations-around-the-world.html

- ↑ “Bitcoin Energy Consumption Index.” Digiconomist, 7 Mar. 2021, digiconomist.net/bitcoin-energy-consumption.

- ↑ Criddle, Cristina. “Bitcoin Consumes 'More Electricity than Argentina'.” BBC News, BBC, 10 Feb. 2021, www.bbc.com/news/technology-56012952.

- ↑ Avalance Consensus Protocol. (2020). [5]. A deep dive into the Avalanche consensus protocol. Retrieved Apr 8, 2021.

- ↑ Zuboff, Shoshana. (2019). [6]. A Fight for a Human Future at the New Frontier fo Power. Retrieved Apr 8, 2021.

- ↑ Max Mersch and Richard Muirhead. (2019). [7]. What Is Web 3.0 & Why It Matters. Retrieved Apr 8, 2021.

- ↑ 26.0 26.1 Irrera, Anna. “Criminals Getting Smarter in Use of Digital Currencies to Launder Money.” Reuters, Thomson Reuters, 9 Dec. 2020, www.reuters.com/article/crypto-currencies-criminals/criminals-getting-smarter-in-use-of-digital-currencies-to-launder-money-idUSKBN28J1IX. >

- ↑ Dyson, S., & Buchanan, W. J. (2019, July 29). The Challenges of Investigating Cryptocurrencies and Blockchain Related Crime. Retrieved March 19, 2021, from https://arxiv.org/pdf/1907.12221.pdf